X-FAB Silicon Foundries: The Analog Foundry Powering Electric Dreams

Quiet Power: How X-FAB Became the Go-To Foundry for the Analog Backbone of Modern Industry

In an industry obsessed with nanometers and headline-grabbing chips, X-FAB Silicon Foundries SE takes a different route. As a specialty foundry focused on analog and mixed-signal semiconductors, it powers the invisible infrastructure behind modern life — from electric vehicles and factory automation to medical implants. With a global footprint and deep expertise in mature manufacturing processes, X-FAB has carved out a resilient niche at the intersection of precision, reliability, and long-term demand.

What you will read today;

Business Overview

Moat and Competitive Landscape

Financial Stability

Management Quality

Operating Profit Potential

Debt Structure

Taxes

Growth Capex Plans

Sector Cyclicality

Global Risk Factors

Peer and Competitive Comparison

1. Business Overview

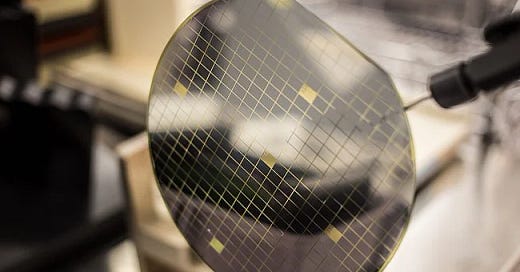

X-FAB Silicon Foundries SE is a specialty semiconductor foundry that focuses on analog and mixed-signal technologies, rather than cutting-edge digital chips. In practice, that means X-FAB makes the “behind the scenes” chips for cars, industrial equipment, and medical devices – think of sensor interfaces, power management ICs, and micro-electro-mechanical systems (MEMS) that quietly enable modern electronics. The company operates six wafer fabrication plants across Germany (Erfurt, Dresden, Itzehoe), France (Corbeil-Essonnes), Malaysia (Kuching), and the USA (Lubbock). These fabs collectively run on mature manufacturing nodes (from 1.0 micron down to 130 nm processes) and provide capacity of about 100,000 eight-inch equivalent wafers per month. Rather than chasing the latest 3nm logic chips, X-FAB’s expertise lies in analog/mixed-signal CMOS, high-voltage and silicon-on-insulator (SOI) processes, MEMS, and the emerging field of silicon carbide (SiC) power semiconductors.

X-FAB’s product and service offerings span a broad range for analog chip designers. The company provides modular process technology platforms (complete with design IP libraries and foundry design support) so that fabless customers can develop custom chips and have them fabbed at X-FAB’s facilities. These technologies cover everything from standard complementary metal-oxide semiconductor (CMOS) and BCD-on-SOI (Bipolar-CMOS-DMOS on SOI, useful for power management) to MEMS process integration and SiC for high-power, high-temperature devices. Crucially, X-FAB does not design its own chips – it purely manufactures for customers. This “pure-play foundry” model means X-FAB’s customers (often fabless design houses) don’t have to worry about X-FAB ever competing with them or poaching their designs. Instead, X-FAB positions itself as a long-term development and manufacturing partner for its clients, offering extensive design support and IP alongside production capacity.

The customer base reflects X-FAB’s strategic focus on automotive, industrial, and medical end-markets. These sectors demand highly reliable analog and power semiconductors, often in harsh environments – exactly the kind of niche where X-FAB’s processes excel. X-FAB serves about 400 customers worldwide, ranging from well-known fabless semiconductor companies to smaller device makers and even integrated device manufacturers that outsource some production. Notably, one customer – Melexis NV of Belgium – accounts for a substantial portion of business. Melexis, a leading automotive chip designer, has historically been X-FAB’s largest client (and until late 2023 was a related party through common ownership). In 2024, sales to this customer were USD 364.2 million, about 45% of X-FAB’s total revenue. This close relationship (Melexis itself had roughly USD 1 billion revenue in 2024) underscores X-FAB’s role as a critical supplier to automotive electronics, given that Melexis chips end up in countless cars. Beyond Melexis, X-FAB’s other customers include analog and mixed-signal chip designers across Europe, the US, and Asia. Geographically, Europe accounted for ~67% of 2024 revenues (with Germany, UK, Austria, France among notable markets), Asia about 23% (led by China at 12.6% of sales), and North America around 9.5%. This diversity gives X-FAB a global reach, but the dominance of European automotive clients – and one Belgian customer in particular – is a defining feature of its business profile.

In summary, X-FAB’s business is built on being the “foundry of choice for the analog world,” providing the manufacturing muscle behind chips that may not make flashy headlines, but are indispensable to modern life. Its specialty processes and customer-centric approach have made it a go-to foundry for automotive sensor chips, industrial controllers, medical implants, and power converters – areas poised for long-term growth as cars go electric and healthcare goes digital. Next, we’ll examine how X-FAB’s position in this niche translates into competitive strengths and what threats it faces in the broader semiconductor landscape.

2. Moat and Competitive Landscape

Operating in the shadow of giants like TSMC, X-FAB has carved out a defensible niche (economic moat) in the specialty foundry segment of the semiconductor industry. One pillar of its moat is the highly specialized know-how required for analog, mixed-signal, and power semiconductor manufacturing. Unlike digital chips, analog components often require unique process tweaks (e.g. special materials, thicker oxide layers for high voltage, or wafer bonding for MEMS) and extensive customer collaboration. X-FAB’s 30+ years of experience in these domains have resulted in proprietary process IP and an extensive library of analog design blocks tailored to automotive and industrial needs. This creates a high barrier to entry – a new foundry can’t easily replicate decades of process refinement and the trust built with customers who demand near-zero defect rates for car or medical chips.

Another element of X-FAB’s moat is its focus on resilient end markets and long product lifecycles. The company deliberately emphasizes automotive and industrial applications, which tend to have long design cycles and multi-year production runs (a car model may use the same chip for a decade). This stands in contrast to consumer electronics, where chip demand can spike and crash with fickle gadget trends. During the recent semiconductor cycle downturn in 2023–2024, X-FAB’s auto business actually grew 2% even as overall revenue fell 10%. Automakers were still clamoring for analog chips to electrify vehicles and add advanced safety features. This suggests demand for X-FAB’s core offerings is relatively resilient, providing some insulation from the wild swings that hit consumer-focused chipmakers. Moreover, X-FAB’s customer relationships often involve co-development and deep integration into the customer’s supply chain, making it sticky – once a chip is qualified at X-FAB for an automotive project, the automaker is unlikely to switch foundries mid-stream due to stringent re-qualification costs and risk. In economic moat terms, this is a mix of high switching costs and intangible assets (process IP, reputation for quality) protecting X-FAB’s business.

The competitive landscape for specialty foundries includes a handful of global peers and the specialty units of larger foundries. Key pure-play rivals are Tower Semiconductor (Israel/US), Vanguard International Semiconductor (VIS) in Taiwan, and certain Chinese foundries, while larger players like GlobalFoundries and even TSMC compete in overlapping segments (e.g. high-voltage processes, 0.18µm analog, RF-SOI, etc.). X-FAB’s competitive advantages versus these peers lie in its automotive pedigree and geographic positioning. It boasts a “proven automotive quality system” – essential for meeting strict auto industry standards (ISO 26262, AEC-Q100, etc.). This has helped X-FAB win business with top auto chip suppliers, whereas some Asian foundries historically focused more on consumer or computing chips. Additionally, X-FAB’s European base can be a selling point: European and U.S. customers value having a supplier outside of mainland China for critical components, and the EU is actively fostering local semiconductor capacity. X-FAB has secured government-backed projects (like the EU-funded PhotonixFAB for silicon photonics) and investment subsidies – about USD 155.8 million in grants to date, which lower its costs and indicate strategic support. These factors strengthen X-FAB’s moat by aligning it with megatrends (vehicle electrification, photonics, medical tech) and with government initiatives seeking a robust regional chip supply chain.

That said, X-FAB faces competitive challenges and risks. One risk is technological overlap with larger foundries: For instance, TSMC’s specialty analog processes or GlobalFoundries’ RF and power management offerings could encroach on X-FAB’s territory for high-volume orders. These giants benefit from economies of scale that X-FAB can’t match, potentially pressuring prices. X-FAB’s strategy here is to differentiate via customization and service – offering more flexible engagement, niche process options, and closer support than a mega-fab would for a mid-size customer. Another challenge is the rapid evolution of SiC power semiconductors, an area X-FAB is investing in. Competition in SiC includes not just foundries but integrated device makers (like Wolfspeed or STMicroelectronics) that make their own SiC chips. X-FAB must prove its fledgling SiC technology can compete on efficiency and yield. The 2024 SiC market “stall” – which caused X-FAB’s SiC revenue to dip 30% – highlights that this is an emerging, volatile arena. Encouragingly, X-FAB has teamed up with substrate maker Soitec on SmartSiC™ substrates to improve yields (X-FAB and Soitec team up to offer SmartSiC™ at Lubbock plant, USA), and it reports “strong market traction” for its next-gen SiC platform (X-FAB Fourth Quarter and Full Year 2024 Results). But it will need to execute well to build a moat in SiC before others catch up.

Finally, pricing power in the specialty foundry space tends to be moderate – these are not commodity chips, so customers prioritize quality and reliability even if it costs a bit more. During the 2021–2022 chip shortage, specialty foundries were able to command higher prices, but as supply catches up, some pricing normalization occurs. X-FAB’s 2024 gross profit margin slipped to ~22% from ~28% in the prior year as the market softened, indicating limited pricing power when customers are digesting inventory. However, the fact that X-FAB remained nicely profitable in a down-cycle (with a 23% EBITDA margin in 2024, versus near-breakeven in the last downturn) suggests it has improved its cost structure and mix of high-value products, which is a sign of a widening moat. In summary, X-FAB’s competitive position is solid in its niche – underpinned by specialization, customer lock-in, and secular growth drivers – but it must continue innovating and expanding capacity smartly to fend off both the heavyweights and the up-and-comers in the semiconductor foundry world.

3. Financial Stability

In assessing X-FAB’s financial stability, one finds a balance sheet that has been strong historically, now leveraged moderately to fund expansion. The company entered its recent growth capex cycle with a sizable net cash reserve, which provided a cushion. As of December 2023, X-FAB had USD 405.7 million in cash and equivalents on hand, thanks to accumulated profits from the 2021–2022 boom. By the end of 2024, that cash position was drawn down to USD 215.8 million, as the company pumped money into new cleanrooms and equipment. Correspondingly, total debt increased – loans and borrowings rose from about USD 261 million (2023) to USD 414 million (2024). Despite this swing to a net debt position (~USD 198M net debt at year-end 2024), X-FAB’s solvency remains solid. The equity base is over USD 1.02 billion, and the net debt-to-equity ratio (~0.19) is low for a manufacturing firm. Furthermore, a significant chunk of the debt is long-term (90% of debt is non-current), with X-FAB utilizing bank loans (including some in Euros) at presumably reasonable interest rates.

Liquidity and downturn resilience also appear adequate. Even in the softer market of 2024, X-FAB generated positive EBITDA of USD 188.9 million, easily covering interest obligations. Net interest expense was minimal – interest income of ~$11.1M nearly offset interest expense of ~$16.1M in 2024, thanks to cash on hand and likely low-interest loans (possibly subsidized or fixed-rate). The company also kept a healthy current ratio (current assets USD 681.6M vs. current liabilities USD 510.0M). Inventories and receivables have likely been managed down in line with the revenue dip, preventing an overhang of unsold stock. In short, X-FAB has navigated the industry inventory correction without financial distress: it bled some cash for expansion (intentionally) but still has over $200M liquidity and untapped credit lines if needed.

One reason we give X-FAB decent marks for stability is its demonstrated ability to handle downturns. Compare 2019 (the last cyclical low) to 2024: In 2019, X-FAB’s EBITDA margin was a mere 6%, and it likely barely broke even. In 2024’s downturn, EBITDA margin was 23%, and the company still earned a net profit of ~$61.5M. This improvement reflects structural cost reductions and a shift to higher-margin products, giving confidence that X-FAB can withstand economic turbulence. The gross margin compression in 2024 (to 22%) is something to watch – it indicates underutilization, which is typical in a semi down-cycle – but management took prudent steps like halting further SiC capacity investments when that segment got oversupplied. By pulling back discretionary expansion and focusing on cost control, X-FAB avoided sliding into an operating loss even as sales dipped.

The strength of the balance sheet also comes from conservative financial policies in past years. X-FAB has generally refrained from heavy dividends or buybacks (retaining earnings to fund growth), and it took advantage of favorable equity ownership structure to secure cheap financing. (For instance, local governments – the state of Sarawak, Malaysia – have been equity partners and lenders, given X-FAB’s importance to local tech ecosystems). The company’s equity grew to over $1B by 2024, and even after the recent net debt uptake, net debt/EBITDA is comfortably below 1.2×, which is low leverage. With the major expansion program slated to complete by mid-2025, X-FAB’s capital expenditures will drop sharply thereafter, likely restoring positive free cash flow and allowing the cash buffer to rebuild. In summary, X-FAB’s finances appear stable and prudently managed – the company has used its war chest to invest for growth, but remains far from overleveraged, and its cash flows from operations have proven resilient even when the tide goes out in the semiconductor cycle. This stability gives it staying power to focus on long-term strategy rather than short-term survival.

4. Management Quality

X-FAB’s management and governance present an interesting mix of high insider ownership, long-term vision, and some unique related-party history. The company’s CEO, Rudi De Winter, has helmed X-FAB since 2014 (after joining as co-CEO in 2011), and he is a seasoned semiconductor executive with a strong reputation. Perhaps more telling, De Winter and his family (notably his wife, Françoise Chombar, herself a renowned semiconductor CEO) were until recently major indirect owners of X-FAB via the holding company Xtrion NV. Xtrion – beneficially owned by De Winter, Chombar, and X-FAB founder Roland Duchâtelet – controlled just over 50% of X-FAB’s shares at the time of its 2017 IPO. This insider dominance meant management’s incentives were closely aligned with shareholder interests; they effectively were the controlling shareholders. Even after a late-2023 reorganization that split Xtrion’s stake between the De Winter-Chombar and Duchâtelet families, insiders still own roughly 61% of X-FAB (30.7% each by the two families). Such high insider ownership is a double-edged sword: on one hand, it implies management is deeply invested in X-FAB’s long-term success (they stand to gain or lose alongside other shareholders); on the other hand, it raises typical governance questions about minority shareholder rights and related-party dealings.

So far, the track record suggests that management has used its control to prioritize long-term growth. The bold $1B capacity expansion plan launched in 2023 is a case in point – rather than maximizing short-term earnings or issuing special dividends, X-FAB’s leaders are reinvesting aggressively to capture future demand. This indicates a growth-oriented capital allocation strategy. They also demonstrated discipline by adjusting this plan when market conditions shifted (pausing the SiC expansion in 2024 without hesitation when the outlook dimmed). Such moves reflect a management that is both ambitious and pragmatic. Furthermore, the leadership has kept a tight lid on costs during the expansion. Despite a ~$90M drop in revenue in 2024, X-FAB managed to stay profitable – implying swift cost containment to maintain margins. The CEO highlighted optimization and automation projects across the group that improved productivity. In other words, management isn’t just throwing money at growth; they’re also working to “do more with less”, which speaks to execution ability.

Integrity and transparency are always crucial when insiders dominate ownership. One area to examine was the relationship with Melexis, the large customer that was (until Nov 2023) controlled by the same Xtrion insiders. This clearly could be a conflict of interest (pricing, preferential treatment, etc.). However, now that Xtrion dissolved its joint holding, Melexis is no longer a related party. Even before that, X-FAB as a public company had to disclose the extent of those dealings (nearly half its revenue) and presumably ensure they were at arm’s length. There’s no indication of impropriety; in fact, one could argue the Melexis-XFAB alliance benefited X-FAB by providing stable demand and co-investment in new technologies (Melexis’s growth in auto chips has fueled X-FAB’s utilization). The key test of management integrity will be diversifying the customer base to reduce that single-customer reliance going forward, which management has acknowledged by highlighting a “strong new business pipeline” beyond the usual suspects.

In terms of leadership depth and culture, X-FAB’s board and executives bring a blend of technical and industry expertise. The presence of Duchâtelet (a serial entrepreneur) and the De Winter/Chombar duo historically meant the board was very hands-on. They’ve also won accolades – for example, X-FAB won the 2024 “Entrepreneur of the Year” award in Belgium – indicating peer recognition of their business excellence. The management appears to be forward-looking, embracing trends like climate change mitigation and digitized medicine as core to the company’s mission. This is evident in product development priorities (e.g. chips for electric vehicles, devices for medical diagnostics) and in how they frame X-FAB’s role in enabling megatrends.

One noteworthy point: X-FAB’s remuneration policy does not emphasize share-based compensation for executives. This is somewhat unusual (no stock options to speak of), but given the huge equity stakes management already holds, their incentives are naturally aligned. The absence of lavish stock grants or option dilution could be seen as positive for shareholders. It also means management’s main financial reward comes from raising the share value over time – a classic owner-operator mindset.

In sum, X-FAB’s management quality can be characterized as owner-driven, technically adept, and long-term focused. They have skin in the game and have shown a willingness to invest in the business during good times and hunker down during tough times. Any investor considering X-FAB for 3+ years should take comfort that the people at the helm are deeply invested (literally and figuratively) in the company’s future, even as we keep an eye on execution and diversification to ensure that strong insider influence continues to benefit all stakeholders.

5. Operating Profit Potential

Analyzing X-FAB’s earnings power requires separating cyclical swings from sustainable “normalized” performance. Let’s start with recent figures: In 2024, which we might call a cyclical trough year, X-FAB’s revenue was USD 816.4 million and it achieved an operating profit of USD 85.5 million. That’s roughly a 10.5% operating margin. In the preceding boom year 2023, operating profit was USD 157.7 million on USD 906.8 million revenue – a robust 17.4% margin. Normalized operating earnings likely lie somewhere in between these extremes, assuming neither severe downturn nor unsustainably hot demand. For a mid-cycle scenario (perhaps 2025–2026 once inventory corrections are past), X-FAB itself is targeting growth: the company has indicated plans to reach ~$1.5 billion annual revenue by 2026 through its expansion investments. Even if that target is optimistic, a more modest scenario of ~USD 1 billion revenue in a typical year with mid-teens operating margin would yield ~$150M operating profit. This seems achievable given the trajectory – recall that even with 10% lower sales in 2024, X-FAB still managed a positive EBIT and kept EBITDA margins above 20%.

Free cash flow (FCF) in a typical year will depend on capital expenditure levels. During the 2023–2024 expansion blitz, FCF was deeply negative – in 2024, capex was about USD 509.6 million, dwarfing the ~$139M in cash from operations (approximate, from $188.9M EBITDA minus working capital and taxes). However, this is a temporary investment phase. Management has stated that post-expansion, they expect to normalize capex to 10–15% of revenue from H2 2025 onward (X-FAB Fourth Quarter and Full Year 2024 Results). If we take 12% of, say, $900M revenue, that’s ~$108M in maintenance/growth capex per year. X-FAB’s annual depreciation is likely to climb given the new assets (depreciation was around $103M in 2024, since EBITDA $189M minus EBIT $85M) – it might rise to ~$130–150M once all new equipment is on-line. But with normalized capex in that $100M range, free cash flow should turn positive by 2025 and could be substantial by 2026 as revenue ramps. For example, if operating profit returns to $150M and depreciation ~$130M, operating cash flow would be ~$280M. After ~$120M capex, FCF could be ~$160M. This back-of-envelope suggests X-FAB has potential to generate $100M+ in annual free cash flow in the post-expansion steady state, assuming healthy utilization of its new capacity.

One adjustment to consider in assessing “true” earnings is that X-FAB has no stock-based compensation to add back(unlike many tech firms). The company explicitly states it has no share option programs or share-based payments so reported operating profit isn’t understated by hidden equity payouts. Labor costs are fully expensed in the P&L. Thus, the EBIT we see is clean from that perspective. We might need to adjust for any one-time items: for instance, in 2023 operating profit included a one-off $5.1M expense to settle a legal claim, and in 2022 Tower Semiconductor had large one-offs from a failed merger (just as context of peers). X-FAB’s 2024 results don’t seem distorted by any big one-offs except perhaps some deferred revenue under IFRS 15 (they noted an $8M revenue deferral in Q4), which slightly affected EBITDA margin, but not a huge factor.

Crucially, we should ask: How sustainable are X-FAB’s profit margins long-term? The company has proven it can hit high-20s gross margins when volume is strong (2022–2023) and hold low-20s gross margin when volume dips. With the new capacity coming online, one short-term risk is underutilization (which depresses margins until new orders fill the fabs). But management timed the expansion to match known demand: much of the spend is on the popular 180nm platform which “has been constrained by available capacity” with strong pipeline demand. So if they execute well, the new fabs should ramp towards optimal utilization by 2026, sustaining or even improving margins through economies of scale. Another factor is product mix – as X-FAB grows its share of high-value SiC and advanced analog (110nm BCD-on-SOI, etc.), those carry higher ASPs and potentially higher margins once mature. In 2024, the company said 93% of revenues came from key end markets with “high value-added business”, reflecting a deliberate tilt towards more complex, margin-rich products.

We should also consider free cash flow adjustments beyond capex: X-FAB benefits from government grants (which offset capex, effectively) – at end-2024, $155M of cumulative capex had been subsidized. Going forward, such grants (often tied to EU “Important Project of Common European Interest” programs or local incentives) will reduce the cash outlay required for growth projects, boosting true free cash generation. On the flip side, as a manufacturing firm, X-FAB will always need some maintenance capex to keep fabs updated (perhaps ~5% of revenue is pure maintenance in the 10–15% total).

Summing up, normalized operating earnings for X-FAB appear capable of reaching ~$150M+ per year (mid-cycle), with normalized free cash flow possibly in the low nine figures once capex moderates. The company’s operating margins in the mid-teens seem sustainable given its niche focus and improved cost base – a far cry from the single-digit margins of the past, indicating a structural uplift. Investors should watch utilization rates and average selling prices in coming years; if X-FAB can fill its new fabs while maintaining pricing (helped by its moat), the operating leverage could even push margins higher than historical averages. In essence, the heavy lifting on investment is being done now so that X-FAB can harvest stronger profits and cash flows over the next decade.

6. Debt Structure

X-FAB’s debt structure is straightforward and, importantly, not burdensome. The interest paid on its loans has been quite low relative to its earnings – in 2024, interest expense on loans was about USD 38.3 million, while interest income on cash was USD 36.0 million , nearly offsetting much of that cost. This suggests that X-FAB’s net interest expense (~$2.3M) is a tiny fraction of EBITDA. The company has likely secured favorable terms on its borrowing, possibly due to relationships with banks in regions it operates (some loans are Euro-denominated which in 2024 had low rates until recently) and perhaps government-supported facilities. X-FAB also doesn’t appear to have exotic debt like high-yield bonds; its debt is mainly bank loans and some lease liabilities (the latter classified under borrowings per IFRS 16).

Looking at the breakdown: by end of 2024, X-FAB had $369.6M in long-term loans and $44.5M in short-term loans. The increase in debt during 2024 came from drawing on credit lines to finance capex – about $209.7M of new loans were taken and $124.2M repaid, a net increase of ~$85M. X-FAB still had unused credit lines available, indicating a liquidity backstop if needed. The long-term debt strategy seems to be focusing on low-cost debt and possibly local financing: for example, fixed-rate bank loans in Euros comprised $64M, which might be loans from European banks or even the European Investment Bank given the strategic nature of semiconductor expansion. The US dollar loans were negligible ($0.5M, likely small facilities). We also see in disclosures that lease liabilities are included in “loans and borrowings” – X-FAB likely leases some equipment or facilities, but this isn’t a major component.

One noteworthy point is X-FAB’s cash vs debt management. In 2023, the company actually paid down a significant amount of debt (over $241M repaid), likely using its cash hoard. In 2024 it partially reversed that. The picture is that X-FAB does not carry debt beyond what’s needed; it had net cash until 2024, and now modest net debt. With large positive cash flows expected after 2025, we can anticipate X-FAB will prioritize debt reduction. Management explicitly mentioned aiming for a balance between debt reduction, capital return, and further growth once the expansion is complete. This implies no intention to accumulate high debt long-term – rather, use it tactically to fund growth, then pay it down. It’s a conservative approach that fits the company’s history.

In terms of interest rate risk, the majority of X-FAB’s debt as of 2024 appears to be at fixed interest (the table mentions “fixed interest bank loans” in EUR and USD), which is reassuring in a rising rate environment. Also, since a chunk of costs and revenues are in USD and EUR, X-FAB naturally hedges currency exposure – they noted profitability isn’t really hit by FX swings due to natural hedging. So having some Euro-denominated debt might match Euro cost streams, providing a further hedge.

Another angle: X-FAB has no publicly traded bonds, so we don’t have bond market data, but the bank loan-centric structure usually means covenants. There’s no sign X-FAB is near any covenant limits (its interest coverage and debt/EBITDA are very healthy). The company’s debt maturity profile isn’t detailed in the snippet we have, but given their incremental borrowing for expansion, it may have structured repayments over several years. With ~ $45M due within a year (likely amortization of some loans), X-FAB can comfortably service that from operating cash. The remainder being long-term likely has maturities spread out. We also see that Malaysia and France assets ballooned in 2024, perhaps funded by local loans – possibly some of the Euro loans were used in France, and maybe local Malaysian borrowing (though Malaysia debt doesn’t show separately, perhaps some government loan included in “other liabilities”?). It’s plausible that Sarawak state (which owns ~14% of X-FAB) might have provided soft loans for the Kuching fab expansion; historically, Sarawak’s fund was a stakeholder and partner.

Overall, X-FAB’s debt strategy appears to be sensible and conservative: use cheap debt when advantageous, avoid high interest costs, keep maturities staggered, and maintain enough cash to stay flexible. The interest coverage ratio is extremely high (EBITDA/Interest > 10×) and even in a worst-case scenario of prolonged downturn, X-FAB could sustain its interest payments without issue. The company’s choice to limit capex in 2025 to $250M maximum also ensures it won’t pile on more debt than necessary. For a long-term investor, there’s comfort in knowing X-FAB is not overleveraged and has a clear plan to deleverage as free cash flow improves. This financial prudence in its capital structure complements the growth-oriented yet risk-aware management style we observed.

7. Taxes

X-FAB operates across multiple jurisdictions, and its tax situation is a tale of different rates and deferred tax maneuvering. The company is legally registered in Belgium (as a European “SE” company), so the Belgian corporate tax rate of 25% serves as the reference for consolidated results. Each of X-FAB’s sites comes with its local tax: Germany effectively ~32%, France 25%, Malaysia 24%, U.S. 21% federal. In 2023 and 2024, however, X-FAB’s effective tax rate diverged significantly from these nominal rates due to utilization of deferred tax assets (DTAs).

In 2023, X-FAB actually recorded a net tax income of $6.7M (i.e. a tax benefit) despite making $155M profit before tax. This was because the company recognized previously unrecognized deferred tax assets to the tune of $58.1M in that year. Essentially, they had past losses or timing differences (perhaps from earlier years or in certain subsidiaries) which they hadn’t booked as an asset before; as the business turned highly profitable in 2021–2022, management became confident these tax losses could be used, so they booked them in 2023, boosting net profit. For example, a large DTA was recognized in Malaysia – at end 2023, X-FAB Sarawak had a DTA of $55.6M, which slightly decreased to $51.0M in 2024. So 2023’s effective tax rate was actually negative (they paid no cash taxes and added income).

Come 2024, the situation normalized somewhat: profit before tax was $83.3M, and income tax expense was $21.8M. That yields an effective tax rate ~26%, which is close to the Belgian statutory rate. However, within that, there were still DTA adjustments. The reconciliation shows X-FAB recognized an extra $12.1M of deferred tax in 2024 (much smaller than prior year), and had to forego $13.2M worth of tax asset on current year losses where it deemed recovery unlikely (i.e. losses without DTA). Notably, in Q4 2024 they adjusted a deferred tax asset downward by $16.5M, causing a one-time hit that led to a quarterly loss. This suggests perhaps they revised assumptions on future profits, especially in one region (possibly the U.S., since the note indicates the US subsidiary’s DTA went from $7.9M in 2023 to $0 in 2024, implying they wrote off a U.S. tax asset as less likely to be used).

What does this mean looking forward? Essentially, X-FAB has accumulated tax shields from prior losses/credits in some jurisdictions, which it can use to reduce cash taxes as it earns profits. The Malaysian fab, for instance, still has over $50M in DTA – likely related to historical losses or capital allowances – which will reduce future taxable income in Malaysia. Similarly, France and Germany might have some deferred tax assets (the note snippet shows France around $15.9M DTA at end-2024). The U.S. apparently had some but maybe not now.

X-FAB’s official tax rate will remain around 25% (Belgium/France) as a reference, but the effective tax rate could be lower in the next few years if these DTAs are utilized. In 2025, for example, if profits rebound, X-FAB might be able to use more of Malaysia’s tax loss carryforwards, meaning the actual cash tax paid is less than 25%. However, those are finite. By contrast, once those are used up, X-FAB will become a full taxpayer in each region. Also, being in multiple countries means sometimes paying higher local rates (Germany’s 30+%). The reconciliation for 2024 shows some impact of different rates (–$1.06M effect for foreign rates), which is relatively minor, implying most profit was taxed near the base rate.

Additionally, X-FAB has benefited from tax credits for R&D in places like France or from investment tax credits. For instance, the presence of deferred tax assets indicates they likely have credit carryforwards. The mention of “differences only valid for special taxes” in the tax recon (minor impact) might refer to things like local trade taxes or R&D credits.

One should note that in 2024, X-FAB’s cash tax was still low – they had that $16.5M deferred tax write-down but that’s non-cash; the current tax payable was only $7.7M at year-end. Many of the taxes running through P&L were deferred accounting entries. As those DTAs get exhausted, cash taxes will rise. By perhaps 2026+, if X-FAB hits $1.5B revenue with strong profit, we might expect it to pay close to the statutory ~25% on marginal profits (unless new tax breaks come with new expansions or it continues to invest heavily to get depreciation shields).

In conclusion, X-FAB’s tax situation has been favorable recently – benefiting earnings via deferred tax assets and keeping cash taxes minimal. The official blended tax rates in its countries average mid-20s%, and X-FAB’s effective tax rate will gravitate there in the long run. There’s no indication of any looming adverse tax issue; rather, the company appears to be in a period of utilizing past tax losses to boost net profits (2023’s net profit was unusually high partly because of the DTA benefit). Investors should be aware that as those one-off benefits subside, reported net income growth might lag a bit (e.g., 2024 net was lower partly because 2023 had a big tax gain). Going forward, assume X-FAB will be a normal tax-paying entity at ~25% rate on incremental profits, which is baked into most projections. Any new tax credits (for instance, if the EU chips act incentives include tax relief) would be an upside surprise not currently counted on.

8. Growth Capex Plans

The last two years have seen X-FAB embark on an ambitious growth capital expenditure (capex) program to expand capacity and capabilities for future demand. It’s crucial to distinguish maintenance capex (the baseline needed to keep existing fabs running at current capability) from growth capex (the investments to add new capacity or technologies). Historically, X-FAB’s maintenance capex was relatively modest – its fabs are older nodes, so they don’t need constant expensive upgrades like bleeding-edge facilities do. We can infer maintenance capex might be on the order of depreciation (~$100M/year pre-expansion). However, starting 2023, X-FAB launched a 3-year, >$1 billion expansion plan, clearly mostly growth capex. In 2024 alone, the company spent $510M (the “main portion” of the program) on capex – this is nearly 4× its historical levels, unequivocally growth-oriented.

What is this capex buying? Primarily, new cleanroom space and equipment to increase output on X-FAB’s most in-demand processes. The flagship project is the capacity expansion for 180nm CMOS: X-FAB built a new fab building in Sarawak, Malaysia and outfitted it with tools, targeting a ramp in 2H 2025. In parallel, X-FAB’s French site (Corbeil-Essonnes) received additional tools to expand and also to introduce the 110nm BCD-on-SOI technology for power analog chips. Essentially, Malaysia and France are getting big boosts to serve automotive and industrial analog demand. Meanwhile, the U.S. site in Lubbock, Texas (X-FAB Texas) was slated for expansion in SiC capacity, but that part was temporarily halted in 2024 due to the SiC market pause. The Texas fab already had a first SiC production line (6-inch wafers) and even installed a second ion implanter early 2023 to double SiC capacity, but further spending was deferred. We may see that resumed once EV demand picks up again. There’s also likely some growth capex in Germany – possibly upgrading the Dresden fab or adding specialty process capability – but the major dollars went to Malaysia (we see Malaysia’s non-current assets more than doubled from $319M to $658M in 2024) and to France (+26% assets), while Germany’s asset base rose ~15% and the US actually shrank a bit (just depreciation).

The projected timeline for these growth initiatives: X-FAB aims to complete the expansion by H1 2025. As of Q4 2024, they were on track – the Malaysian cleanroom was built and tools were being installed/qualified, and the French expansion tools had all been delivered by end of 2024. This means 2025 will still see some capex (they guided up to $250M) mainly to finish equipping and perhaps any delayed deliveries. By the second half of 2025, capex should drop to a maintenance level (as noted, ~10-15% of revenue run-rate). So effectively, 2023–H1’25 is the heavy build-out phase; H2’25 onward is harvest phase.

In terms of maintenance vs growth split: If we assume maintenance capex is ~$80–100M/yr, then of the $510M spent in 2024, roughly $400M+ was true growth capex. Similarly, 2023 (though data not explicitly given here) likely saw, say, $200M capex (with maintenance inside that). So by end of 2025, X-FAB will have invested around a billion dollars extra. What does that buy in output? Potentially, it could raise X-FAB’s annual revenue capacity significantly – management’s implicit goal is from ~$900M to ~$1.5B revenue capacity (Investor presentation). The asset base increase supports that: total fixed assets grew from $831M (2023) to $1.225B (2024), and will grow further in 2025. So by 2026, X-FAB’s PP&E could be ~$1.3–1.4B, nearly double that of 2022. We might expect wafer output capacity to roughly double as well in the targeted nodes. For example, if X-FAB was running ~100k wafers/month across fabs in 2022, they might be aiming for ~150–180k/month by 2026 with the new lines.

It’s important that investors consider execution risk here: heavy growth capex can lead to cost overruns or delays. So far X-FAB seems to be managing it well – they even spent a bit less than planned ($509.6M vs $550M budget in 2024), perhaps due to timing of tool deliveries. They’ve indicated some 2024 capex simply shifted into early 2025, not an overrun. And importantly, they remain adamant that after this sprint, they will “significantly reduce” capex to a normal level. That discipline is good: it shows this isn’t an endless money pit but a defined expansion to meet identified demand.

We should also highlight the nature of growth investments: They are focused on areas with clear secular growth – automotive analog, power electronics, and advanced MEMS. The 180nm platform is popular for automotive sensors and mixed-signal ASICs; adding more of that capacity should quickly attract customers (some likely pre-committed via MOUs or capacity agreements – not explicitly stated, but the confidence to invest hints at that). The introduction of 110nm BCD-SOI is a forward-looking move: it will enable new high-performance power management chips, likely for electric vehicles and industrial power. If successful, this tech node will open new revenue streams. Meanwhile, the partial freeze on SiC capex is prudent: no point adding SiC wafer capacity when the market is digesting inventory (X-FAB’s SiC revenue was only $51.6M in 2024, showing it’s early days). However, X-FAB stands ready to ramp SiC when the EV market picks up again – they doubled implanter capacity already and can resume other investments later (the land and cleanroom in Texas presumably have room). So growth capex is being paced according to each segment’s outlook.

Return on investment for this capex will be something to monitor beyond the 3-year horizon. Ideally, each dollar invested yields maybe $0.5 to $0.8 in annual revenue at healthy margins. If $1B capex yields ~$600M additional annual revenue by 2026 (taking them from $900M to $1.5B), and at 20-30% gross margin, that’s $120–180M gross profit, meaning a multi-year payback which is acceptable in this industry. If demand disappoints and they only utilize half of the new capacity, the ROI would suffer. But given automotive semiconductor content is rising (EVs need far more chips than combustion cars, ADAS requires sensors, etc.) and X-FAB’s customers are likely booking slots, the risk of massive idle capacity seems low.

In summary, X-FAB’s growth capex is a bold bet on the future, but one that is well thought out: expand core strengths (180nm, analog power) where orders exist, and hold back where needed (SiC) to avoid waste. The timeline is nearly at its peak now, with completion in sight. Investors should expect a sharp drop in capex after mid-2025, which will free up cash flow and mark the transition from investing to yielding results. X-FAB has essentially been laying the foundation (and the fab floors) for its next decade of growth – the heavy lifting in capex will soon translate into what we hope to be healthy top-line and profit growth over our 3+ year investment horizon.

9. Sector Cyclicality

The semiconductor industry is notoriously cyclical, and X-FAB’s specialty segment is not immune – though it behaves a bit differently than the boom/bust of memory chips or cutting-edge logic. Historically, analog and automotive chip demand cycles lag broader semiconductor cycles. We saw this in the recent pandemic-era swings: mainstream digital chips (CPUs, GPUs) went from shortage to glut by 2022, but automotive analog chips kept booming into early 2023 because carmakers were still catching up from shortages. Eventually, even that segment hit an inventory wall: in late 2023, auto suppliers started trimming orders, leading X-FAB to experience a downturn in 2024 after a record 2023.

X-FAB’s revenue history reflects these cycles. In the mid-2010s, growth was modest; 2019 was a down year (global auto sector slump) and X-FAB had very low margins. Then the 2020–2021 upswing began: despite the pandemic initially denting auto output, by late 2020 the demand for chips skyrocketed, and X-FAB’s revenues climbed from $478M (2020) to $658M (2021) to $907M (2023). This 90% jump from 2020 to 2023 was extraordinary – fueled by the unique convergence of post-COVID recovery and the secular increase in chip content per vehicle. X-FAB capitalized on that, hitting all-time highs. However, as sure as night follows day, the cycle turned: in 2024, industry-wide inventory correction set in, especially in industrial and consumer segments. X-FAB’s industrial market revenue fell 25% and medical fell 16% in 2024 as customers worked off excess inventory. The company’s total sales dropped 10% from 2023’s peak. This swing illustrates the cyclicality – though notably, automotive held up best (even grew slightly), showing how not all end-markets sync up perfectly.

Looking back further, analog foundries also went through cycles in the 2000s and 2010s often linked to global economic conditions. During recessions or auto downturns, orders can dry up abruptly. However, one difference: automotive and industrial cycles tend to be shorter and less drastic compared to, say, memory chips where pricing can collapse. Automakers try to avoid shutting production for lack of parts, and industrial demand is tied to capex which can be deferred but eventually comes back. X-FAB’s utilization rates swing with these cycles – high 90%+ utilization in boom times, maybe dropping to 60–70% in troughs. The company’s improved cost structure now means even at lower utilization, it can stay above water.

One should also note the seasonality in X-FAB’s business: Q1 is often softer, and Q3 can be flat due to European summer holidays affecting orders (many customers are European). The company’s guidance for 2025 (revenue $820–870M, implying flat to up 6%) acknowledges the continued destocking in early 2025 for auto, with recovery skewed to H2 2025. This is typical cycle behavior – about 18-24 months after a peak, the trough hits and then replenishment orders resume. Indeed, X-FAB saw bookings pick up sharply by Q4 2024 (e.g., microsystems bookings nearly doubled QoQ), hinting that the bottom of the cycle was likely in late 2024.

It’s instructive to compare with peers: Tower Semiconductor and VIS had similar trends – they flattened or declined slightly in 2023-2024 after strong 2021-2022. GlobalFoundries had a 9% revenue drop in 2024. These confirm that 2024 was a down-cycle year for specialty semis broadly. But the long-term trend remains upward. The megatrends X-FAB serves – EVs, industrial automation, IoT medical devices – act as tailwinds that drive an upward trajectory across cycles. In fact, X-FAB management explicitly calls out “megatrends such as the electrification of everything and digitization of medicine” that underpin a secular growth story beyond the cyclic volatility.

From a long-term investor perspective, it’s essential to embrace the cyclicality: expect that every few years there might be an inventory correction or macro-induced slowdown. X-FAB’s job is to remain profitable in the troughs and thrive in the upswings – which it seems to be managing. The current cycle appears to be turning upward again as we enter 2025/2026. If global automotive production stabilizes and EV sales accelerate, X-FAB could see a multi-year upcycle in chip demand (EVs require roughly twice the semiconductor content of gas cars, benefiting power analog and sensors). There’s also often a “catch-up” phase after a downturn where orders surge to replenish inventories – we may witness that in late 2025.

One external cyclical risk is the broader economy: a deep recession could cut car sales and industrial orders, which would hurt X-FAB even if secular trends are positive. But absent a major recession, the company’s diversification across auto/industrial/medical provides some balance – e.g., medical chips demand is less correlated to auto cycles, and some industrial segments (like renewable energy or aerospace) have their own cycles.

In conclusion, X-FAB operates in a cyclical sector but one with relatively stable, long-term growth undercurrents. The company has shown that it can handle the down parts of the cycle much better now than in the past (staying profitable in 2024 vs losses in prior downturns), which makes the cyclicality less hazardous for investors. An investment in X-FAB requires patience to ride out the dips – such as the current inventory correction – with confidence that the next upswing (which appears on the horizon) will bring new highs in revenue and profit, especially with the expanded capacity ready to capitalize on it.

10. Global Risk Factors

In our increasingly interconnected (and sometimes fractious) world, X-FAB faces a set of global risk factors that could impact its business beyond the usual market forces. Let’s break down a few: trade tariffs, regulatory shifts, and geopolitical tensions.

Tariffs and trade barriers: X-FAB sells to customers worldwide and has manufacturing on three continents. This global footprint actually helps mitigate some trade risks – for instance, having a U.S. fab means X-FAB can supply American customers domestically if U.S.-China trade frictions intensify. However, X-FAB does export a lot from Europe and Malaysia to China (China was ~12.6% of 2024 revenue). The U.S.-China trade war so far has mostly targeted advanced node chips; analog chips at 180nm are generally not restricted technology. That said, if China were to impose retaliatory tariffs on foreign semiconductor imports or favor local foundries, X-FAB’s China sales could suffer. Conversely, Western efforts to onshore semiconductor supply might benefit X-FAB’s European and U.S. fabs (as they are non-Asian sources). It’s a two-edged sword: trade policy could either divert more business to X-FAB (for resilience in supply chains) or hamper access to certain markets (if protectionism rises). As of now, we haven’t seen specific tariffs targeting analog chips, but it’s a space to watch.

Regulatory and governmental factors: Being a Belgian-headquartered company with multinational operations, X-FAB must navigate different regulatory regimes. One positive is the supportive stance of governments toward semiconductor investments lately – e.g., Europe’s Chips Act and U.S. CHIPS Act. X-FAB’s expansions in France and Malaysia likely enjoyed government backing (grants, possibly tax breaks). In the U.S., X-FAB Texas might even benefit from federal or state incentives if they expand SiC capacity (SiC is critical for EVs, which the U.S. is incentivizing). However, regulations can also pose costs: environmental, health, and safety regulations for fabs are stringent (chemicals handling, cleanroom emissions, etc.). X-FAB has to comply with EU environmental rules and local labor laws, which can be more onerous than in some competitor locales. It prides itself on a robust culture and presumably good compliance (no major incidents reported), but regulatory compliance is a constant baseline cost.

Geopolitically, one cannot ignore the risk of conflict or diplomatic rifts. X-FAB has a fab in Malaysia – Southeast Asia is generally stable, but any escalation in U.S.-China tensions could affect that region’s trade. More starkly, the global chip industry is on edge about Taiwan (home of TSMC). If a Taiwan crisis occurred, demand could spike for non-Taiwan foundries or supply chains could be severely disrupted (TSMC’s specialty analog capacity is huge, and Taiwanese chip tool suppliers are key suppliers). X-FAB, being in Europe/Malaysia/US, would be insulated from the immediate fallout of a Taiwan disruption and might even see a surge in orders as customers scramble for alternatives. But let’s hope the world doesn’t test that scenario.

Another global risk: pandemic or other systemic disruptions. We saw how COVID-19 affected car production (and thus chip orders). X-FAB managed through COVID with only short shutdowns, but any future global health crisis or climate disaster could impact its operations. Having multiple sites is a mitigant (diversification), but something like a prolonged energy crisis in Europe could raise costs or force rationing – X-FAB’s German and French fabs rely on steady power. The company likely has contingency plans (backup generators, etc.), especially after witnessing the 2021 energy crunch.

On the regulatory front specific to semiconductors, there’s also export controls on equipment. X-FAB uses equipment from U.S., Japanese, European suppliers. If geopolitical issues restrict the sale of certain tools to Malaysia (for instance, U.S. may restrict tech to China, but Malaysia is an ally so less concern), it could complicate fab upgrades. So far, no issue – the tech is mature and not under embargo.

One more consideration: Intellectual property and security regulations. Automotive and medical chips raise safety/security concerns. Governments may require trusted supply chains. X-FAB could be subject to audits or certifications for “trusted foundry” status to supply certain defense or critical infrastructure chips. This could be an opportunity (secure contracts) but also a compliance cost.

Overall, X-FAB seems reasonably well positioned against global risks: It operates outside the high-risk zones (no fabs in China or Taiwan), engages with government initiatives positively, and has multi-region redundancy. Still, investors should monitor how the U.S.-China tech rivalry evolves – e.g., if China heavily subsidizes its own analog foundries, competition could stiffen in that market; or if Western governments decide to heavily favor domestic fab capacity (through subsidies or “buy local” rules), X-FAB as a non-American company might or might not qualify. Given it has a U.S. entity (X-FAB Texas), it might even tap U.S. subsidies.

In summary, the key global risks for X-FAB boil down to trade policies and geopolitical tensions. So far these have been manageable or even slightly favorable (with governments keen to support firms like X-FAB to build secure supply chains). The company will need to stay agile – for example, by leveraging its geographically diverse fab network to sidestep any one country’s restrictions. An investor in X-FAB should keep one eye on the macro-political landscape, but can take some comfort that X-FAB’s footprint diversification and niche focus provide a degree of protection in a volatile world scene.

11. Peer and Competitive Comparison

When stacking X-FAB against its peers in the specialty foundry arena, a nuanced picture emerges. X-FAB is smaller than some rivals but punches above its weight in certain niches. Let’s compare it to a few key players: Tower Semiconductor, Vanguard International Semiconductor (VIS), and the specialty businesses of GlobalFoundries (GF) and TSMC. We’ll look at financial metrics and qualitative differences like business mix and geographic exposure.

Revenue Scale (2024): X-FAB’s 2024 revenue was $816M, down from $907M in 2023. Tower Semiconductor is larger – roughly $1.44B in 2024 (flat vs 2023). VIS of Taiwan had about NT$45.2B in 2024 revenue (converting to roughly $1.45B USD, similar to Tower) given NT$11.55B in Q4. GlobalFoundries is much bigger, with $6.75B in 2024 sales, though not all of that is “specialty” (GF includes mainstream fabs). TSMC is orders of magnitude larger (>$70B revenue), but if we isolate TSMC’s “specialty technology” segments (like 28nm and above, analog & embedded), it still likely generates many billions – far larger than X-FAB’s scope. So in sheer size, X-FAB is about half the size of Tower/VIS, and a fraction of GF or TSMC. That said, X-FAB is growing capacity to narrow the gap; by a few years out, it could join the “~$1.5B club” with Tower and VIS if plans succeed.

Profitability: Here it gets interesting. X-FAB’s operating margin in 2024 was ~10.5%, and net margin ~7.5% (after a more normal tax rate). Tower, excluding the one-time Intel breakup fee, had an operating margin around 14% in 2023. For 2024, Tower’s net margin was about 14% – notably higher than X-FAB’s. VIS reported an operating margin ~16-17% in late 2024 and net margin ~16%. So both Tower and VIS currently enjoy somewhat better profitability, likely due to economies of scale and perhaps more favorable product mix (Tower does a lot of high-margin RF and silicon photonics; VIS, as a pure-play, had 28.7% gross margin in Q4 2024). GlobalFoundries in 2024 actually had a net loss (~-$262M) on $6.75B revenue, as it struggled with underutilization; GF’s gross margin was ~24.5%, on par with X-FAB’s 22% gross margin, but GF’s huge overhead dragged it to loss. TSMC, of course, operates at ~50%+ net margin on advanced nodes, but that’s a different animal.

In terms of gross margin and EBITDA margin, X-FAB was competitive: 23% EBITDA margin in a down year, whereas Tower’s gross margin was ~25% and net margin 14%. X-FAB’s overhead (R&D, SG&A) as a percentage of sales is a bit higher due to its smaller scale, which compresses operating margin relative to Tower/VIS. But one could argue X-FAB has room to catch up as it scales.

Capex Intensity: X-FAB’s capex in 2024 was a whopping 62% of revenue (509.6/816) – far above peers. This is a temporary spike; Tower, by contrast, had more modest capex – in Q4 2023 Tower spent $136M on capex, which annualized is ~38% of revenue, but Tower likely slowed investment while awaiting the Intel deal. VIS in 2024 aimed for capex to support new tech, but its gross PPE additions were smaller relative to revenue (VIS tends to keep capex within depreciation plus a bit). GF’s capex was about $2.18B in 2024, ~32% of revenue (GF also moderated capex in downturn). So X-FAB’s capex intensity has been the highest among peers recently – an aggressive expansion stance. Post-2025, X-FAB plans to revert to ~12% of revenue capex, which would be more in line or even lower than peers (Tower often did 15-20% in growth years, VIS similarly around 20%).

Business Mix: X-FAB is heavily automotive (in 2024, automotive was ~61% of revenue, up from 54% in 2023 as industrial/medical shrank). Tower’s mix is more diversified: it serves industrial, consumer imaging, RF (for mobile), and some automotive, but automotive is not as dominant. Tower also has significant CMOS image sensor and RF-SOI business, and was developing silicon photonics and power GaN – slightly different emphases. VIS historically made a lot of display driver ICs (for LCD panels) and some power management; that’s more consumer-centric (display drivers for phones and TVs), though VIS has been pivoting towards automotive and industrial microcontrollers in recent years. VIS’s fortunes have been tied to the LCD cycle (their margins took a hit when display driver demand fell in 2022–24). GF has a broad mix: some cutting-edge (mobile SoCs), but also substantial specialty RF and automotive (GF is a major supplier of auto MCU chips at 22nm and 12nm, and RF front-end modules at 8SW RF-SOI). GF’s automotive exposure is smaller share than X-FAB’s but growing. TSMC’s specialty business is huge in IoT, connectivity, and it’s making inroads in automotive (pushing advanced nodes into auto, like 7nm for ADAS, which is beyond X-FAB’s scope).

So X-FAB stands out as one of the most automotive-focused foundries. This gives it strength in that domain (with quality systems and long-term contracts), but also concentration risk. The flip side: X-FAB has comparatively less exposure to consumer electronics volatility than, say, VIS or GF’s mobile phone related business. In downturns led by consumer, X-FAB can outperform.

Geographic footprint: X-FAB operates fabs on three continents, which none of its direct peers do to the same extent. Tower has two fabs in Israel, two in Japan (acquired from Panasonic), and one in the US (Texas) – so also multi-continent, but heavily Israel-centric and those Japan fabs mainly serve a specific customer (Panasonic). VIS is entirely in Taiwan (Hsinchu and Taichung). GF has fabs in the US (New York, Vermont), Germany (Dresden), and Singapore – quite global. TSMC is in Taiwan primarily, with one fab in China (Nanjing) and building in US and Japan. So X-FAB’s geographic diversification is on par with the best (GF), and better than a pure Taiwan or Israel foundry. This helps in supply chain resilience and accessing local talent pools. It also means X-FAB’s cost structure varies: labor in Malaysia is cheaper than in Germany, which might help margins; but having European fabs means higher energy and labor costs than purely Asian ops.

Margins and Utilization: Historically, smaller specialty foundries like X-FAB and Tower had lower margins than TSMC/UMC because of scale and sometimes lower utilization. However, in the 2021-2022 chip shortage, X-FAB’s EBITDA margin hit 33% in 2022 (with record EBITDA $246M), which actually rivaled Tower’s and was not far off some larger players. This indicates that at high utilization, X-FAB’s profitability can surge. Tower’s 2023 net margin was an anomaly at 36% due to Intel’s breakup fee. Excluding that, Tower and X-FAB are in a similar ballpark operationally. VIS traditionally had strong margins (20-25% operating) during LCD booms, but that’s come down; they guided ~29-31% gross margin for early 2025. So X-FAB is competitive but still with room for improvement to match peers’ best performance. Its new capacity, if filled, should bring some scale benefits that narrow the margin gap with Tower/VIS.

Customer Diversification: We noted X-FAB’s top customer ~45% of revenue. Tower’s largest customers are much smaller fraction – Tower serves many mid-size customers and had no single >10% customer as of a few years ago (except Intel as an ephemeral one due to acquisition attempt). VIS’s business might be more concentrated (they have a few big ones like Novatek for display drivers). GF’s top customer used to be AMD (but now diversified); no single >10% now publicly. So X-FAB is an outlier in customer concentration. That is a risk if that customer stumbles (Melexis’s own sales dropped ~18% in 2024, which fed into X-FAB’s drop). However, given the intertwined ownership previously, one might see it as a strategic partnership more than a risk of sudden loss. Still, from an investor perspective, X-FAB could improve by broadening its customer base, something management likely is pushing (winning new automotive programs, more industrial/medical clients to reduce that 45% share).

Technology and Product mix: X-FAB focuses on 180nm and above for CMOS, plus MEMS and SiC. Tower has some overlap (they do 180nm, 130nm analog, MEMS, and also SiGe BiCMOS for RF). Tower doesn’t do SiC (Tower’s parent Intel was more focused on Tower’s silicon photonics and RF). VIS does older nodes (350nm, 180nm, 90nm for driver ICs). GF and TSMC extend down to 12nm/7nm for digital but also offer 55nm, 40nm BCD etc. One advantage for X-FAB is that it specializes in mixed-signal + MEMS integration – few foundries offer MEMS-on-CMOS like X-FAB does at scale. This can set it apart: e.g., an industrial sensor that needs both MEMS and readout circuit can be built within X-FAB’s processes. TSMC doesn’t do MEMS; Tower does some MEMS; VIS mostly no. So X-FAB’s MEMS expertise is a differentiator. Additionally, X-FAB’s early move into SiC foundry is notable – GF and TSMC are not foundry-ing SiC (they stick to silicon). Only a couple of Chinese foundries and Cree/Wolfspeed (which is vertically integrated) do SiC. So X-FAB is trying to establish a beachhead in third-generation semiconductors which could pay off as EV adoption grows.

From this, we see X-FAB is a niche leader in automotive analog, whereas Tower is a strong #2 in analog foundry with broader applications, and VIS is big in its specific segments. GF and TSMC have greater breadth, but analog is just one part of their empire.

Long-Term Outlook: With a solid footing in a growing niche, X-FAB’s long-term investment thesis boils down to sustainable growth on the back of secular trends and improved scale. The company’s economic moat in analog/mixed-signal foundry services for automotive and industrial applications appears durable, supported by high switching costs and deep expertise. Financially, X-FAB has shown prudent management, using its strong balance sheet to fuel expansion while maintaining stability through cycles. The next 3+ years will be pivotal: as its $1B expansion comes online, X-FAB must execute by filling that capacity with profitable business. If successful, we could see X-FAB’s revenues climb toward the upper end of its targets (potentially $1.2–1.5B) and margins approaching those of its larger peers, all while continuing to generate healthy cash flows.

Of course, no investment comes without risks – an overhang is the reliance on one key customer and the cyclical nature of orders. However, the alignment of megatrends (EVs, industry 4.0, medical tech) is in X-FAB’s favor. Even as global semiconductors face short-term headwinds, the content of analog and power chips in end products is rising. X-FAB’s position as a leading specialty foundry in the West (complementing Asian foundries) may also become more strategically valuable in an era of tech sovereignty and supply chain diversification.

X-FAB is that quietly confident mid-sized player, not making front-page news like the chips in iPhones, but steadily enabling the innovations that make cars safer, factories smarter, and medical devices more capable. It has navigated the silicon cycle’s twists and turns with increasing finesse. The coming years will tell if X-FAB can fully realize its analog ambitions – converting new cleanrooms and processes into enduring profits. For long-term investors, the pieces are in place for X-FAB to transition from a *“behind the curve” niche supplier to a key enabler of the electrified, sensor-rich future, rewarding patience with sustainable growth and value creation.

Given the depth of analysis, we conclude that X-FAB Silicon Foundries SE offers a compelling long-term case: a company with a clear focus, widening moat, improving financial muscle, and exposure to resilient growth markets. It stands as a testament that sometimes in semiconductors, being in the right niche at the right time beats being the biggest – and X-FAB’s niche is poised to shine in the years ahead.

💬 What are your thoughts on X-FAB's potential? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe — your support truly motivates me to continue creating quality content.