Step-by-Step Valuation: A Practical DCF and IRR Example

Master Stock Valuation with a Detailed Step-by-Step Discounted Cash Flow (DCF) & Internal Rate of Return (IRR) Analysis

Whenever I evaluate a stock I don’t just look at the share price. For me, real investing hinges on understanding how a company generates cash flow and whether those cash flows can be sustained or expanded over the long term. So, in this post, I’ll break down how I personally walk through both Discounted Cash Flow (DCF) and Internal Rate of Return (IRR) for Apple, using end-of-day data from March 17, 2025. The goal isn’t to give you a one-size-fits-all formula—it’s to show you how to adapt a proven framework to your own investing style.

Here you can find the Google Sheet I use for this exercise, both the empty one if you would like to follow step by step, or the final one if you would like to play directly with parameters.

Table of Contents

First Set Your Discount Rate

Then Let's Fill Company Details

Come Up with Growth Estimates

Then Estimate Operating Margin (EBIT)

Then Fill Estimated Interest Payments (or Income)

Then Estimate Tax Rates

Then We Need to Calculate Net CapEx & Working Capital

We Are Done—Arrive at Discounted Cash Flow and Terminal Value

Finally, I Want to Calculate the IRR

Conclusion & Key Takeaways

1. First Set Your Discount Rate

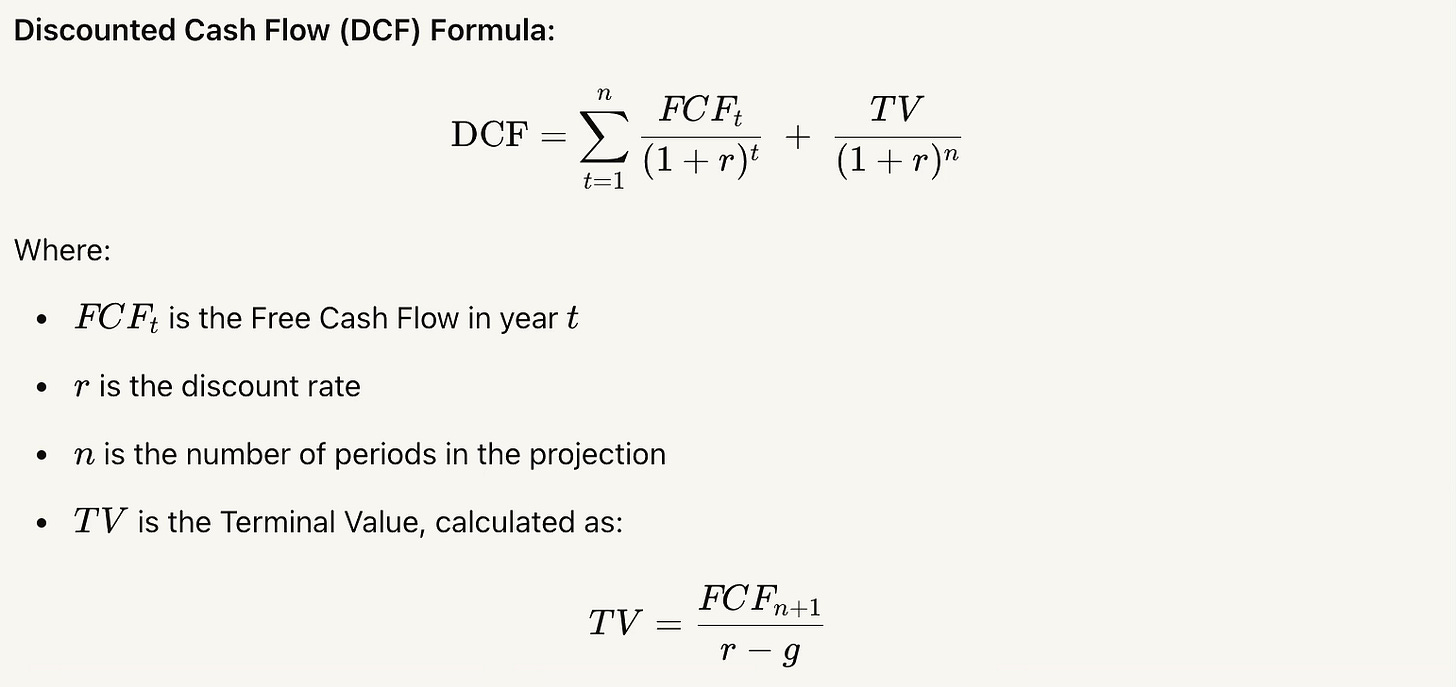

Let’s briefly explain Discounted Cash Flow (DCF) Analysis. DCF is used to estimate the intrinsic value of a stock based on projected future cash flows.

How It Works:

Project Future Free Cash Flows (FCF) – Estimate the company’s FCF over a specific forecast period (usually 5-10 years).

Apply a Discount Rate (WACC or Required Return) – Discount future cash flows to present value using the Weighted Average Cost of Capital (WACC) or a required rate of return.

Calculate Terminal Value (TV) – Since businesses don’t just stop after 10 years, estimate the company’s value beyond the forecast period using a terminal growth rate.

Sum the Present Values – The present value of projected cash flows and the present value of the terminal value are added together.

Adjust for Debt & Shares Outstanding – Subtract net debt and divide by the number of shares to get the per-share intrinsic value.

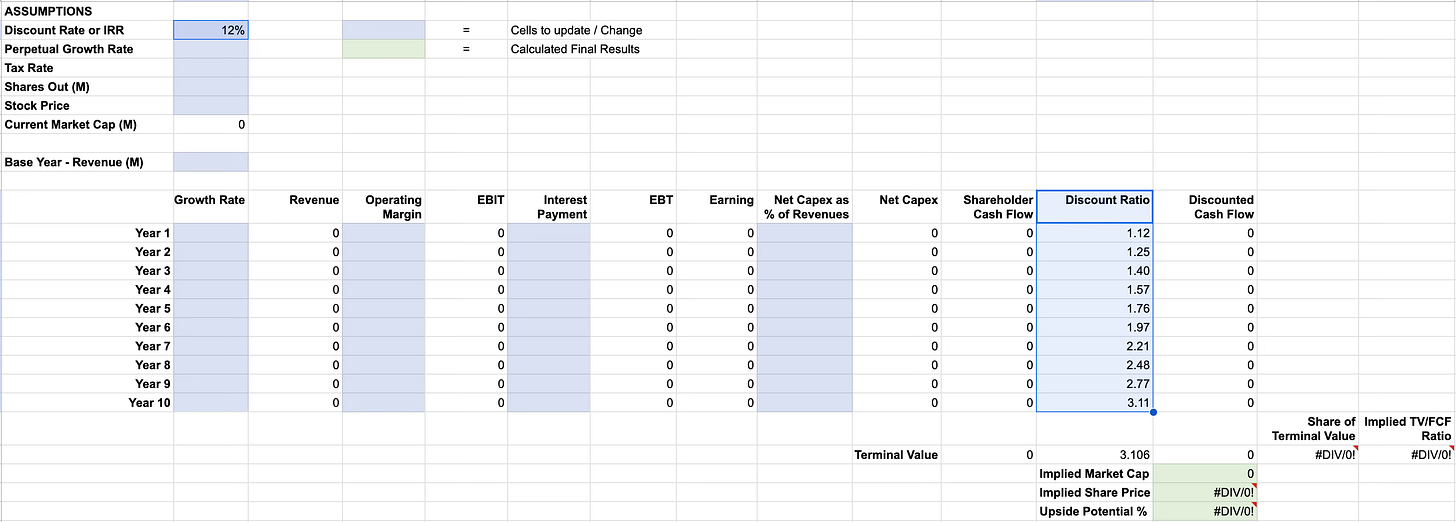

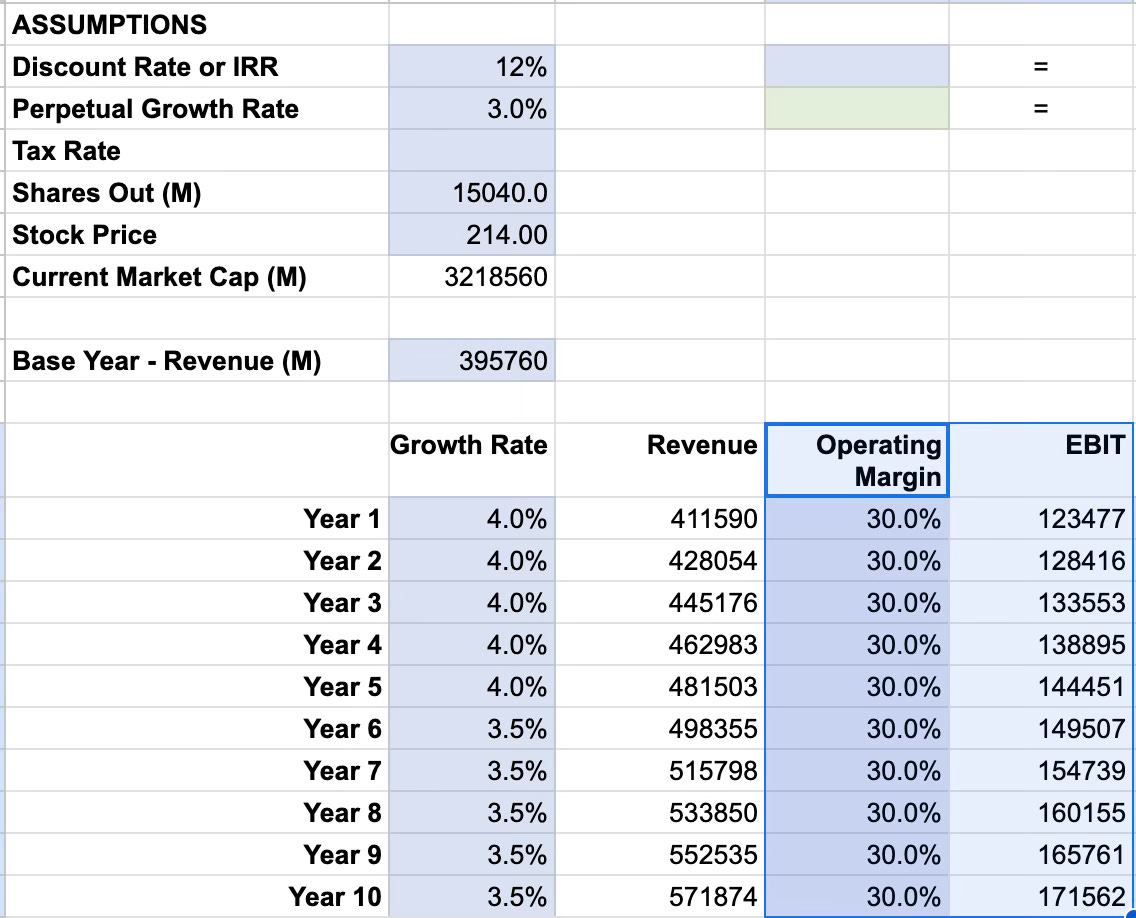

The discount rate is a critical assumption because it tells you how to value future cash flows in today’s dollars. I’m using 12% here:

This will calculate the discount ratio for each year automatically (e.g., Year 1 uses 1/(1+0.12), Year 2 uses 1/(1+0.12)^2, and so on).

For a mature company like Apple, some might opt for 8–10%. I choose 12% to account for my desired return and a margin of safety.

Personal Tip: A higher discount rate makes your valuation more conservative, essentially asking for a higher hurdle to clear.

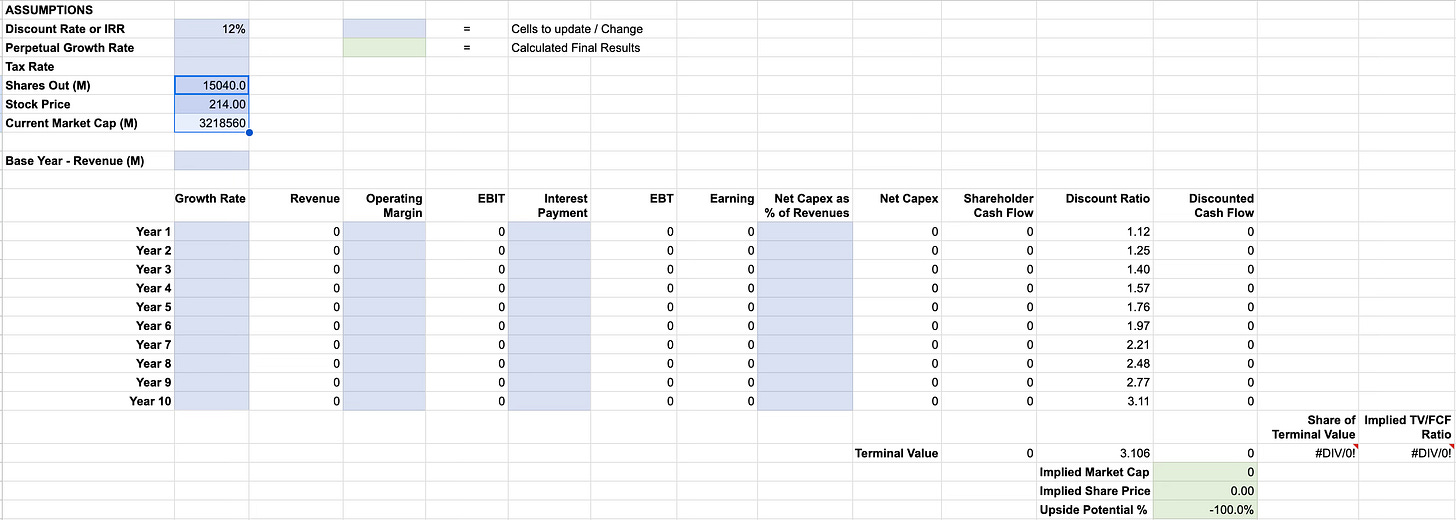

2. Then Let's Fill Company Details

Next, input the basics:

Price: Pull automatically (in Google Sheets, for instance) via

=GOOGLEFINANCE("AAPL").Outstanding Shares: Enter the total number of shares Apple has issued.

From these two data points, your sheet can compute Apple’s current market capitalization so you can later compare your DCF-based valuation to the market’s valuation.

3. Come Up with Growth Estimates

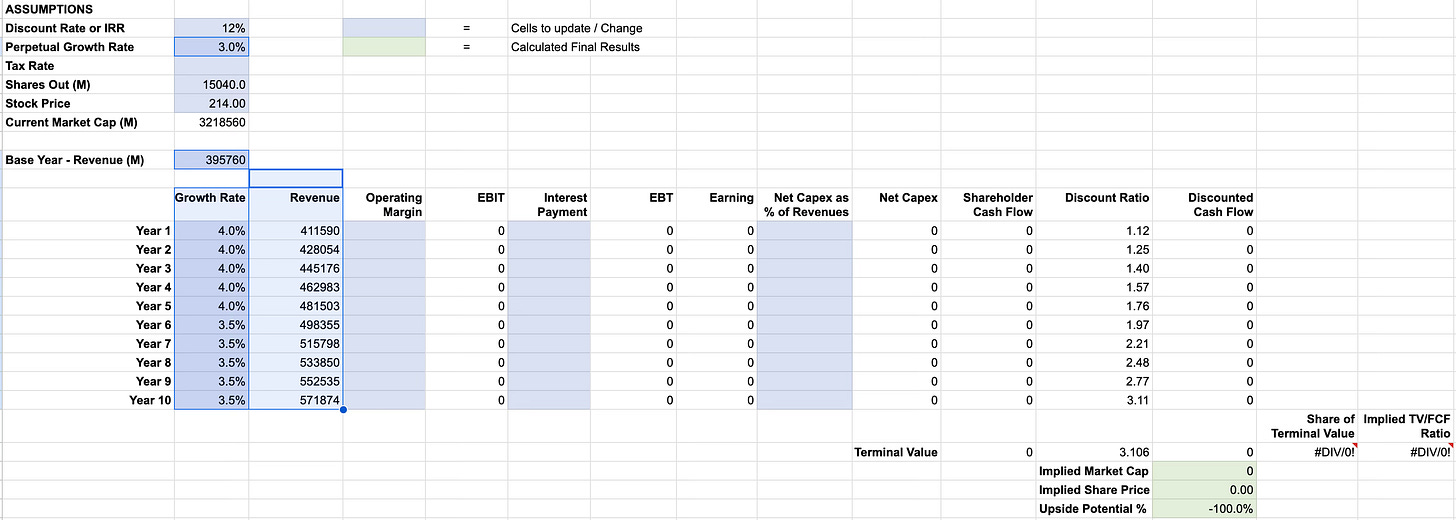

Base Year Revenue: For Apple, we’re using $395.76B (in spreadsheet terms, 395760 as millions).

This figure will anchor the entire valuation, so it should be as up-to-date as possible.

Apple’s growth has eased in the past few years. I’m assuming:

4% annual growth for Years 1–5,

3.5% annual growth for Years 6–10,

3% as the perpetual growth rate afterward.

This will calculate the expected revenue numbers for next 10 years.

Why These Numbers? Apple’s global footprint and stable product lines can sustain moderate growth, but the smartphone market is maturing. Adjust these rates if you think Apple’s future products (like AR/VR) will drive faster expansion.

4. Then Estimate Operating Margin (EBIT)

Operating margin shows how much profit remains after operational costs:

I assume 30% for Apple, consistent with its historical performance.

Multiply (automatically in Google Sheet) each year’s projected revenue by 30% to get that year’s EBIT (operating profit).

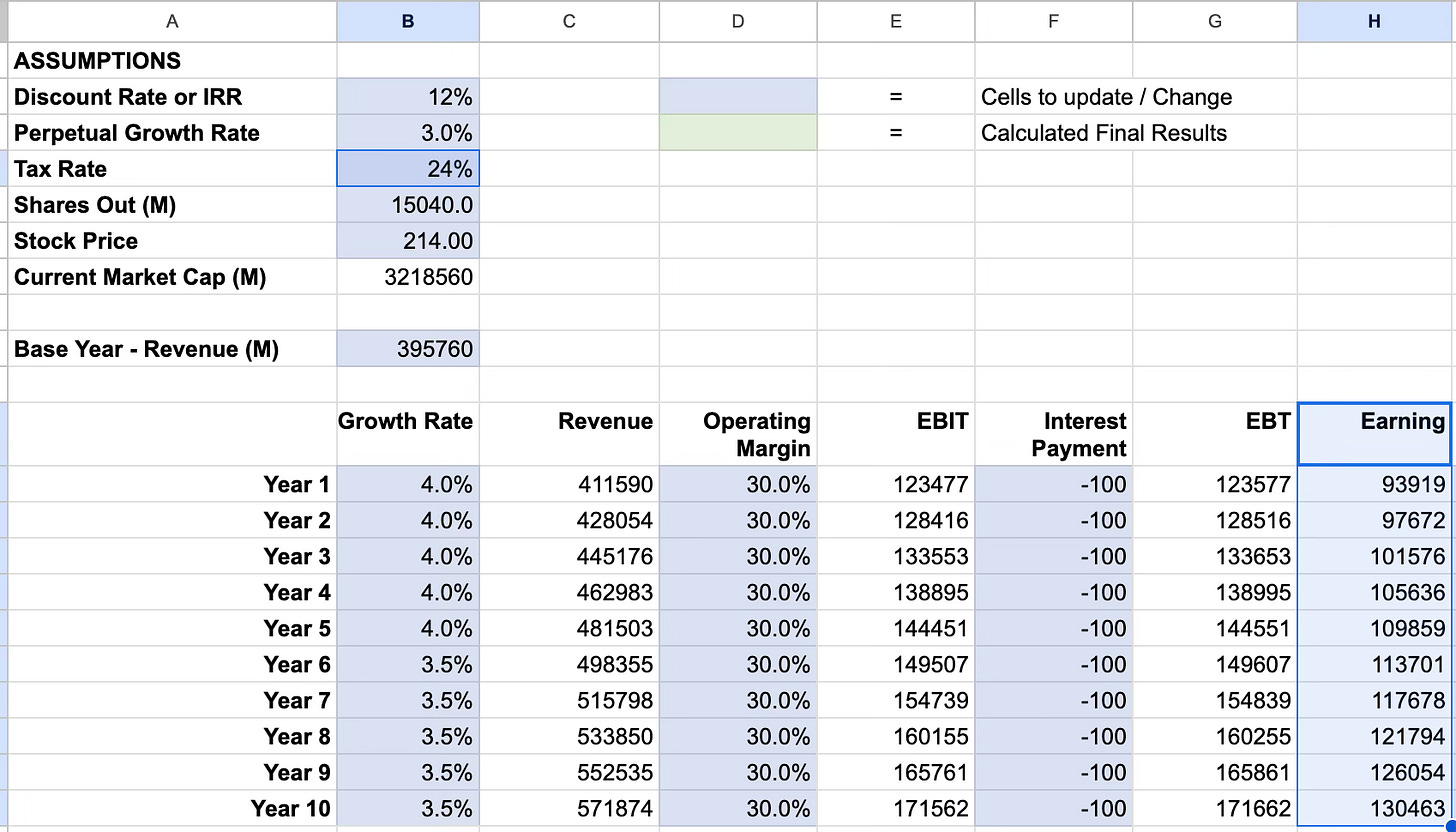

5. Then Fill Estimated Interest Payments (or Income)

Because I’m interested in shareholder returns:

Interest (Net): If a company has more cash and marketable securities than debt, it should produce interest income. For simplicity, I’m putting $100M as negative interest expense (i.e., net interest income).

The resulting line is EBT (Earnings Before Tax).

Personal Note: I factor interest into the cash flows directly, rather than adding it separately at the end, because my primary focus is on actual returns to shareholders. For instance, if Apple holds substantial cash reserves earning just 4%, I'd prefer to see them either invest in profitable ventures or return that capital through dividends or buybacks. This distinction sets my approach apart from most investors, as I deliberately penalize companies that leave large amounts of cash idle.

6. Then Estimate Tax Rates

Tax can significantly affect net earnings:

I use 24%, close to Apple’s recent effective tax rate.

Earnings After Tax = EBT × (1 – 0.24) = EBT × 76%.

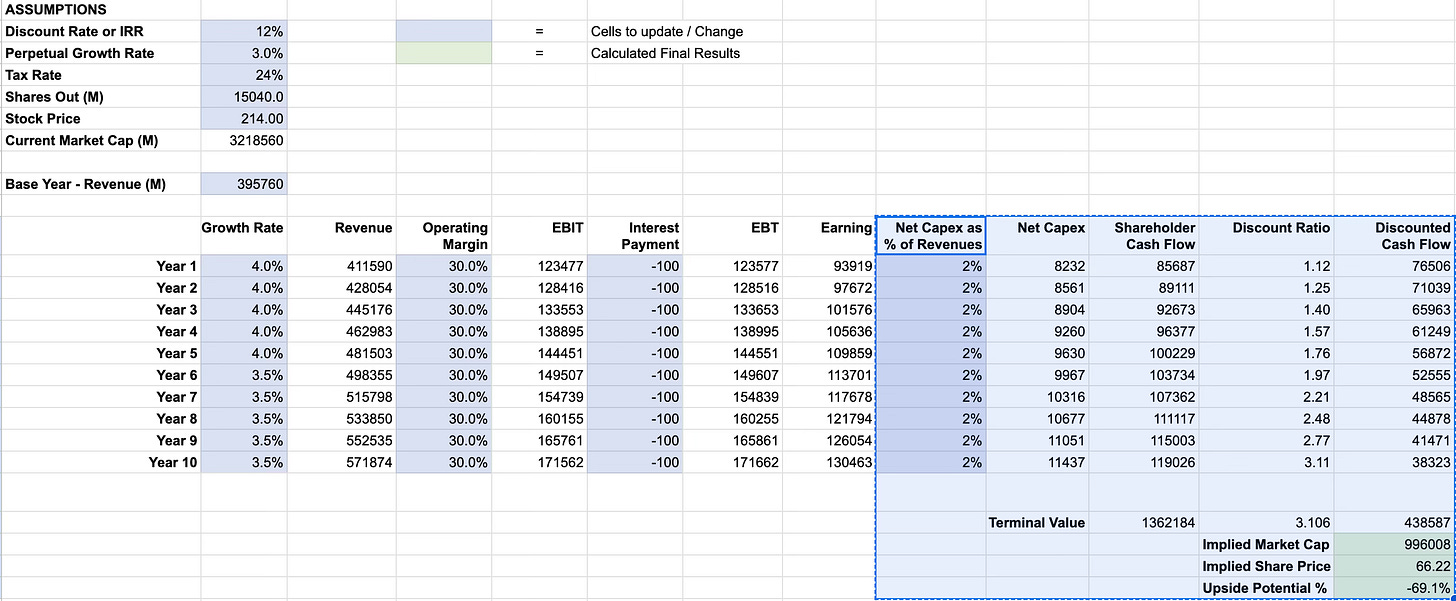

7. Then We Need to Calculate Net CapEx & Working Capital

This is how we arrive at free cash flow (FCF), which is what truly matters for shareholders:

Net CapEx: Capital expenditures minus depreciation. I assume about 2% of revenues, factoring in Apple’s reshoring or supply chain investments.

Working Capital: Apple’s working capital needs tend to be modest. Adjust if you expect big product launches or changes in inventory.

Subtract these from Earnings After Tax to get the real “distributable” cash flow each year.

8. We Are Done—Arrive at Discounted Cash Flow and Terminal Value

Once free cash flow is estimated for each forecasted year:

Discount each year’s FCF back to present value using the 12% rate.

Terminal Value: In Year 10, you calculate:

Sum: The total discounted value of Years 1–10 plus the discounted TV gives you an implied fair equity value for Apple (once net debt/cash is accounted for, if you’re modeling it explicitly).

Personal Note: Checking Terminal Value Proportion

I always like to double-check how much of the DCF value is coming from the terminal value. If it’s super high—think 80–90% or more—it usually signals I should revisit my assumptions. But honestly, for mature, stable companies like Apple, having a sizable chunk in the terminal value is often normal. Just something to keep an eye on.

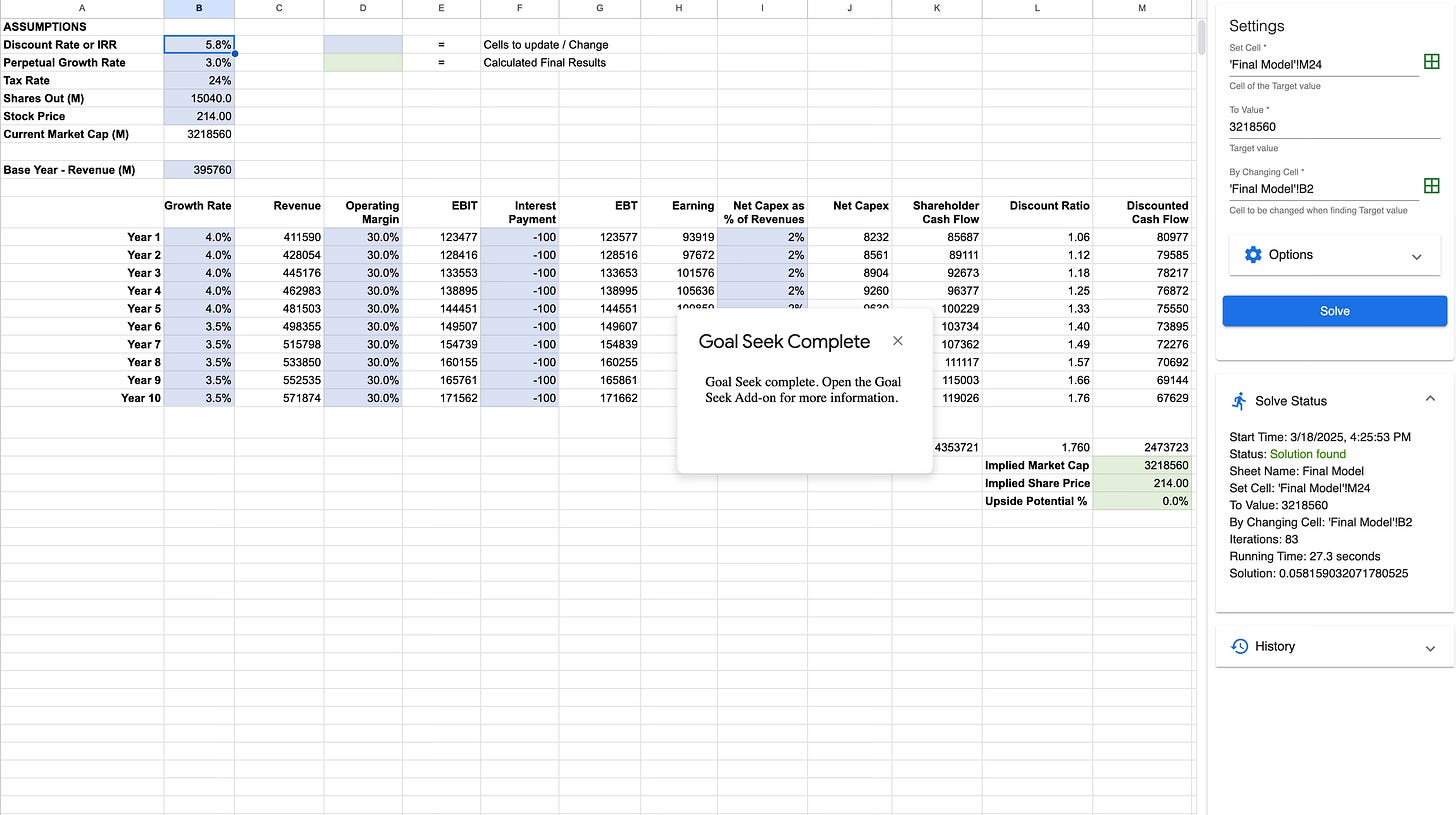

9. Finally, I Want to Calculate the IRR

The Internal Rate of Return (IRR) essentially asks: “If I buy Apple at today’s market cap and future cash flows come in as forecasted, what annual return do I get?” Here’s how:

Goal Seek: In Excel or Google Sheets, set the target value to Apple’s current market cap (cell with your “implied market cap”).

Change the IRR Cell: Tweak the discount rate until the calculated value matches the actual market cap.

If the IRR is higher than 12%, Apple might be a buy for someone targeting a 12% return. If it’s lower, the market may be expecting slower growth or you might be overestimating Apple’s future earnings power.

Here is also a lengthy discussion of why I prefer IRR to DCF:

10. Conclusion & Key Takeaways

1. Process Over Precision

Valuation is less about pinpointing the perfect number and more about creating a logical, transparent, and repeatable method. The journey matters more than the destination.

2. Stay Flexible

Be prepared to adjust growth rates, discount rates, and capital expenditure assumptions. Tailor your valuation models to fit your investing style and risk tolerance.

3. Compare to Market

Once you've calculated a fair value, always compare it with the current market price. The difference (margin of safety) helps guide informed buy or sell decisions.

4. IRR Cross-Check

Always validate your conclusions with an Internal Rate of Return (IRR) analysis. It ensures consistency between your discount rate, growth assumptions, and targeted returns, serving as a valuable sanity check.

💬 What are your thoughts on valuation with Discounted Cash Flow (DCF) & Internal Rate of Return (IRR)? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe – your support truly motivates me to keep creating quality content.

Logically and literally, the intrinsic value is determined by the rally between net income growth and invested capital growth.

My Unconventional Methods:

1.

Discounted EPS ( 35.1271372205 Years)

= 6.32×(1-(0.9528339279÷1.028)^35.1271372205)÷(1-(0.9528339279÷1.028))

= $ 80.4321426694

Eps Ttm 6.32

Gni Ttm Factor 0.9528339279

CPI factor 1.028

ROIC (NI/IC) Ttm 35.1271372205

Years = 35.1271372205

Or

2.

Equilibrium Factor after balancing Gni and ROIC

=

100×(√(0.9528339279×1.3512713722)-1)

= 13.4696968021

Discounted EPS ( 13.4696968021 Years)

=

6.32×(1-(1÷1.028)^13.4696968021)÷(1-(1÷1.028))

= $ 72.0753361767

3.

35.1271372205×6.32

= $ 222.0035072336

4.

13.4696968021×6.32

= $ 85.1284837893