Jet2 PLC: A Deep Dive into the UK’s Leisure Travel Powerhouse

How Jet2 Quietly Became the UK’s Most Trusted Holiday Brand — And Why Its Business Model May Be One of the Most Underappreciated in European Aviation

This Jet2 analysis is picked as part of our Community Long-Term Stock Picking series. You can join the next round here, or find the latest round in the chat or Notes section.

Jet2 isn’t just an airline — it’s a vertically integrated, cash-generating machine that has carved a durable niche in one of the most competitive industries on earth. While its low-cost rivals battle on fares and its heavyweight peers wrestle with bloated balance sheets, Jet2 flies a different route: pairing flights with fully-packaged holiday convenience, all anchored by customer loyalty and financial prudence.

In this long-form breakdown, we examine Jet2’s economic moat, financial health, capital allocation discipline, and long-term prospects as both a durable compounder and a growth platform. Drawing on verified data, primary filings, and sector-specific trends, we’ll assess whether Jet2 has what it takes to earn its place in a long-term investor’s portfolio.

Let’s get into the cockpit.

Business Overview

Economic Moat and Competitive Landscape

Financial Stability

Management Quality and Capital Allocation

Operating Profit and Cash Flow

Tax and Interest

Growth Capex Outlook

Sector-Specific Considerations

Valuation Analysis (DCF & IRR)

1. Business Overview

Business Model & Services: Jet2 PLC operates an integrated leisure travel business focused on taking customers on holiday. It has two main segments: Jet2.com, a low-fare leisure airline, and Jet2holidays, the UK’s largest package holiday tour operator. Jet2.com provides scheduled flights from its UK bases to over 70 destinations across Europe (especially the Mediterranean and Canary Islands), while Jet2holidays offers ATOL-protected package holidays that bundle Jet2 flights with accommodations (over 5,100 hotels ranging from 2-star to 5-star) and transfers. This integrated model allows Jet2 to have full control over its seat supply and better manage seasonal demand by shifting capacity between flight-only and package customers.

Key Customer Segments: Jet2 targets UK leisure travelers, from families and couples to retirees, seeking affordable sun and city vacations. It caters to a broad range with differentiated brands (e.g. Jet2CityBreaks, Jet2Villas, Indulgent Escapes, VIBE for younger adults) covering budget self-catering up to luxury all-inclusive packages. Over two-thirds of its flight seats are sold as part of Jet2holidays packages, reflecting strong demand for the convenience and financial protection of bundled holidays. Notably, Jet2holidays has a high repeat customer rate (over 60% bookings are from repeat customers), indicating loyalty in its core UK holidaymaker segment.

Geographic Footprint: Jet2 operates from 11 UK airport bases (growing to 12 with a new base at Liverpool in 2025), which collectively give it reach to over 80% of the UK population. Its flights connect these regions to popular destinations in Spain, Greece, Turkey, Cyprus, Portugal and other sun spots. In Summer 2024, Jet2 had 127 aircraft operating and 17.2 million seats on sale, rising to 18.3 million seats planned for Summer 2025 as it expands capacity. This makes Jet2.com the UK’s third-largest airline by passengers (after Ryanair and easyJet) and Jet2holidays the #1 tour operator in the UK by package customer volume. The company’s strong presence in regional UK airports (like Leeds, Manchester, Birmingham, Newcastle) has helped it capture market share outside London, often serving customers closer to home.

2. Economic Moat and Competitive Landscape

Durable Competitive Advantages: Jet2’s primary competitive edge lies in its integrated model and customer service reputation. Unlike pure airlines, Jet2holidays vertically integrates flight, hotel, and transport services, capturing more customer spend and loyalty. This model provides a degree of moat through distribution control – Jet2 can fill its planes with its own package holiday customers, which smooths seasonality and yields. It also enjoys economies of scope: the tour operation guarantees passenger volumes for the airline, while the airline enables competitive package pricing. Additionally, Jet2 differentiates with a customer-first approach and “VIP service” ethos that has earned it numerous awards (e.g. Which? Travel Brand of the Year for three consecutive years). This service focus – from friendly staff to hassle-free bookings and reliable refunds – has strengthened its brand positioning as a trusted holiday provider, fostering high repeat business. In an industry often criticized for poor service, Jet2’s award-winning customer satisfaction is a competitive asset that is hard for ultra-low-cost rivals to replicate without raising their cost base.

Cost Structure & Pricing: Jet2 operates a low-cost base akin to budget airlines, though not as ultralow as Ryanair. It historically benefited from operating older Boeing aircraft purchased outright (reducing ownership costs) and maintaining high seat density. However, with its ongoing fleet renewal to Airbus A321neos, Jet2 is moving to more fuel-efficient planes that should lower unit costs further. The company’s cost per seat includes providing some frills (e.g. 22kg baggage allowance in packages, in-flight service) and using primary or large secondary airports. Its cost per passenger is therefore slightly higher than Ryanair’s ultra-sparse service model, but Jet2 balances this with higher ancillary and package revenue. Jet2 demonstrated pricing power in the post-COVID rebound – in the year ended March 2024, average package holiday prices rose 11% (to £830) and average flight-only fares rose ~14%. Despite these hikes, demand remained robust with load factors ~90%, evidencing resilient customer willingness to pay for its offering. This suggests Jet2 has some pricing latitude due to its differentiated service and package value proposition, unlike commodity transport players.

Industry Dynamics & Trends: The European short-haul leisure travel market is large, resilient, and currently in a growth phase. UK consumers have shown a strong post-COVID travel rebound, prioritizing holidays even amid inflation – 87% of UK consumers plan a holiday post-April 2024 according to Mintel research. Industry capacity has recovered to pre-pandemic levels and is still growing: European air travel is forecast to grow ~2.2% CAGR through 2040, and the UK overseas package holiday market is expected to expand ~20% by 2028. This rising tide benefits all major players, but especially those like Jet2 that have added capacity. Jet2 has outpaced rivals in growth – for example, its package customer numbers in Summer 2024 were 4.7 million, up 74% from pre-COVID (HY20) levels. The collapse of Thomas Cook in 2019 also removed a key competitor and allowed Jet2 and TUI to capture pent-up demand.

However, competition remains intense. Jet2’s key rivals are Ryanair and easyJet (low-cost carriers with bigger scale) and TUI (another integrated tour operator). Ryanair in particular enjoys the lowest unit costs in Europe and aggressive expansion, putting pressure on fares. easyJet targets a similar UK customer base (flight-only and city breaks) and has been recovering capacity. TUI, while still reorganizing post-pandemic, competes for package holiday customers especially in the higher-end and all-inclusive segment. Jet2 has thus far grown its share, but it operates in a price-sensitive market with low switching costs.

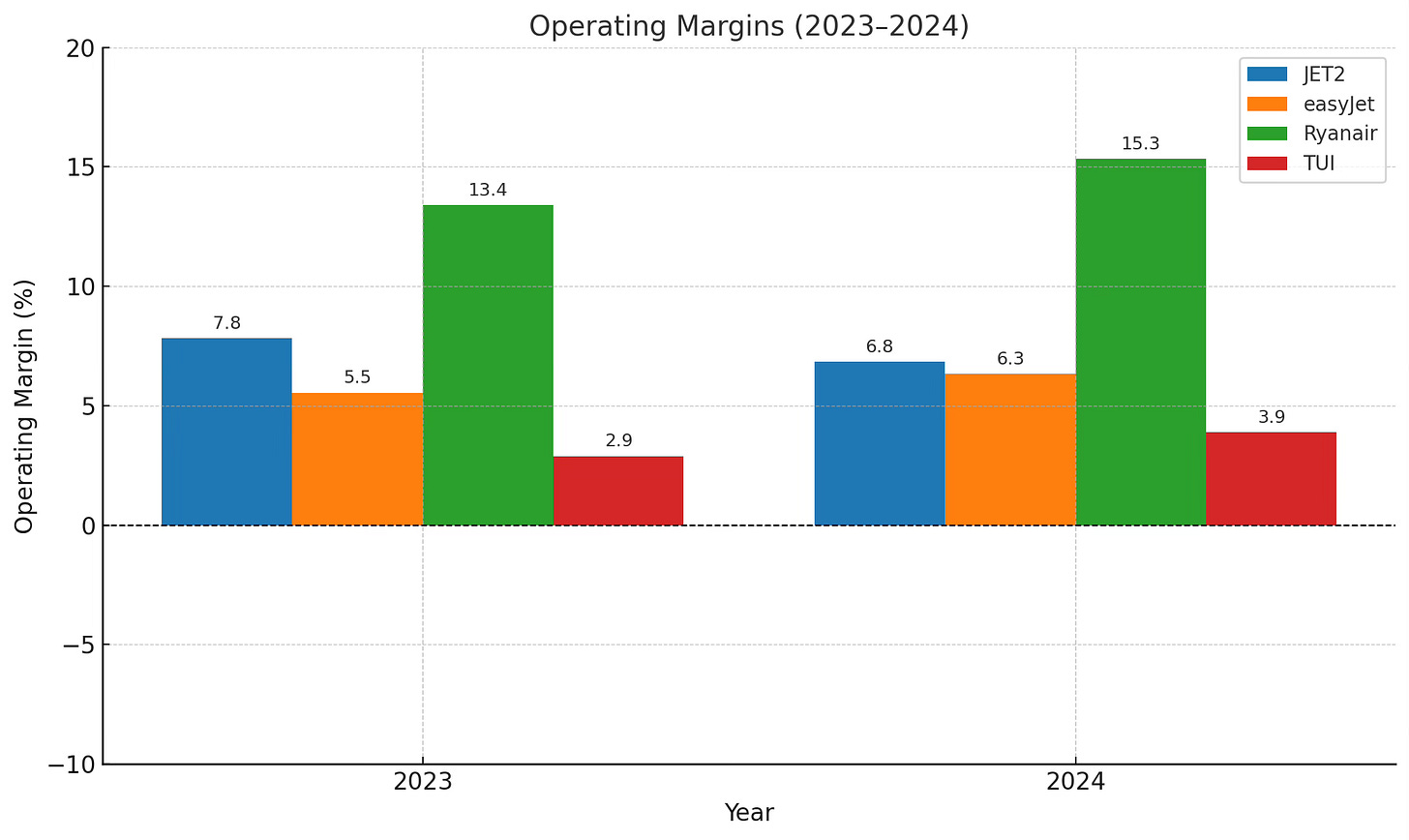

Market Position vs. Competitors: Jet2 is now the UK’s #1 tour operator to beach destinations and #3 airline by passenger numbers. It carried 17.7 million passengers in FY2024, generating £6.3 billion revenue. By comparison, easyJet flew ~89.7 million passengers in FY2024 with £9.3 billion revenue, and Ryanair flew 183.7 million passengers with €13.44 billion revenue. TUI Group (which operates its own airline and global holiday business) served 19.1 million guests and had €20.7 billion revenue in FY2023. Jet2 is smaller in absolute size, but its operating profit margins have been relatively solid coming out of the pandemic, surpassing TUI and rivaling easyJet’s. The chart below benchmarks Jet2’s latest operating margin against peers:

As shown, Ryanair’s cost leadership yields significantly higher profitability. Jet2 and easyJet, with higher cost bases and focus on customer service, achieved mid-single-digit margins around 6–7%. TUI lagged with margins under 4%, partly due to its heavier fixed costs and debt. This competitive landscape indicates that Jet2 has been more efficient or better managed than TUI, but it cannot match Ryanair’s ultra-low cost advantages. Jet2’s moat therefore is not cost leadership, but its package holiday integration, strong brand loyalty, and focus on a higher-margin customer segment that values service. These factors have enabled Jet2 to consistently fill its planes (FY2024 load factor ~90%) and maintain profit per passenger even amid cost inflation.

Resilience of Demand: Leisure travel demand has proven resilient even during economic uncertainty. After the pandemic, consumers prioritized spending on holidays (“experience over things”), which helped Jet2 deliver record revenue and a return to profit in 2022–2024. While a severe recession could dampen discretionary travel, UK holidaymakers historically tend to protect their main summer vacation, perhaps down-trading rather than canceling. Jet2’s range of budget-friendly packages positions it well to capture value-conscious travelers if consumer budgets tighten. Moreover, package holidays offer cost certainty (flights + hotel locked in), which can appeal during times of currency volatility or inflation. The risk to demand is higher for non-essential city breaks or shoulder-season trips, but Jet2’s diversified product mix (beach, city, off-peak) helps spread this risk. Notably, during industry downturns like 2008, low-cost leisure travel proved more resilient than premium or business travel. Jet2 was a much smaller player then, but in the COVID shock it demonstrated agility by quickly refunding customers (building goodwill) and raising liquidity to survive the shutdown. This ability to navigate crises – combined with pent-up demand that often follows – suggests that Jet2’s core leisure demand is durable over a 3+ year horizon, albeit cyclical.

Major Risks and Challenges: Despite its strengths, Jet2 faces several risks. Macroeconomic downturn is a key risk – high inflation or a UK recession could hit consumers’ travel budgets, reducing volumes or forcing Jet2 to discount prices (hurting margins). Competitive capacity is another: both Ryanair and easyJet are adding aircraft aggressively in the UK and Europe in the coming years, which could lead to oversupply on certain routes or price wars. For instance, if rivals drop fares to gain share, Jet2 might have to respond given the price-sensitive market. Fuel price volatility remains a constant risk for airlines – Jet2 spends hundreds of millions on fuel (combined fuel and carbon costs were £803.7m in FY2024, up 34% due to price increases). While it has a hedging program to smooth near-term fuel costs, a sustained spike in oil prices could raise Jet2’s operating costs significantly, especially as its older aircraft are less fuel-efficient (mitigated as new A321neos enter service). Foreign exchange fluctuations (e.g. a weaker GBP) can also inflate costs for Jet2, which pays for fuel, aircraft leases, and some hotel contracts in USD or EUR – again partly hedged but not fully eliminated.

Additionally, regulatory and environmental pressures are mounting. Airlines are increasingly subject to carbon pricing (EU/UK Emissions Trading Scheme) and mandates for Sustainable Aviation Fuel (SAF). For example, the EU is introducing a mandate from 2025 requiring a minimum SAF blend in jet fuel; Jet2 has proactively started using a 1% SAF blend on some routes in 2024 to get ahead of this. These green measures, while necessary, add costs – Jet2 noted that the end of a carbon exemption for Canary Islands flights in 2023 raised costs ~1%. Over time, carbon taxes and SAF (which is 2–5x more expensive than kerosene) could pressure margins if Jet2 cannot pass on the costs. Climate change and sustainability also pose a strategic risk: as a holiday airline, Jet2’s business model is exposed to increasing public and political scrutiny over aviation’s carbon emissions. The company is addressing this through fleet renewal and efficiency (it reduced CO2 per passenger km to 65.7g in FY2024), but long-term, air travel could face demand dampening or additional taxes due to environmental concerns.

In summary, Jet2 operates in a competitive, cyclical industry with thin margins, but it has carved out a robust position in the UK leisure travel niche. Its brand loyalty, package holiday focus, and solid service reputation provide some insulation against pure price competition. However, it remains vulnerable to external shocks (fuel, macro, FX) and aggressive competitor moves. A long-term investor should monitor these industry dynamics, as Jet2’s ability to maintain pricing and load factors in the face of rising costs or new competition will be crucial for its sustained profitability.

3. Financial Stability

Balance Sheet Strength: Jet2 emerged from the pandemic with a reinforced balance sheet, bolstered by liquidity raises (including a £387m convertible bond in 2021) and prudent cash management. As of March 31, 2024 (FY2024 year-end), the group had £5.57 billion in total assets against £4.16 billion in total liabilities, equating to net assets of £1.409 billion. A notable feature is Jet2’s large cash holdings from customer bookings. At FY2024 year-end, it reported £1.44 billion in cash and equivalents plus £1.75 billion in money market deposits. This £3.19 billion gross cash is offset by advance customer deferred revenue of £1.926 billion for holidays/flights yet to be delivered. Jet2 internally distinguishes “Own Cash” (unrestricted cash excluding customer deposits) which stood at £520.4 million at March 2024. This was down from £1.06 billion a year prior, mainly because the company utilized cash for operations and growth as travel resumed. However, seasonality has a big impact: at September 30, 2024 (half-year), as bookings for future travel poured in, Own Cash rebounded to £2.32 billion. In any case, Jet2 has ample liquidity relative to its size, underpinned by customer prepayments that act as a form of working capital financing for the business.

Debt and Leverage: Against its cash, Jet2’s debt is moderate and largely associated with fleet financing. At March 2024, total borrowings were £755.8 million (mostly long-term, including the convertible bond), and lease liabilities for aircraft and other assets totaled £699.6 million. Excluding leases (which are operating in nature), Jet2 effectively had a net cash position if including its large customer cash balance. Even on an “own cash” basis, the company had around £520m cash vs. £756m borrowings, implying net debt of ~£236m. This is a conservative leverage level given FY2024 EBITDA was £680.3m. Moreover, Jet2 has been actively deleveraging: in April 2024, it prepaid £87.9 million of higher-interest aircraft loans from its cash reserves. This will save on interest costs going forward. By summer 2024, Jet2’s strong cash inflows had turned it net cash positive again. The company’s capital structure (equity £1.4bn, debt <£0.8bn) appears solid and capable of withstanding shocks. Jet2 also has asset backing in owned aircraft (PPE of £1.19bn), which it could leverage or sell-leaseback if needed.

Cash Flow and Shock Resilience: Jet2’s operations are highly cash generative in normal times. In FY2024 it produced £1.09 billion net cash from operating activities, driven by robust profits and a large working capital inflow of £363m from customer deposits (as bookings outpaced holiday deliveries). Even after £404m of capital expenditure and other investing outflows, free cash flow was strongly positive. The company used excess cash to repay debt (£173m) and even resumed dividends (£25.8m). This indicates healthy financial flexibility. In a downside scenario (e.g. travel demand shock), Jet2’s cash balance provides a cushion to refund customers or cover fixed costs for a period. During COVID-19, Jet2 demonstrated its resilience by raising additional cash (via equity and the convertible bond) and drastically cutting costs to survive essentially zero revenue for several months. Those measures, along with government support programs, enabled it to avoid insolvency and quickly rebound when travel restarted.

As of 2024, Jet2 appears better prepared for shocks: it has more equity, substantial liquidity, and less debt than before. Its going concern analysis includes stress tests, and the Board is comfortable with the company’s capital headroom. Key to stability is that customer monies effectively act as a revolving credit – if operations halted, that cash would need to be refunded, but the company could also scale back variable costs dramatically (parking planes, etc.). The main fixed obligations in that scenario would be aircraft lease payments and minimal staff (most staff can be furloughed or released as seen in 2020). With net cash and an investment-grade treasury policy, Jet2 should be able to withstand a moderate shock (like a temporary demand dip or fuel spike). An extreme shock like another global travel shutdown would still be challenging, but Jet2’s past crisis handling suggests it would take swift action (seeking government aid, raising equity if needed) to bridge the gap. Overall, the financial health is robust, marked by high cash reserves and prudent leverage, which supports Jet2’s capacity to invest in growth while weathering unexpected turbulence.

Capital Expenditure Commitments: One area to watch is Jet2’s forward capex commitments, which are substantial due to its fleet plan. The company has placed a 146-aircraft Airbus A321neo order (firm) for delivery through 2035. By March 2024, 7 of these new planes had been delivered, leaving 139 to arrive over the next ~11 years. This represents a major multi-year financial commitment – likely in excess of £6–7 billion at list prices (though to be financed over time). Jet2’s strategy is to fund these deliveries via a mix of internal cash flow, operating leases, and potentially new financing. The company explicitly states it is considering funding alternatives and has confidence in its “financial strength and continued confidence in prospects” to support this growth capex. The existing cash pile and ongoing profits suggest Jet2 can make the required pre-delivery payments and take on new debt or lease obligations without jeopardizing stability. Also, deliveries are staggered (roughly 12-15 aircraft per year at peak), which aligns with the retirement of older aircraft and market growth. In the near term, capex is ramping up: FY2024 net cash used in investing was £482m, including £404m on new aircraft and related spend. This will increase in coming years as more A321neos arrive (e.g. 10 new aircraft were added in just the first half of FY2025). Jet2’s cash balance provides a buffer to cover these investments. Even so, the investor should monitor that Jet2 doesn’t overstretch – significant unexpected cash outflows or a downturn coinciding with heavy capex could tighten liquidity. So far, indicators are positive: by Sep 2024 Jet2 still had £3.6b in cash & deposits despite accelerating capex.

In conclusion, Jet2’s financial foundation is strong. It has returned to substantial profitability and cash generation post-pandemic, rebuilt a net cash position, and carries manageable debt. This stability underpins its growth ambitions and gives confidence that it can withstand macro or operational shocks. The main financial risk lies in executing its large fleet investment without eroding the balance sheet – something management appears cognizant of, given their phased approach and continued cash buildup. With prudent cash management and hedging (for fuel, FX – see below sections), Jet2 is positioned to remain solvent and liquid under a range of scenarios, which is reassuring for a long-term equity investor.

4. Management Quality and Capital Allocation

Management Track Record: Jet2’s management team is experienced in the travel industry and has a history of strategic execution and prudent growth. Steve Heapy, CEO since 2013, and formerly head of Jet2holidays, has overseen the company’s expansion from a regional airline into a UK package holiday leader. Under the broader leadership of founder and long-time Executive Chairman Philip Meeson, Jet2 (previously Dart Group) grew consistently for decades, with a focus on cash generation and reinvestment in the business. Meeson carefully nurtured a customer-centric culture that underpinned Jet2’s success. In September 2023, Philip Meeson stepped down as Chairman and retired from the Board, handing the reins to a new non-executive Chairman (Rick Green, appointed interim Chair). The transition appears orderly, and Meeson’s legacy – of conservative finances and “People, Service, Profits” philosophy – continues to influence management decisions. The fact that Jet2 navigated the pandemic without insolvency, and quickly returned to record profits, speaks to management’s capability and resilience. They have demonstrated cost discipline (e.g. grounding fleet and cutting spend during COVID) and savvy market timing (expanding after competitors retrenched).

Insider Ownership and Incentives: Importantly, insiders remain materially invested in Jet2’s success. Even after selling some shares, Philip Meeson retains about 12.7% ownership of Jet2, aligning his interests with shareholders. He did trim his stake by in 2024 for personal financial reasons, but stated he “believes there is a great future for Jet2” and the firm is ideally positioned with its aircraft order to capitalize on market potential. CEO Steve Heapy and other executives also own shares and have incentive plans tied to performance (annual bonuses and share awards). The presence of a significant founder-shareholder and a culture of internal promotions (many senior managers have been with Jet2 long-term) suggests management is committed to the company’s long-term value. There have been no concerning insider disposals beyond Meeson’s planned sell-down.

Capital Allocation Strategy: Jet2’s capital allocation has historically prioritized reinvestment in growth over short-term shareholder returns – a strategy that has paid off in market share gains. The company has been expanding its fleet, destinations, and infrastructure (like the new “ROC” Retail Operations Centre, discussed below) to support future growth. It pays a dividend, but modestly. In FY2024, Jet2 resumed dividends (total 14.7 pence per share for the year, costing ~£25.8m) after suspending them during the pandemic. This dividend represents only ~6% of net profit, signaling that management is cautious and wants to retain earnings for expansion. They even increased the final dividend by 34% in 2024 given the strong results, but the yield remains small. Share buybacks have been authorized by shareholders (a 10% buyback authority was renewed at the 2023 AGM), yet management did not execute any buybacks in FY2024. This suggests they see better use of cash in funding growth (new aircraft deliveries, etc.) rather than reducing the share count at this stage. The Board’s capital allocation principles likely prioritize maintaining a strong balance sheet, investing in fleet and technology, then returning surplus to investors when appropriate.

Growth Investments: The clearest sign of Jet2’s long-term focus is its aggressive fleet renewal/expansion program. Committing to 146 new Airbus A321neo jets is a bold bet on future demand – it will roughly double the size of Jet2’s fleet by 2035 while replacing older Boeing models with more efficient planes. Management timed the initial order in late 2021 (during the pandemic downturn) to secure favorable terms from Airbus. They have since doubled down by exercising all purchase rights to lock in the full order. This indicates high confidence in Jet2’s growth trajectory. Additionally, Jet2 invested in a state-of-the-art Retail Operations Centre (ROC) in 2023 – a centralized catering and logistics facility (the first of its kind in UK aviation) to streamline in-flight retail operations. The ROC, a multi-million-pound project completed in Oct 2023, uses automated scanners and enhanced security to efficiently supply aircraft across Jet2’s network with food, drinks, and duty-free products. This investment improves operational control and should enhance on-board service (important for revenue and customer satisfaction) while reducing wastage. It exemplifies Jet2’s willingness to spend on infrastructure that supports its customer-first ethos and scalability.

Cost Management: While investing for growth, management has also shown cost discipline. They managed to keep FY2024 operating cost per passenger roughly flat versus FY2019 despite inflation, by improving productivity and benefiting from higher load factors. For example, Jet2’s profit per flown passenger in FY2024 was £24, the same as pre-pandemic, meaning they offset cost increases with pricing and efficiency. The adoption of new fuel-efficient aircraft will further reduce unit costs (each A321neo has ~20% lower fuel burn per seat than the older planes it replaces). Management also hedges key costs (fuel, FX) under a Board-approved policy to stabilize short-term expenses. In terms of overhead, Jet2’s head office remains relatively lean for its size, and the company benefits from scale in areas like maintenance and handling (it even self-handles ground operations at 7 of its bases to save third-party fees. Overall, Jet2’s leaders have balanced frugality with smart investments – they cut or delay spending when needed (e.g. deferred capex during COVID), but are not afraid to deploy capital for strategic gains when financially sound.

Management Quality Summary: The quality of Jet2’s management appears high, as evidenced by their navigation of industry challenges, strong operational execution (on-time performance, etc.), and forward-thinking decisions. They are incentivized to grow shareholder value, with significant insider ownership and a track record of aligning expansion with market demand. Importantly, management has demonstrated shareholder-friendly behavior: they avoided diluting shareholders more than necessary during the crisis and resumed dividends as soon as practicable, reflecting confidence in the outlook. As Jet2 transitions from founder-led to a more standard governance structure, it will be important for the new Chairman and board to maintain this discipline. So far, signs are positive that Jet2’s culture and strategy remain intact. For a long-term investor, the management’s proven ability to allocate capital wisely – prioritizing profitable growth and safeguarding the balance sheet – bodes well for sustainable value creation.

5. Operating Profit and Cash Flow

Recent Performance: Jet2’s profitability has rebounded sharply as travel recovered. In FY2024 (year ended Mar 2024), the company achieved an Operating Profit of £428.2 million (up 9% YoY), with an operating profit margin of 6.8%. This is a dramatic turnaround from the pandemic losses in FY2021–22, and only slightly below the pre-COVID margin (~7.8% in FY2019). Profit before tax was £529.5m (8.5% PBT margin), and after 25% tax, net profit was £399.2m. To put this in context, Jet2 earned roughly £30 of profit per passenger flown in FY2024 – a solid result for a leisure airline, matching its FY2019 levels.

Looking forward, analysts and management expect Jet2 to maintain strong profitability barring shocks. In the first half of FY2025 (summer 2024), Jet2 already delivered £701.5m operating profit, +14% vs the prior year’s record, and upgraded its full-year outlook. This implies Jet2 could exceed £500m operating profit for the full FY2025. On average over a cycle, Jet2 might generate £400–£600 million in operating profit annually, assuming it continues to grow capacity and keep load factors high. The operating margin in a normalized environment could reasonably be in the high single-digits (7–9%). Notably, Jet2’s pre-pandemic peak margin was around 10–11% EBITDA margin (FY2019), aided by low fuel prices then. With new efficient aircraft and higher direct-sourced package revenue, Jet2 may target approaching 10% EBITDA margins again in the mid-term, which would translate to ~7–8% operating margins (depending on depreciation). This level of profitability is likely sustainable as long as demand remains firm and competition rational. Management has shown they are able to hold on to margin gains – for example, in FY2024 higher revenue per passenger offset cost headwinds, resulting in operating profit per passenger being flat vs last year despite inflation.

Free Cash Flow (FCF): Jet2’s cash generation is robust thanks to its negative working capital cycle (customers pay upfront). In a normalized year, the company converts a large portion of its operating profit into free cash. FY2024 cash from operations (before working capital) was £691.7m. After a £362.8m working capital inflow (mostly customer deposits) and net interest/tax, operating cash flow was £1.094 billion. Subtracting capital expenditures of £408m (PPE + intangibles), FCF was roughly £685m. However, this includes growth capex for fleet. To gauge maintenance FCF: Jet2’s maintenance capex (to keep existing fleet running) is much lower than current total capex. For instance, before the major Airbus order, Jet2’s annual capex was about £150–£200m (for engine overhauls, replacements, etc.). We can estimate maintenance capex now at perhaps £150–£250m per year; the rest of capex is growth (new aircraft, new bases, the ROC facility, etc.). Adjusting FY2024, if we assume ~£200m was maintenance and ~£204m was growth capex, then FCF before growth investments would be on the order of £880–£900m. That figure indicates Jet2’s existing operations are highly cash-generative. These funds are being plowed into growth capex (new planes) which is why reported FCF will be lower during the fleet expansion phase.

Jet2’s free cash flow outlook remains positive but will likely moderate as capex rises in line with aircraft deliveries. The company has stated that the increasing cash balance provides “a solid foundation for the increasing gross capital expenditure in new aircraft fleet over the coming years”. In other words, management intends to reinvest much of the operating cash flow into its fleet program. Even so, Jet2 is generating enough cash to cover capex and still pay dividends and reduce debt. Over a 3-year horizon, one could expect Jet2 to produce substantial cumulative FCF, albeit with a large portion reinvested. If we average out cycles, Jet2’s average annual FCF(net of maintenance capex) might be in the hundreds of millions of pounds. As the fleet program winds down in the long term, FCF could ramp up significantly if growth capex falls and the larger fleet is fully cash-generative.

Stock-Based Compensation (SBC): Jet2’s SBC is relatively low; in FY2024, equity-settled share-based payments expense was £14.7m. This is only about 2% of operating profit, and the company typically issues new shares to an employee trust to satisfy options (which it accounts for in equity). For FCF calculations, SBC is already a non-cash expense in the income statement, so one might add it back if considering cash flow available to equity. However, the dilution from SBC is minor (no significant impact on share count historically). Jet2 also incurred a one-off cost when establishing the employee benefit trust in 2024, but that’s an equity transaction. In summary, SBC does not materially skew Jet2’s cash flow – FCF net of SBC is essentially the same as FCF before SBC, given the small magnitude.

Margins and Profit Drivers: Jet2’s current margins are boosted by a strong pricing environment and operational efficiency, but also somewhat held back by cost inflation and ramp-up expenses. The key question for margin sustainability is: can Jet2 keep yields and load factors high as it grows, and can new planes plus scale economies offset rising costs? There are reasons for optimism:

Revenue per passenger has structurally increased post-COVID (customers are spending more on holidays and ancillaries). In FY2024, Jet2’s revenue per flown passenger was £353, up 14% vs prior year. Some of that is inflation, but some is customers trading up (e.g. more packages). As long as demand stays strong, Jet2 should be able to command healthy pricing.

Cost per passenger: Fuel and carbon costs jumped in FY2024 (up 34%), which pinched margins slightly. If fuel prices stabilize or Jet2’s hedging locks in lower rates, margins can improve. New A321neos deliver ~20% fuel savings per seat, directly aiding future margins. Also, Jet2’s older Boeing fleet has higher maintenance costs; as these retire, maintenance cost per aircraft should drop (FY2024 saw unusually high maintenance spend due to aging planes and leased aircraft). This suggests some cost relief ahead.

Operating leverage: Jet2’s fixed costs (staff, infrastructure) are spread over more passengers as capacity grows, which helps unit costs. The company managed a slight reduction in operating profit margin from 7.8% to 6.8% in FY2024 even with a big fuel cost headwind, indicating it held margins fairly well. With careful cost control and pricing, it could maintain or even expand margins. For example, Jet2’s pre-FX PBT margin in FY2024 was 8.3%, up from 7.8% in FY2023. Management described this as a “strong margin” and aims to at least sustain it.

In a normalized environment (stable fuel, no extreme disruptions), Jet2’s EBIT margin around 7% seems achievable consistently. Upside to margins could come if competition remains rational, allowing Jet2holidays to continue growing its higher-margin package mix (package customers grew 15% in FY2024, raising the package mix to 68% of total customers). Packages contribute more absolute profit per passenger than flight-only sales, so a higher mix lifts overall margins. Indeed, Jet2’s strategy is to increase package mix, which should support margin resilience even if flight yields face pressure.

Overall, Jet2’s operating profits and cash flows are in a strong phase of growth, and the company is wisely channeling those cash flows into assets (new planes) that will fuel the next leg of expansion. For a long-term investor, the critical watchpoint is that Jet2 continues to generate solid FCF net of its growth investments – so far, it has, thanks to the cash-rich nature of the business. If margins stay robust and capex is well-managed, Jet2 could even consider higher dividends or buybacks down the line without jeopardizing growth. But for the next few years, expect management to prioritize using operating cash flow to self-fund as much of the fleet program as possible. This sets Jet2 up for a future inflection where growth capex tapers off and the company becomes a cash cow with substantial free cash flow, potentially leading to enhanced shareholder returns at that stage.

6. Tax and Interest

Tax Rates: Jet2 is a UK-domiciled company and is subject to UK corporation tax (which rose from 19% to 25% in April 2023). In FY2024, Jet2’s statutory tax charge was £130.3 million on £529.5m profit before tax – an effective tax rate of 25%. This aligns closely with the UK statutory rate, indicating the company isn’t using aggressive tax avoidance or significant tax incentives. In FY2023, the effective tax rate was 22% on lower profits, benefiting from the 19% rate applicable for most of that year and some deferred tax adjustments. Jet2 does not have much in the way of exotic tax structuring; its operations are mainly in the UK (where it pays taxes on tour operator margins) and to a lesser extent in overseas jurisdictions for local branches (but those are relatively small or often zero-rated as international aviation can have tax exemptions for certain income). The company had accumulated tax losses from the pandemic years (FY2021–22) which created a deferred tax asset. In FY2024, Jet2 utilized a portion of these tax loss carryforwards, which helped reduce cash tax payments, but for accounting, the effective rate still reflected the standard rate. As of Mar 2024, Jet2 likely has limited remaining tax-loss shields since it has returned to profitability; going forward one should expect an effective tax rate around 25% (in line with UK rates) unless rates change or new allowances (like capital investment super-deductions) are enacted.

Jet2 does have one notable tax-friendly aspect: it can accelerate depreciation on aircraft for tax purposes, which sometimes defers cash tax. However, with profitability restored, it is now a full tax payer. There are no significant tax credits or incentives that Jet2 benefits from regularly – though the UK has had some support for carbon-reducing investments, and Jet2 might get tax relief on certain qualifying capex (which would show up as deferred tax differences). The annual report didn’t mention any special tax credits; the focus was on the increasing tax rate as temporary benefits fade.

In summary, investors should model Jet2’s effective tax rate at ~25% in the coming years. If UK tax policy changes (e.g. an increase in corporate tax or new industry levies such as a frequent flyer tax), that could affect Jet2’s net income. Conversely, any tax incentives for sustainable fuel or green investments could provide minor relief.

Interest Income/Expense: Jet2’s financing position in FY2024 resulted in net interest income, a rarity for airlines. Specifically, the company had £159.5m of finance income and £70.9m finance expense, yielding £88.6m net financing income (excluding FX). This was a sharp swing from a £5.8m net expense the prior year. The driver was Jet2’s large cash balances earning interest in a higher rate environment – average cash and deposits exceeded £3b during the year, and as bank interest rates rose, Jet2 earned substantial interest on its money market deposits. By contrast, its interest expenses (on debt and leases) were £70.9m, which did increase due to more leased planes and the convertible bond interest, but were outweighed by interest income.

Thus, Jet2 actually made a net positive contribution to profit from interest in FY2024. Including a small foreign exchange revaluation gain, total net financing contribution was £98.0m. This is likely to continue in the near term: with interest rates still high (UK base rates ~5% through 2024) and Jet2 holding a large cash balance especially during peak seasons, interest income will remain significant. For example, in H1 FY2025 Jet2 earned £84.2m net finance income in just six months. However, as the company uses cash for aircraft payments or if rates fall, this tailwind will diminish. Jet2’s interest trajectory might see net interest income peak and then trend down towards a neutral or slight expense as it takes on new financing for planes. The convertible bond (if not converted) and any new aircraft debt will add to interest costs. But Jet2’s intent to pay many aircraft via internal funds or leases (where the “interest” cost is implicit in lease expense) means it might avoid a heavy interest burden.

7. Growth Capex Outlook

Maintenance vs Growth Capex: It’s important to distinguish Jet2’s ongoing capex needs to maintain operations from its discretionary growth investments. Maintenance capex for an airline/tour operator includes routine aircraft maintenance (engine overhauls, airframe checks), mandatory equipment updates, and replacement of any retired assets (e.g. ground equipment, IT systems). Jet2’s maintenance capex is relatively moderate because much of its fleet historically was older owned aircraft with fully depreciated values – maintenance occurred through operating costs (expensed repairs) rather than large capital replacements. That said, as the fleet ages, Jet2 does incur capitalized maintenance (like purchasing spare engines or doing major refurbishments). We can infer maintenance capex from pre-growth periods: e.g., in FY2018–2019 Jet2’s total capex was around £180–£200m per year, when the fleet count was stable. This provides a rough benchmark for maintenance capex in a steady state.

Growth capex, on the other hand, is currently the dominant portion of Jet2’s investments. This includes purchases of new aircraft to expand the fleet and replace older jets, pre-delivery payments to Airbus, investments in new bases or facilities (like the new Bristol and Liverpool airport expansions, and the ROC facility), and significant IT projects for scaling up. The Airbus A321neo order is by far the largest component of growth capex. Jet2’s firm order of 146 aircraft (deliveries through 2035) means an average of about 12-15 aircraft per year in the late 2020s, though the schedule may be back-loaded. For FY2025–FY2027, deliveries might be on the order of ~20-30 aircraft total (the exact schedule isn’t public, but Jet2 took 10 in H1 FY25 and more are arriving). Each new A321neo has an list price around $130m, but airlines typically get ~50% discount, so cash cost say ~$65m (£50m) each. If Jet2 directly purchases ~10 aircraft per year, that’s ~£500m annual capex, which aligns with the £404m spent in FY2024 and likely higher in FY2025. However, Jet2 can also lease some aircraft rather than buy, which moves the cost from capex to lease expense. Indeed, Jet2 has been supplementing with additional leased aircraft in peak seasons to meet demand without immediate purchase.

Given this, Jet2’s growth capex will fluctuate: years with many owned deliveries will see high capex, whereas some growth will be via leases (off-balance sheet capex). Management has explicitly noted the coming “increasing gross capex in new aircraft fleet over the coming years” and that they have the cash to support it. They have not published a specific capex guidance, but one can estimate capex will be elevated through at least FY2028. Perhaps Jet2 spends on average £400–£600m per year on capex during 2024–2028, then maybe slightly less as more deliveries are leases or tail off. Maintenance capex will also rise a bit as the fleet gets larger (more aircraft to maintain), but that’s incremental.

Fleet Renewal Timeline: Jet2 plans to retire its older Boeing 757-200s and some 737-800s as new Airbus jets arrive. In fact, by summer 2024 it retired the last six 757s in service. The replacement of 757s is complete, so new deliveries now are adding net capacity or replacing 737NGs. The bulk of 737-800NGs (which form the current core fleet) will likely be phased out in the late 2020s/early 2030s as they age ~20 years. The 146 A321neos are enough to not only replace all ~100 of Jet2’s older planes but also grow the fleet to around 150 aircraft by mid-2030s. This implies a sustained growth capex program over the next decade. Jet2’s public communications (like the annual report and investor presentations) emphasize that this is a long-term strategy to increase efficiency and capacity. The company will monitor demand and can adjust (they could defer or sell aircraft if needed – although having firm orders means some commitments). The recent exercise of all purchase rights in June 2024 indicates Jet2’s confidence, as it locked in those 36 additional jets to bring the order to 146 total.

The duration of heavy growth capex is therefore roughly 10-12 years (2024–2035), aligning with the aircraft delivery schedule. Importantly, not all capex will be purchase – Jet2 could opt for sale-and-leaseback on some deliveries, which effectively recoups the purchase cost and spreads it into lease payments (lessening immediate capex). They did some sale-and-leaseback historically (e.g. on older aircraft or to generate cash when needed). In FY2024, Jet2’s capex cash flow included some leasing additions (they acquired 8 additional leased aircraft in Summer 2023), meaning they are comfortable using operating leases as a tool.

Aside from aircraft, other growth capex includes building out vacation destination infrastructure (Jet2 doesn’t own hotels, but it might invest in tech platforms for hotel contracting, or in its holiday operations), expanding offices or training centers (perhaps another operations center as they grow), and IT upgrades (digital systems for customers). These are relatively small compared to aircraft spending. The ROC was a notable one-time project (completed 2023), and any further major infrastructure (like a bigger hangar or simulator center) would be minor in cost relative to planes.

In summary, Jet2’s maintenance capex is modest (~£200m or less annually in steady state), whereas growth capex is the dominant part of its investment plan through 2030. The company is essentially reinvesting its entire operating cash flow into fleet growth (and using some of the customer cash float) to ensure it has modern, efficient capacity to meet future demand. This should drive revenue and profit growth, but investors need to be patient as free cash flow to equity will be constrained by this capex in the medium term. The payback is that by 2030, Jet2 will have one of the youngest fleets in the industry, which will yield cost and environmental benefits (and possibly warrant a valuation premium).

8. Sector-Specific Considerations

Cyclicality and Demand Cycles: The travel industry is inherently cyclical, tied to economic conditions and consumer confidence. Historically, during economic downturns or shocks, airlines and tour operators see demand fall and pricing weaken, leading to profit pressure or losses. However, leisure-focused companies like Jet2 often fare better than business-focused airlines in downturns because consumers tend to protect their main holidays. For instance, in the 2008–2009 recession, many budget airlines saw only a mild drop in leisure travel as people sought cheaper vacations rather than canceling outright. Jet2, being agile and regionally focused, managed through that period without major distress, whereas some competitors (e.g. XL Leisure, later Thomas Cook in 2019) failed. During the COVID-19 cycle (2020–2022), which was an unprecedented collapse in travel, Jet2 had to cease operations for months and incurred heavy losses (nearly £(374) million loss in FY2021 and FY2022 each). But crucially, it raised capital early, preserved cash, and was ready to ramp up quickly once restrictions lifted. Jet2’s recovery in 2023–2024 was faster and stronger than many peers – its passenger volume in FY2024 (17.7m) exceeded pre-COVID FY2020 (14.6m), showing it captured pent-up demand and perhaps market share.

Performance in Downturns vs Peers: In an industry downturn (short of a total shutdown), Jet2’s flexible model gives it some resilience relative to competitors. It can adjust capacity by altering the mix of flight-only vs package allocation, reduce frequencies, or lease out surplus aircraft to other carriers. It also does not rely on business travel (which can evaporate in recessions), focusing purely on leisure where demand, while deferrable, often returns strong once conditions improve. Jet2’s closest peer, TUI, historically has high fixed costs (owning hotels, cruise ships, etc.) and high debt, which made TUI more vulnerable in the pandemic (TUI needed multiple bailouts and dilutive capital raises). Jet2, with a lighter asset model (no owned hotels) and better balance sheet, arguably is more nimble and financially resilient than TUI in downturns. Versus the low-cost airlines (Ryanair, easyJet), Jet2’s performance in a downturn might lag Ryanair’s (since Ryanair’s ultralow fares can stimulate demand even in recessions, and it has lowest costs to stay profitable). EasyJet, with a cost base closer to Jet2’s, may similarly struggle for profits in a bad recession. But Jet2 has a secret weapon: package holidays have a degree of built-in demand – families plan annual holidays almost as a staple, and Jet2holidays can entice customers with discounts or low deposits to keep volumes. Also, package bookings are often made well in advance (locking in some demand), whereas flight-only can be last-minute and volatile. In summary, Jet2 should manage industry downturns reasonably well: it might cut capacity 10-15% and offer promos, but likely remain cash-flow positive or only lightly loss-making in a mild recession. In a severe scenario, it has the levers (selling aircraft, cutting workforce – unfortunately – and relying on its cash buffer) to endure until demand recovers.

Fuel Cost Exposure: Jet2’s single largest operating cost is aviation fuel. Volatile fuel prices are a perennial risk. Jet2 mitigates this via a hedging program – typically, it hedges a significant portion of its fuel needs 12–24 months in advance using forward contracts and options. This smooths the impact of short-term spikes. For example, Jet2 likely hedged much of its FY2024 fuel at lower prices, partially shielding it when oil rose in 2022/23, though not entirely (fuel/unit cost still rose 24%). As of mid-2024, Jet2 would have hedged a chunk of summer 2024 and winter 2024/25 fuel at certain prices (the details aren’t public but similar airlines hedged ~60-80% of near-term consumption). Jet2 also hedges carbon allowances to manage that cost. While hedging provides time to adjust fares, sustained high fuel prices eventually force higher ticket prices or lower margins. Jet2 can pass on some fuel increases via fuel surcharges or higher package prices, but with a lag and only as much as competition allows. Over the long run, fuel efficiency gains from new aircraft are Jet2’s strategy to combat fuel price exposure – each new A321neo is ~16% more fuel efficient per seat (), which will significantly reduce Jet2’s fuel per passenger and carbon cost burden. Additionally, Jet2’s relatively young fleet by 2030 will position it better than airlines clinging to older jets if fuel costs climb or carbon taxes increase.

Still, a sharp fuel spike (like oil doubling) in an unhedged period could hurt Jet2’s earnings. In such a case, all airlines suffer; the usual pattern is fare increases follow, though with a lag if demand permits. Jet2’s decent profit margins provide some cushion – it could absorb a temporary increase (reducing margins) and remain solvent, unlike highly levered peers who might breach covenants. A mitigating factor: fuel is a lower percentage of costs for Jet2holidays (since hotel costs are also part of the package cost structure), whereas for a pure airline fuel can be ~30-40% of costs. So Jet2’s integrated model diversifies its cost base.

Regulatory and Tax Changes: The travel sector faces evolving regulations. One looming change is the UK and EU governments’ Sustainable Aviation Fuel (SAF) mandates. The UK is set to introduce a SAF mandate from 2025, and the EU’s RefuelEU initiative requires airlines to uplift a certain % of SAF each year (starting at 2% in 2025, rising thereafter). SAF currently costs significantly more than conventional jet fuel. Jet2 has proactively begun blending 1% SAF at certain airports in 2024, ahead of the mandate, to gain experience and perhaps secure supply. While commendable environmentally, this will increase Jet2’s fuel costs. The mandates are small at first (1–2% blend won’t break the bank), but by 2030 the EU mandate rises to ~6%. Airlines will likely pass these costs onto ticket prices as “green fees” if possible. Jet2’s relatively affluent customer base for packages might tolerate a slight price increase for sustainability, but if not, Jet2 may have to absorb some costs. Government incentives or credits could offset some SAF expense; Jet2 and industry groups are lobbying for support to reduce the SAF price premium.

Another regulatory aspect is carbon pricing. The EU Emissions Trading System (ETS) and UK ETS require airlines to purchase carbon permits for flights. The scope of these schemes is expanding – the EU is phasing out free allowances and including more flights (e.g. EU->UK flights fell under UK ETS or EU ETS depending on segment). Jet2 reported carbon allowance costs increased 19% in FY2024 and noted the removal of an exemption on Canary Islands flights adding cost. By 2026, all Jet2’s EU flights will likely be fully exposed to ETS costs, and the UK may increase its ETS stringency too. Carbon prices have risen dramatically (from €5 to €80+ per tonne in the last decade). This is effectively a tax on airlines. Again, Jet2 will aim to offset it with efficiency (lower CO2 per pax km) and price adjustments. It also may push more for operational measures – e.g. lobbying for air traffic control reforms to shorten routes (Jet2 notes ATC inefficiencies in Europe add 8% emissions). Any new air passenger taxes or environmental taxes could also emerge; for instance, some countries consider taxing frequent flyers or on flights deemed non-essential. The UK already has Air Passenger Duty (APD) which is an added cost on tickets. APD was reduced on domestic flights but increased slightly on some long-haul, not too relevant for Jet2 (which is mostly short-haul international). If APD or similar were raised for short-haul to curb emissions, that would directly increase ticket prices and might dampen demand at the margin.

Foreign Exchange (FX) Sensitivity: Jet2’s revenues are almost entirely in GBP (customers pay in £ for packages and flights). However, a significant portion of its costs are in foreign currencies: fuel is priced in USD, aircraft and parts in USD, many hotel contracts in Euros (for European destinations), and some operational costs in local currencies (EUR, USD, Turkish lira etc. for overseas staff, handling, etc.). This creates FX exposure. A weakening of GBP against USD or EUR raises Jet2’s GBP-reported costs. For example, if GBP falls, fuel (USD) becomes more expensive in GBP terms; hotel contracts in Euro cost more pounds. Jet2 hedges foreign currency needs – likely using forward contracts for USD and EUR out up to 18 months. This provides short-term protection. Indeed, Jet2 had a £9.4m FX revaluation gain in FY2024 from marking its balance sheet positions to market, suggesting it actively manages currency holdings. In the long run, if GBP were to structurally depreciate (e.g. due to Brexit or economic issues), UK travelers’ overseas holidays become more expensive, which could hurt demand or force Jet2 to squeeze margins. Conversely, a strengthening GBP would lower costs or allow price cuts to stimulate demand.

Jet2 partially mitigates currency risk by denominating some customer pricing in Euro when sourcing local excursions or dynamic packaging, and by potentially sourcing more in GBP (negotiating some hotel rates in sterling). Also, the UK outbound travel demand can be inversely correlated to GBP strength: ironically, if GBP is weak, Brits may travel abroad less or spend less, but those who do might lean on package deals for better value (helping Jet2holidays).

In practice, Jet2’s FX hedging has been effective – we did not see large FX hits in its results; rather, they had small gains/losses that are manageable. The company will likely continue hedging a significant portion of USD and EUR needs, so short-term currency swings won’t destabilize it. Long-term investors should be aware that Jet2’s earnings are optimally in a scenario of a reasonably strong GBP, low fuel prices, and steady demand. But even if GBP fluctuates, Jet2 has the tools (hedges, pricing adjustments) to cope.

In conclusion, Jet2 must navigate a range of sector-specific factors: demand cyclicality, which it addresses through flexibility and a focus on leisure essentials; fuel and carbon costs, which it mitigates with hedges and new aircraft; and regulatory changes, which it engages with proactively (early SAF adoption, lobbying for fair policies. The company’s recent performance shows it can handle these challenges adeptly – e.g., despite higher fuel and ETS costs, it improved profit in 2024. Peers like Ryanair will always pressure Jet2 on price, and TUI on holiday packaging, but Jet2 has carved a defensible niche. Its approach to sustainability – aiming for Net Zero 2050 and achieving top-tier sustainability ratings (CAPA’s top 10 airlines globally for sustainability) – also indicates it is preparing for the sector’s future constraints rather than ignoring them.

For a long-term investor, Jet2 presents a case of a company that learned from past cycles and has emerged stronger, with prudent risk management for fuel/FX and a proven ability to adjust to market conditions. While industry headwinds like fuel spikes or recessions could cause choppy results in any given year, Jet2’s trend of growing its customer base and maintaining solid margins suggests it can ride the industry’s ups and downs and still deliver value over a 3+ year horizon. The key will be execution of its growth plan without losing the tight grip on costs and customer satisfaction that got it here. If management can do that, Jet2 is well positioned to thrive in the European leisure travel sector’s next cycle.

9. Valuation Analysis (DCF & IRR)

Revenue Projections

Base Year Revenue: £6,933 million (Last twelve months)

Annual Growth Rate: 8%, comprising:

2–3% inflationary uplift (aligned with UK CPI projections and aviation sector cost trends)

~5% capacity expansion, primarily via fleet and route additions

Terminal (Perpetual) Growth Rate: 3%, consistent with long-term global air travel demand growth and inflation

Operating Margin

Target Operating Margin: 7%, in line with the average of recent years (FY19: 6.5%, FY23: 7.4%)

Margin stability reflects Jet2's tight cost control, direct booking model, and vertically integrated operations (package holidays + airline)

Effective Tax Rate

UK Corporate Tax Rate: 25%, effective from April 2023, assumed stable

Jet2 is domiciled in the UK, with earnings primarily sourced domestically and in the EU (no complex tax shielding structures assumed)

Interest Payments

Net Cash Position: Jet2 is currently net cash positive, with cash exceeding interest-bearing debt

Interest Income: Small income from cash reserves, though conservatively excluded from operating assumptions

Financing Consideration:

If fleet expansion is debt-financed, interest expense would reappear; alternatively, leasing would shift costs to operating expenses and raise implicit interest charges

Net Capital Expenditures (CapEx)

Maintenance CapEx: Assumed to match annual depreciation (~£250–300 million), reflecting ongoing upkeep of existing fleet

Growth CapEx:

£400 million annually, allocated for aircraft purchases

Grows at 3% per year (inflation-adjusted) through Year 9

Note: Jet2 may utilize operating leases or sale-and-leaseback arrangements to manage upfront CapEx, though this would impact EBIT margins and interest profile

Methodology

You can check these two posts to understand the methodology I use here:

IRR at the Current Stock Price

At its current trading price of around £13.44, our model indicates an internal rate of return (IRR) of about 13.2%. In other words, this IRR is the annualized rate that aligns the present value of anticipated cash flows with the stock’s current price. If JET2 achieves its projected growth, an investor buying in now could see an annual return in the vicinity of that percentage.

Discounted Cash Flow (DCF) Valuation & Upside Potential

At a 12% discount rate, the implied price is £16.48, with an upside potential of 22.6%.

At a 15% discount rate, the implied price declines to £10.20, yielding an upside potential of -24.1% meaning that stock is overvalued.

💬 What are your thoughts on Jet2’s potential? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe – your support truly motivates me to keep creating quality content.

Great write-up - a name I'm also pretty heavily invested in.

I think some investors find Jet2's fairly low margins offputting (their target is 5-8% operating, much lower than most other airlines). However, it's not an apples-to-apples comparison - most of their revenue is attributable to the hotels, but since they're effectively just a reseller of these, the expected margins on those is a lot lower. I'd guess if you were to split the airline and the hotels into two separate businesses, you'd see something like 12% margins at the airline and 3% on the package holidays - though of course the business wouldn't work so well if they were separate.