GigaCloud Technology (GCT) Deep Dive and Valuation

GigaCloud Technology (GCT): A Deep Dive into Its Business Model, Financial Strength, and Competitive Edge for Value Investors

Welcome to our comprehensive deep dive on GigaCloud Technology (GCT). In this publication, we explore GCT’s business model, financial fundamentals, competitive advantages, and risk profile, all through a value investing lens. Whether you are evaluating GCT for potential investment or simply researching its place in the B2B e-commerce landscape, this resource aims to provide thorough, fact-based insights drawn from the company’s official SEC filings and credible industry references.

Below is the list of topics covered:

Business Overview – GCT’s marketplace model, logistics network, and revenue streams.

Competitive Landscape & Moat – Key advantages and barriers to entry.

Financial Stability – Revenue growth, profitability, and balance sheet strength.

Insider Ownership & Share Structure – Control dynamics and voting power.

Risks from Tariffs & Competition – External challenges and mitigation strategies.

Comparison with Competitors – Positioning versus Alibaba, Wayfair, and others.

Valuation Analysis (DCF & IRR) – Intrinsic value assessment and market implications.

We trust this guide will equip you with a well-rounded perspective on GigaCloud Technology’s fundamentals and risk factors, providing the essential context you need to evaluate its long-term value proposition.

Business Overview

GigaCloud Technology Inc. is a global B2B e-commerce platform provider specializing in large-parcel merchandise (bulky goods like furniture, appliances, fitness equipment). Its core product is the GigaCloud Marketplace, an end-to-end online platform that connects manufacturers (primarily in Asia) with resellers (primarily in the U.S., Asia, and Europe). The marketplace integrates product discovery, payments, and logistics into one solution – GigaCloud arranges fulfillment from the manufacturer’s warehouse to the end customer at a single fixed price, addressing the complexity of cross-border shipping for oversized items. This one-stop model allows even small online retailers to source globally without managing international freight and warehousing themselves. Manufacturers, in turn, gain access to a broad base of resellers overseas, making GigaCloud an important distribution channel for reaching Western markets.

GigaCloud launched the marketplace in 2019 focusing on furniture and has since expanded into home appliances and fitness equipment. The company has grown rapidly – Gross Merchandise Volume (GMV) transacted on its platform was $1.34 billion in 2024, up from $518 million in 2022. To enhance its offerings, GCT also engages in 1P (“first-party”) sales – it buys inventory and sells directly through its marketplace and on third-party e-commerce sites like Amazon, Walmart, Wayfair, and others. These 1P sales (about 70% of revenue historically) complement the 3P marketplace by boosting product variety and driving volume, while GCT’s role as the seller provides it with proprietary demand data. In 2023, GigaCloud acquired Noble House, a major B2B furniture distributor, for ~$77.6 million, and Wondersign, a digital catalog SaaS company, for $10 million. The Noble House deal expanded GCT’s product portfolio and customer base in home furnishings, and the Wondersign acquisition adds a software tool for retail buyers (now rebranded as “Wonder” app) to browse and order products. GCT operates 35 large-scale fulfillment centers across the U.S., Europe, and Asia (totaling 10.3 million sq. ft. of storage), forming a global logistics network to handle its large-item shipments efficiently. Overall, GigaCloud’s business model is positioned as a “pioneer” of large-parcel B2B e-commerce, offering a unique combination of marketplace and in-house logistics services. This has made it one of the fastest-growing platforms in its niche, with a strong presence in furniture and other bulky goods segments.

Competitive Landscape and Moat

Industry context: GigaCloud operates at the intersection of B2B e-commerce and international logistics. It faces competition from other e-commerce marketplaces where wholesalers and retailers transact, as well as from traditional supply-chain channels. In the broad B2B e-commerce arena, Alibaba.com is a prominent global platform connecting suppliers in Asia with buyers worldwide. Alibaba’s scale is much larger than GCT’s, but Alibaba historically focuses on smaller goods and typically leaves shipping arrangements to the parties. Notably, Alibaba has begun enhancing its logistics offerings – for example, in 2025 Alibaba partnered with shipping giant Maersk to integrate ocean freight services into its platform, aiming to give SMEs direct access to container shipping at transparent rates (Alibaba partners with Maersk to offer logistics services). This move underscores that major players are addressing the logistics gap, potentially encroaching on GigaCloud’s one-stop solution advantage. Other indirect competitors include Amazon Business(Amazon’s B2B marketplace) and large wholesale distributors in specific categories. However, the market for bulky goods online is under-penetrated – selling furniture or gym equipment across borders is challenging due to high shipping costs and the need for warehousing and delivery infrastructure. Many smaller competitors lack end-to-end capabilities; the industry remains fragmented and highly competitive with various regional players and legacy import/export brokers.

GigaCloud’s moat and advantages: Despite the competitive landscape, GCT has built significant competitive advantages in its niche:

Integrated Logistics Platform: GigaCloud offers a turnkey logistics solution (including ocean freight, warehousing, and last-mile delivery) bundled with the transaction. This is a high barrier to entry – setting up IT systems, fulfillment centers, and a global transport network requires heavy capital investment and operational expertise. GCT’s fulfillment network (35 warehouses near major ports) and partnerships with shipping/trucking firms would be costly and time-consuming for a new entrant to replicate. This integration allows GCT to handle large-parcel shipments more efficiently than a typical marketplace that must rely on third parties for delivery.

Network Effects: As a marketplace, GigaCloud benefits from a virtuous cycle of growing participants. Its competitive pricing and “virtual warehouse” model attract more buyers (retailers), which in turn draws more sellers (manufacturers) to list products, further expanding selection and volume. In 2024, GCT had 1,111 active third-party sellers (up 36% YoY) and 9,306 active buyers (up 85% YoY), indicating strong network growth. This scale can lead to volume-based cost advantages in procurement and shipping that smaller rivals cannot easily match.

First-Mover Focus on Large Goods: GigaCloud has positioned itself squarely in the large-parcel segment(furniture, appliances) which many e-commerce firms avoided due to logistical complexity. This focus gives it specialized know-how in handling oversized items. The company’s end-to-end model effectively “democratizes” global sourcing of big products for small and mid-sized retailers. Traditional big-box retailers like Wayfair or Home Depot are mainly B2C and maintain their own supply chains; GCT instead empowers a long tail of sellers. This niche focus, combined with the tech platform, acts as a moat since incumbents in B2B may not have similar infrastructure for bulky items.

Switching Costs and Ecosystem: For a retailer using GigaCloud, the service is more than just a storefront – it’s an entire supply chain solution. Once they integrate GCT for inventory sourcing and drop-shipping, switching to piecemeal alternatives (finding separate freight forwarders, warehouses, etc.) could be less convenient or more expensive. Similarly, manufacturers get instant access to overseas buyers and fulfillment. This creates some stickiness, as evidenced by the high percentage of GCT’s revenue derived from its marketplace year after year. Additionally, GCT is expanding its ecosystem (e.g. the Wondersign/Wonder app for in-store digital catalogs) to deepen ties with buyers. Each value-added service increases customer dependency on the GigaCloud platform.

Pricing power and demand resilience: Despite its strengths, GigaCloud operates in a price-sensitive environment. The company’s pricing power is limited by competition – it charges a modest commission of only about 1–5% on marketplace transactions, much lower than typical B2C marketplaces, to encourage adoption. This suggests GCT cannot significantly raise fees without risking sellers moving to alternative channels. Its logistics fees must also remain competitive (Alibaba’s integration with Maersk, for instance, promises cost-effective shipping. On the flip side, GCT’s integrated model can offer cost savings to customers (by bundling services) which can bolster demand even when end consumers become price-conscious. In terms of demand resilience, GCT is somewhat insulated by its B2B nature – it sells to businesses rather than directly to consumers. During industry-wide e-commerce slowdowns in 2023–24, many consumer-facing firms saw declining sales, but GigaCloud continued to grow robustly, implying it was capturing market share. Marketplace GMV grew ~69% in 2024 despite macroeconomic headwinds. That said, the products involved (furniture, etc.) are discretionary goods, so a severe economic downturn or drops in consumer demand for home goods could reduce orders on GCT’s platform. The company’s broad geographic reach (with rapid growth in Europe in 2024) and category expansion help mitigate regional demand swings (GigaCloud hits a revenue high and expands its B2B marketplace). In summary, GigaCloud’s moat lies in its unique platform and logistics integration, giving it an edge in a challenging segment. It must continue executing efficiently to maintain this edge, as larger competitors are beginning to address the same pain points.

Financial Stability

GigaCloud’s financial performance has been strong and improving, which is a positive sign from a value-investing perspective. Key indicators from the latest annual report (FY2024 10-K) include:

Robust Revenue Growth: GCT’s revenues have climbed substantially each year. Total revenue was $1.161 billion in 2024, up 65% from $703.8 million in 2023, which in turn grew ~44% from $490.1 million in 2022. This growth has been driven by both organic expansion of its marketplace (higher GMV and more transacting buyers) and the contribution of acquisitions (e.g. Noble House added B2B sales volume in late 2023). Even in the latest quarter, Q4 2024 revenue rose ~21% YoY, indicating sustained momentum.

Healthy Margins and Profitability: Unlike many young e-commerce companies, GigaCloud is consistently profitable. Gross profit in 2024 was $285.2 million (a ~24.5% gross margin) and operating income was $130.6 million. Net income came in at $125.8 million for 2024, up from $94.1 million in 2023 and $24.0 million in 2022. While the gross margin dipped slightly in 2024 (partly due to product mix and integration of Noble House’s wholesale business), operating margins have remained in the low-teens percentage – approximately 11% operating margin and 10.8% net margin in 2024. The company has demonstrated improving profit trends, scaling up from a small net profit in 2022 to a much larger profit base by 2023–24. Management has managed expenses well; even with rapid growth, GCT kept SG&A in check to deliver operating leverage.

Strong Cash Flow and Balance Sheet: GCT’s operations generate significant cash. Net cash from operating activities was $158.1 million in 2024, exceeding that year’s net earnings. This reflects solid working capital management and the fact that the marketplace model can produce upfront cash (e.g. from buyers’ payments) before GCT pays suppliers. Over 2022–2024, cumulative operating cash flow was over $340 million. The company has been reinvesting some of this into growth (over $90 million used in 2023 for acquisitions, and $55 million used in 2024 for capex and investments, yet it remains very well-capitalized. As of December 31, 2024, GigaCloud held $259.8 million in cash and equivalents, plus ~$42.7 million in short-term investments. Importantly, the company carries no long-term debt and is essentially debt-free. Its only significant liabilities are operating lease obligations for its warehouses (a common practice in logistics). This clean balance sheet means low financial risk – GCT can withstand economic hiccups without heavy interest burdens, and it has the liquidity to fund expansion or cushion a downturn.

Ability to Weather Downturns: With double-digit profit margins, positive free cash flow, and a cash-rich, debt-free balance sheet, GigaCloud is well-positioned to sustain profitability even if growth slows. The company’s cost of revenue largely varies with volume (product procurement, shipping costs), so it has some flexibility if demand softens. Operating expenses (like technology and warehouse overhead) are being spread over a growing revenue base, which has helped maintain profits. Moreover, GCT’s cash reserves ($300+ million including investments) give it a buffer to continue strategic investments or cover any temporary working capital needs. In a recession scenario, GigaCloud might see lower order volumes, but its current financial stability (no debt and a strong cash flow track record) indicates it could endure a tough year without sacrificing its long-term viability. Overall, the financials show a stable and growing company: revenues are rising quickly, margins are respectable for the industry, and cash generation is strong – all key pillars that value investors look for in a fundamentally solid business.

Insider Ownership and Share Structure

According to the Form 10-K, as of December 31, 2024, GigaCloud Technology Inc had a dual-class share structure consisting of Class A ordinary shares (one vote per share) and Class B ordinary shares (ten votes per share). All Class B shares are held by the company’s founder, chairman, and chief executive officer, Mr. Wu. Those Class B shares represent approximately 20% of GigaCloud’s total outstanding share capital but control about 71.5% of the aggregate voting power. Overall, taking into account Class B shares and any Class A shares that may be held, the company’s executive officers, directors, and greater-than-5% shareholders as a group collectively beneficially owned roughly 28.7% of GigaCloud’s total shares, corresponding to about 74.6% of the total voting power. As a result, the company qualifies as a “controlled company” under the Nasdaq Stock Market Listing Rules.

In terms of overall shareholder structure, the Form 10-K notes that, as of February 28, 2025, GigaCloud Technology Inc had 31,989,632 Class A ordinary shares (one vote each) and 8,076,732 Class B ordinary shares (ten votes each), for a total of 40,066,364 shares issued and outstanding.

As of early 2025, insider ownership of GigaCloud Technology remains heavily concentrated with founder Larry Lei Wu, who, through super-voting Class B shares, controls the company’s direction. Other executives and directors hold comparatively modest stakes, though collectively insiders own roughly 40%+ of the equity. The most significant change in insider composition over recent years has been the exit of venture investor DCM, which reduced its stake from about 25% at IPO to under 5% by late 2024. This transition was smooth and well-telegraphed via SEC filings, and it even coincided with strong stock performance as public investors absorbed DCM’s shares.

In conclusion, GigaCloud’s insider trading and ownership profile in 2025 reflects a company still led by its founder-owner, with insiders largely holding onto their shares. Continued diligence in tracking these activities via SEC reports will help investors gauge the sentiment and incentives of those who likely know the company best: its insiders.

Risks from Tariffs and Competition

GigaCloud’s business is exposed to external risks such as international trade policies and competitive pressures, both of which could impact its long-term growth trajectory.

Tariff and trade policy risks: Because GCT’s marketplace links Asian manufacturers to Western resellers, it is directly affected by tariffs, import/export regulations, and geopolitical trade tensions. In recent years, the U.S.–China trade war introduced steep tariffs on categories like furniture. Many of those tariffs (enacted in 2018–2019) remain in place, and the overall U.S.–China trade relationship continues to be uncertain. This is a risk for GigaCloud because higher import duties can raise the cost of goods flowing through its platform, potentially reducing demand or squeezing margins. GCT has partly mitigated this by diversifying sourcing beyond China – according to the 10-K, most third-party suppliers for GigaCloud’s 1P inventory are now in Southeast Asian countries (e.g. Vietnam, Indonesia). Additionally, for third-party marketplace transactions, typically the sellers are responsible for any export taxes and tariffs. In other words, GCT’s role is primarily intermediary, so it may pass through tariff costs rather than bearing them directly. However, there’s still an indirect effect: if tariffs make products too expensive, U.S. resellers may order less or look for domestic sources. New or increased tariffs in the future (or quotas, embargoes, etc.) could disrupt GCT’s supply chain or make its offerings less competitive in price. Political tensions (e.g. U.S. restrictions on Chinese companies or China’s regulations on data/currency flows) also create compliance risks and could complicate cross-border operations.. GigaCloud will need to stay agile – shifting sourcing to tariff-friendly regions and ensuring logistics routes remain open. Value investors should monitor trade policy developments, as tariffs are an external risk largely out of GCT’s control. The current mitigation (sourcing from multiple Asian countries) helps, but broad protectionist measures in its key markets could still pose a headwind.

Competition and market dynamics: GigaCloud operates in a competitive environment and must continue to differentiate itself. The risk of intensifying competition comes from several angles. Large e-commerce companies could enter the B2B large-item space more aggressively – for example, if Amazon or Alibaba expand services specifically for furniture and bulk goods, or leverage their logistics scale, GCT could face pressure. We’re already seeing Alibaba integrate global freight services (through Maersk) to court the same SME customer base. Additionally, local competitors in each region might have advantages: GCT noted that domestic companies often understand local customers and regulations better and have established local brands, which can be an edge when expanding in those markets. For instance, in Europe or Asia, GCT may compete with regional B2B platforms or wholesalers who are deeply entrenched. If those rivals adopt similar technology or marketplace models, GigaCloud’s growth could slow. There’s also competition from the status quo – some retailers might still prefer traditional sourcing (trade shows, agents, direct factory contracts) or use alternative online marketplaces.

Impact on pricing and margins: Because of competition, GCT might be forced to keep its commission and service fees low. If a competitor offers lower logistics rates or commissions, sellers could demand better terms on GigaCloud. The company acknowledged it may not be able to offer continually attractive terms to sellers and buyers if its own costs rise or if usage dips. This could result in sellers or buyers leaving the platform, which creates a feedback loop of lower network activity. So far GCT has managed to grow users, but maintaining that means vigilance on pricing and service quality. Its limited pricing power (standard commissions 1–5% is a risk if profitability needs to be increased – it can’t simply raise fees without potentially losing volume.

Demand cyclicality: Competition aside, macroeconomic factors pose a risk to demand on the platform. Furniture and large home goods are cyclical – in a downturn or if consumer spending tightens (due to inflation or high interest rates), retailers will scale back inventory orders. GigaCloud has noted that economic uncertainties, inflation, and lower consumer confidence can adversely impact the e-commerce industry, especially for big-ticket, non-essential goods. The recent global environment of higher inflation and interest rates has indeed made consumers more price-sensitive. GCT saw that end-consumers were looking for deals (e.g. more frequent “Prime Day” style sales events by Amazon and Wayfair) which indicates softness in demand unless promotions are offered. If retailers face slow sales, they may reduce purchases from GigaCloud’s marketplace. Resilience comes from GCT’s diverse buyer base – thousands of small and mid-sized sellers across regions, rather than a few big clients. This diversification can help smooth out demand: a slump in one country may be offset by growth in another. In 2024, for example, European GMV on GigaCloud surged 155% even as some other markets were slower. Nonetheless, the risk of an overarching global downturn remains. GCT has indicated it can adjust – for instance, by optimizing its cost structure if needed – but there’s no guarantee it can fully escape a broad drop in B2B trade.

In summary, tariffs and competition are two external risk factors that investors should weigh. Tariffs can increase costs and disrupt supply chains, while competitive pressures could erode GCT’s market share or force margin concessions. GigaCloud’s strategy of multi-country sourcing, integrated services (to add value beyond price), and strong capital reserves helps buffer these risks. However, continued vigilance is required: the company must navigate trade policy changes astutely and keep innovating to stay ahead of rivals. Value investors will want to see that GCT can defend its moat under these external challenges and continue growing profitably.

Comparison with Competitors

When comparing GigaCloud to its industry peers, a few things stand out: GCT is much smaller in scale than the giants, but it is growing faster and is already profitable, which differentiates it in a sector where many players sacrifice margins for growth.

In the broad B2B marketplace space, GigaCloud’s ~$1.34 billion in annual GMV (2024) is a drop in the bucket relative to the overall market opportunity. The U.S. B2B e-commerce marketplace sector is projected to reach $8.5 trillion in gross merchandise value by 2030 (B2B E-Commerce Marketplaces Overview Report 2024-2030: - GlobeNewswire). Even global leaders like Alibaba (which operates Alibaba.com for international wholesale) likely facilitate tens of billions in GMV annually. This means GCT’s current share of the total B2B trade pie is very small – there is plenty of room to expand. The flip side is that large incumbents have resources that dwarf GigaCloud’s. Alibaba Group, for example, has a market capitalization in the hundreds of billions and an extensive ecosystem (Alibaba.com, 1688.com in China, etc.), whereas GigaCloud is a ~$600–700 million market cap company with a focused niche. Yet, Alibaba’s sheer size and focus on broad categories can sometimes mean less specialization; GCT’s edge is being laser-focused on logistics-intensive goods. Another peer to consider is Amazon – while Amazon’s core is B2C, its Amazon Business division (serving business buyers) reportedly surpassed $35 billion in annual sales. Amazon’s scale in logistics is massive, but Amazon Business is more about selling existing products to companies (office supplies, etc.) rather than sourcing from factories like GCT does. No direct public competitor mirrors GigaCloud’s exact model, which makes a direct apples-to-apples fundamental comparison difficult. GCT is something of a hybrid between a marketplace (like Alibaba) and a distributor/3PL (like a global logistics company), operating in a unique niche.

Looking at financial performance vs. peers, GigaCloud’s profitability is a notable distinction. Many e-commerce companies in the furniture/home goods space have struggled to turn a profit. For instance, Wayfair Inc., a leading online furniture retailer (B2C, but its scale provides a useful benchmark), generated $11.9 billion in revenue in 2024 yet still posted a net loss of $492 million for the year ( Wayfair - Wayfair Announces Fourth Quarter and Full Year 2024 Results, Reports Positive Year-Over-Year Growth with Strong Profitability ). Wayfair’s gross margins (~30%) are slightly higher than GCT’s, but its heavy marketing and overhead costs keep it in the red. In contrast, GigaCloud had $1.16 billion in revenue and earned $125.8 million net profit in 2024. This shows that GCT is running a much leaner, more profitable operation at a smaller scale – an attractive trait from a value perspective. Another peer, Alibaba, is profitable overall, but its international commerce wholesale segment is just one part of a larger conglomerate (Alibaba doesn’t break out profit for Alibaba.com alone). Traditional distributors or 3PL companies (like air/ocean freight forwarders) might have single-digit profit margins and low growth, whereas GigaCloud is combining high growth with double-digit margins. For example, if we compare to a logistics firm: XPO (a U.S. trucking/warehousing company) has around 6-7% operating margins on ~$7 billion revenue, and growth in low single digits – GCT outperforms on growth and matches or exceeds margins, albeit at much smaller scale.

In terms of market share and positioning, GigaCloud has established itself as a leader in the large-parcel B2B niche. It is one of the few platforms enabling cross-border wholesale of bulky goods with end-to-end service. Its closest comparable in China might be JD.com’s international logistics arm or some services of Pinduoduo’s Temu (though Temu is B2C), but those are tangential. GCT’s rapid growth suggests it is capturing share from traditional channels. The company’s 69% jump in marketplace transaction volume in 2024 far outpaced overall e-commerce growth rates. Even amid a slower economy, GCT grew revenue 65%, whereas a broad e-commerce bellwether like Amazon saw North America sales grow ~13% in 2024 (and Wayfair’s sales actually shrank slightly). This indicates GigaCloud is likely gaining market share in its segment. Furthermore, GCT’s expansion into Europe (155% GMV growth in EU in 2024) shows it can quickly penetrate new regions, whereas larger competitors might not be as nimble in niche categories.

A summary comparison could be drawn as follows: GigaCloud is a small but fast-growing player with a unique model, competing in arenas with very large incumbents. It has proven it can grow profitably, something that sets it apart from many e-commerce companies that prioritized growth at the expense of earnings. Its market share in the total B2B e-commerce industry is still tiny, which is both a challenge (lots of headroom means more competition will notice it) and an opportunity (even capturing a fraction of the multi-trillion B2B shift online can fuel GCT’s growth for years). Value investors will appreciate that GCT already has the fundamentals (profit, cash flow) that many peers lack. However, they will also note that GCT’s stock carries more risk than a giant like Alibaba due to its size and concentrated ownership. Ultimately, GigaCloud’s fundamentals are solid relative to competitors, and its strategic positioning – focusing on an underserved segment with high barriers – gives it a potential moat in the face of much larger companies. If it continues to execute, GCT could further differentiate itself and perhaps one day approach the scale (and market recognition) of the larger e-commerce platforms, all while delivering shareholder value through sustained profitable growth.

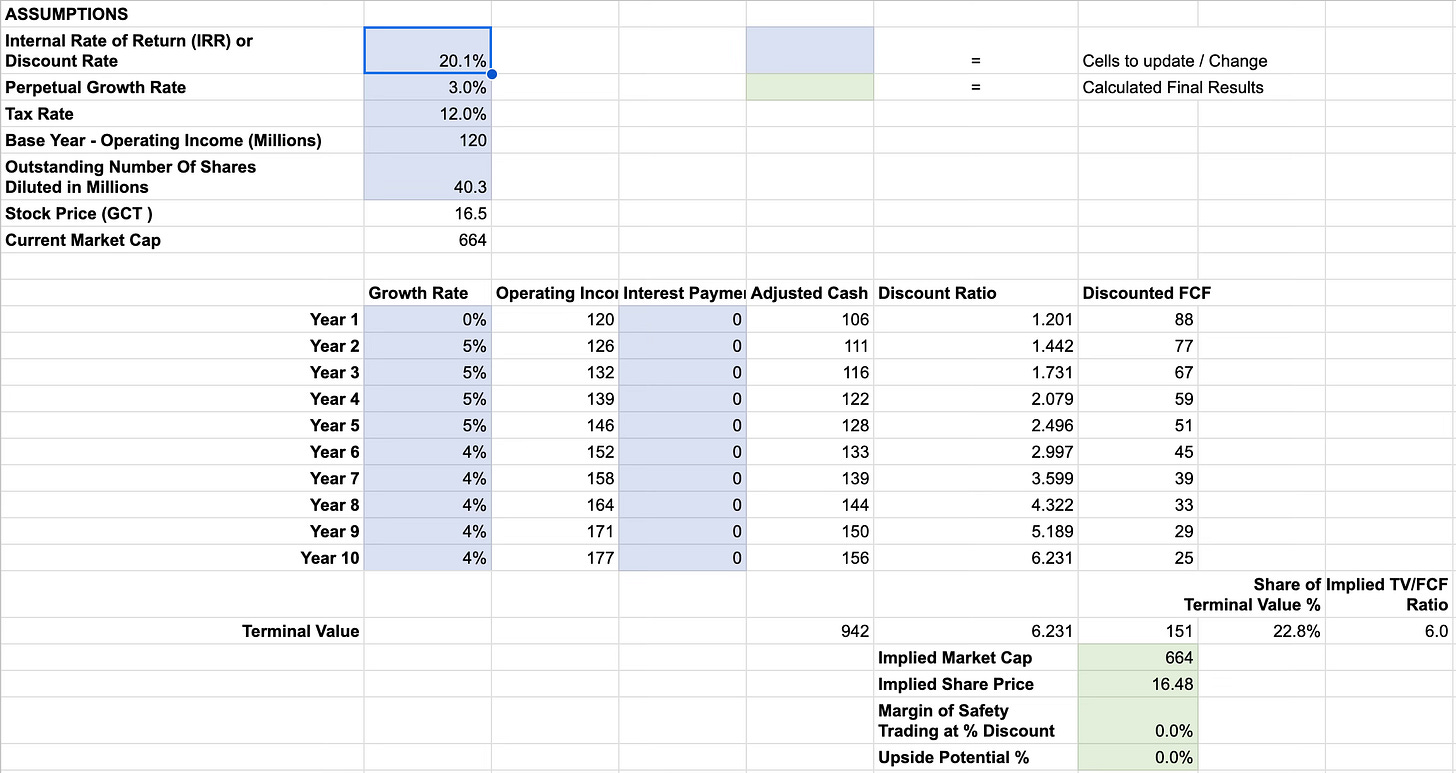

Valuation Analysis (DCF & IRR)

In this section, we outline the assumptions and methodology used to estimate the company’s intrinsic value, including projected growth rates, operating income, tax considerations, and the treatment of cash flows. While these projections are based on recent performance and conservative expectations, they should be revisited as new information becomes available.

1. Operating Income and Growth Assumptions

Next Year (Year 1):

Growth Rate: 0%

Operating Margin: 10%

Projected Operating Income: $120 million

This forecast reflects a conservative stance, assuming essentially no top-line expansion and a stable operating margin. It provides a baseline for subsequent years.

Years 2 to 5:

Growth Rate: 5% per year

Years 6 to 10:

Growth Rate: 4% per year

Perpetual Growth Rate (Beyond Year 10):

Long-term Growth: 3% per year

These assumptions gradually taper from moderate expansion (5% to 4%) to a perpetual rate near inflation/GDP growth (3%). By keeping the long-term growth rate modest, we err on the side of caution to avoid overestimating the company’s sustainable expansion.

2. Capital Structure and Interest Income

The company currently carries no debt, so there is no interest expense. Though the firm may earn interest on excess cash balances, we assume zero net interest income in our projections. This approach simplifies the model, reflecting the likelihood that the company will either:

Reinvest surplus cash in organic growth initiatives or acquisitions, or

Return excess capital to shareholders via buybacks.

Because reinvestment decisions and resulting returns can be difficult to predict, excluding interest income further ensures a conservative valuation estimate.

3. Tax Rate Analysis

Based on the company’s Cayman Islands structure, we project an effective tax rate of about 12%. This estimate is derived from a detailed analysis of recent tax benefits and corporate tax differentials:

Base U.S. Corporate Tax Rate: 21%

Foreign Tax Rate Differential:

$5.4M / $125.8M net income ≈ ~4.3% reduction

Preferential Tax Rates:

$1.8M / $125.8M net income ≈ ~1.4% reduction

Transfer Pricing Adjustments:

$6.4M / $125.8M net income ≈ ~5.1% reduction

Deferred Tax Assets: Temporary benefits, excluded from the long-term outlook

Unremitted Foreign Earnings: Deferred, but not permanently tax-free

Combining these factors suggests a rate closer to 10–12% over the long run, assuming stable tax strategies and no significant changes in domestic or international tax laws.

4. Free Cash Flow and Reinvestment

Despite historically high returns on investment, the model does not explicitly account for the company’s potential to invest excess cash in new growth opportunities. By taking a conservative view—assuming limited reinvestment or acquisitions—we may be undervaluing the business if management continues to deploy capital effectively.

As new projects or acquisitions come online, the actual free cash flow to shareholders could be lower in the near term (due to reinvestment), but potentially higher in the long run if those investments generate returns above the cost of capital.

5. Methodology & Google Sheets Model

You can read more on the methodology I use here:

You can play with this model and assumptions from this link:

6. IRR at the Current Stock Price

At its current trading price of roughly $16.50, our model indicates an internal rate of return (IRR) of about 20.1%. In other words, this IRR is the annualized rate that aligns the present value of anticipated cash flows with the stock’s current price. If GCT achieves its projected growth, an investor buying in now could see an annual return in the vicinity of that percentage. It is also worth noting that the terminal value constitutes just 22.8% of the total cash flows, and the implied exit TV/PE multiple is a modest 6.0x - both solid sanity checks.

7. Discounted Cash Flow (DCF) Valuation & Upside Potential

DCF results with unchanged assumptions, adjusting only the discount rate:

At an 8% discount rate, the implied price is $58.14, reflecting an upside potential of 253%.

At a 12% discount rate, the implied price drops to $31.88, with an upside potential of 93.6%.

At a 15% discount rate, the implied price further declines to $23.71, yielding an upside potential of 44.0%.

Final Thoughts

GigaCloud Technology presents a compelling case as a value-oriented growth company. Its logistics-driven marketplace model provides a moat, and its financials are robust. However, investors must monitor competition, tariff policies, and market cyclicality.

💬 What are your thoughts on GCT’s potential? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe – your support truly motivates me to keep creating quality content.

I like the PE, ROIC, Net income growth, and MOAT. Great write-up.