Crocs (CROX) Valuation: DCF & IRR Analysis (+ Google Sheets Model)

Crocs (CROX) Valuation: 17.6% IRR Potential & DCF Upside of 22% to 202% – Investment Case Breakdown

Crocs (CROX) presents a compelling value opportunity, with strong cash flows, a resilient brand, and significant upside potential based on our DCF valuation and IRR analysis. Below is a structured breakdown of the key insights covered in this report:

Content Overview

Overview & Market Performance – A snapshot of Crocs’s recent stock performance, revenue trends, and financial health.

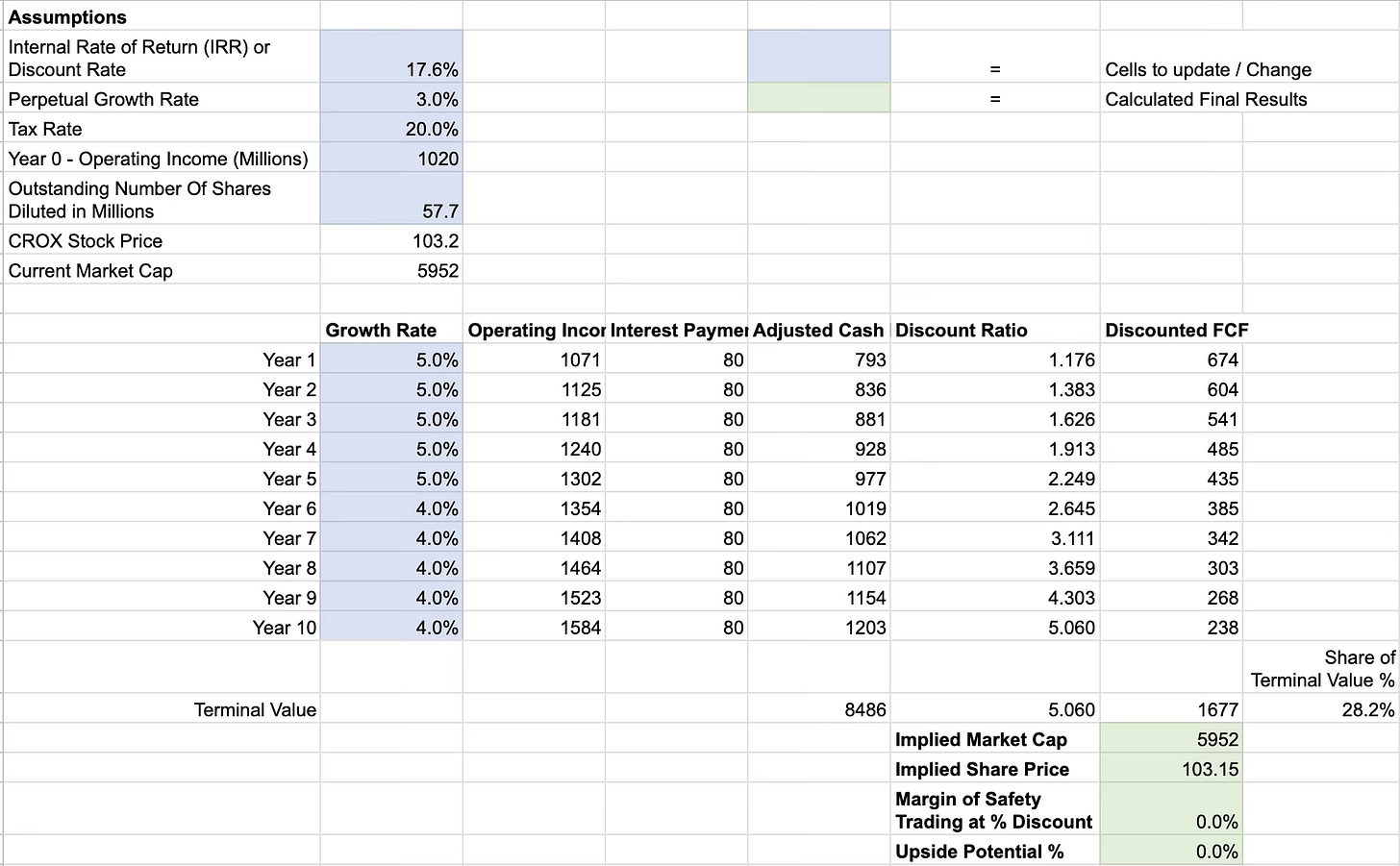

Model Assumptions & Methodology + Google Sheets Model – Key inputs, including growth forecasts, tax rates, and operating assumptions, used in our valuation with Google Sheets Model.

Discounted Cash Flow (DCF) Valuation & Upside Potential – A deep dive into the intrinsic value calculation, with DCF-derived price targets ranging from $126 to $311 per share.

IRR at the Current Stock Price – Evaluating Crocs’s potential 17.6% annual return based on projected future cash flows.

Key Financial Highlights – A summary of revenue, profitability, and cash flow performance, with insights from the latest 10-K report and investor presentation.

Investment Thesis & Market Positioning – The fundamental reasons why Crocs remains an attractive long-term investment.

Risks & Growth Opportunities – Analyzing potential challenges (e.g., fashion trends, macroeconomic risks) and upside catalysts (e.g., international expansion, digital growth, and product innovation).

This analysis aims to provide investors with a data-driven, long-term perspective on Crocs, highlighting its potential for strong returns despite market concerns.

1. Overview & Market Performance

Crocs, Inc. continues to assert its leadership in the casual footwear space with its signature Crocs brand and the complementary HEYDUDE segment. Currently, the stock is trading around $103 per share—a significant pullback from its mid-2023 highs in the $150–$160 range. This level reflects market caution amid growth concerns, yet is underpinned by strong fundamentals. For FY2024, Crocs posted revenues of approximately $4.1 billion, delivered robust free cash flow, and achieved an adjusted operating margin of roughly 25.6%, while diluted EPS came in at about $15.88.

Last week I shared a post on the business side, you can also check that one for a deeper background.

2. Model Assumptions & Methodology + Google Sheets Model

Assume operating income remains stable at last year's level of $1,020M. Capital expenditures (CAPEX), depreciation & amortization, and leases are at the same levels in the cash flow statement(additions and substractions), so no adjustments are necessary.

Crocs' debt level is within its target range, currently between 1–1.5x annual profit. Given this, we can expect the company to maintain its debt level and incur approximately $80M in annual interest expenses, subject to interest rate fluctuations.

For tax assumptions, use a 20% long-term rate, though the company projects an 18% tax rate for 2025.

Growth projections:

5% annually for the next five years

4% annually for the following five years

3% perpetual growth, aligning with inflation (no real growth)

These are conservative estimates. The company has the potential to exceed them, particularly through international expansion of the Crocs brand and revitalization of Hey Dude.

Base Operating Data:

Year 0 Operating Income: $1,020 million

Tax Rate: 20%

Annual Interest Expense: $80 million

Outstanding Diluted Shares: 57.7 million

Current CROX Stock Price: $103.20 (Market Cap: $5,952 million)

Growth & Terminal Value:

Years 1–5: Operating income grows at 5% per annum

Years 6–10: Growth slows to 4% per annum

Perpetual Growth Rate (for Terminal Value): 3%

Adjusted Free Cash Flow (FCF) is calculated as:

\( \text{FCF} = (\text{Operating Income} - \text{Interest}) \times (1 - \text{Tax Rate}) \)

DCF Framework: Cash flows for Years 1–10 are discounted back at the chosen rate, and the Terminal Value is computed using the perpetuity formula where g is the perpetual growth rate and r the discount rate.

You can play with this formula ask assumption from this link:

3. Discounted Cash Flow (DCF) Valuation & Upside Potential

Based on the model’s assumptions—and incorporating insights from the 10‑K report and investor presentation—we evaluated Crocs’s intrinsic value using three different discount rate scenarios. Our model uses:

Growth assumptions: ~5% annual growth for the next five years, with a slight moderation thereafter.

Terminal growth: A 3% perpetual rate.

Key operating inputs: Derived from FY2024 performance metrics (solid cash flow generation, strong margins, and ongoing share repurchases).

The resulting DCF values and implied upside are:

8% Discount Rate:

DCF Value: ~$311 per share

Upside Potential: Approximately 202% ([(311 – 103) / 103] × 100)

12% Discount Rate:

DCF Value: ~$170 per share

Upside Potential: Approximately 65%

15% Discount Rate:

DCF Value: ~$126 per share

Upside Potential: Approximately 22%

Even the more conservative scenarios suggest that Crocs’s future cash flows are valued significantly higher than the current market price, indicating strong upside potential if the company meets its growth targets.

4. IRR at the Current Stock Price

At the current trading price of about $103, our model calculates an internal rate of return (IRR) of roughly 17.6%. This IRR represents the annualized return required to reconcile the present value of projected cash flows with today’s share price. In practical terms, if Crocs achieves its forecasted growth, an investor purchasing at the current price might realize an annual return around this level.

5. Key Financial Highlights

Drawing from the latest 10‑K report and investor presentation, here are some of Crocs’s standout metrics and strategic initiatives:

Revenue & Segment Performance:

Total FY2024 Revenue: Approximately $4.1 billion

Crocs Brand: Drove a ~10% increase to about $3.3 billion

HEYDUDE Brand: Contributed roughly $824 million

Profitability:

Adjusted Operating Margin: ~25.6%

Diluted EPS: ~$15.88 (FY2024)

Adjusted EPS (non-GAAP): ~$13.17

Cash Flow & Shareholder Returns:

Operating Cash Flow: Nearly $990 million

Active Share Repurchase Program: Reflecting strong management confidence

Strategic Initiatives:

Product Diversification: Beyond iconic clogs, Crocs is expanding into sandals, slides, and personalized accessories.

International Growth: Efforts are underway to capture additional market share in Asia and Europe.

Digital & DTC Expansion: Increased focus on digital marketing and direct-to-consumer channels to enhance margins and customer engagement.

6. Investment Thesis & Market Positioning

Crocs’s Investment Case:

Iconic & Diversified Product Portfolio: Crocs’s classic clogs remain popular, but the company is actively growing its product lineup to include sandals and HEYDUDE styles, thus addressing a broader casual footwear market.

Broad Market Appeal: With most products priced under $100, Crocs appeals to a wide audience—fueling strong brand recognition and consumer loyalty.

Robust Financial Performance: The combination of strong revenue growth, impressive margins, and efficient cash flow generation underscores Crocs’s ability to reinvest in growth initiatives and return capital to shareholders.

Upside Potential: The DCF analysis shows substantial intrinsic value even under conservative assumptions, implying that the current share price may offer significant upside.

7. Risks & Growth Opportunities

Risks:

Consumer Trends: The enduring appeal of Crocs’s iconic styles is critical. Any shift in fashion trends could adversely affect demand.

Integration of HEYDUDE: The post-acquisition performance of the HEYDUDE brand is essential. Execution delays or underperformance could dampen overall growth.

Competitive Landscape: The footwear market is highly competitive, and Crocs must continuously innovate to maintain its market share.

Supply Chain & Macroeconomic Factors: Global disruptions and economic headwinds (such as FX volatility and cost inflation) remain key risks.

Growth Opportunities:

International Expansion: With relatively low market share in many key regions, there is significant room for growth through localized marketing and distribution strategies.

Product Innovation: Continuous expansion into new footwear segments can capture additional market share.

Digital & Direct-to-Consumer Channels: Enhancing digital engagement and growing the DTC channel can further boost profitability and strengthen customer loyalty.

Conclusion

At a current trading price of around $103, Crocs’s valuation suggests an IRR of approximately 17.6%, with DCF-based intrinsic values ranging from $126 to $311 per share across varying discount rates. Even the most conservative scenario (15% discount rate) indicates a potential upside of over 20%, while the 12% scenario points to roughly 65% upside. This robust valuation, combined with Crocs’s strong financial performance and diversified growth strategy, presents an attractive investment case—albeit with inherent risks tied to market trends and operational integration.

For further details, you can review the primary source documents:

Crocs 10‑K Report (February 13, 2025): CROX-US-10-K-13-Feb-25.pdf

2025 Investor Presentation: 2025-Investor-Presentation.pdf