Are Luxury Catamarans Your Next Portfolio Anchor? Catana Group Deep Dive and Valuation

A Family-Owned Luxury Catamaran Builder Delivering 10-Year Revenue CAGR of 20%, EPS Growth of 38%, and Trading at Only 4.5x P/E—Combining Dividends, Buybacks, and Long-Term Value

Catana Group, a French specialist in luxury and performance-oriented sailing and power catamarans, has carved a distinctive market position through innovation, brand strength, and strategic vertical integration. With robust financial health, prudent management led by the Poncin family, and a balanced growth strategy, Catana is well-equipped to weather market cycles and capitalize on the increasing global preference for multihull vessels.

This comprehensive analysis explores Catana Group's business model, competitive advantages, financial stability, and growth prospects to provide investors with clear insights into the company's long-term potential.

Table of Contents

Business Overview

Moat and Competitive Landscape

Financial Stability

Management Quality and Shareholder Alignment

Operating Profit and Cash Flow Analysis

Debt and Interest Structure

Tax Profile

Capital Expenditures (CapEx)

Sector Cyclicality

Family Ownership and Governance Influence

Financial Projections and Outlook

Valuation Analysis (DCF & IRR)

1. Business Overview

Catana Group is a French yacht builder specializing in sailing and power catamarans. It operates three main product lines: BALI Catamarans, Catana luxury catamarans, and the new YOT power catamarans. The Bali range, launched in 2014, features innovative “open-space” cruising catamarans with large living areas and solid foredecks, and now accounts for the bulk of the Group’s revenue. The Catana brand is a high-end, blue-water sailing catamaran line (with carbon-infused construction and performance-oriented designs) comprising ~5% of revenue and sold exclusively to private owners. In 2023, Catana Group expanded into motor yachts with the YOT range of power catamarans; initial 36-foot and 41-foot models were unveiled in 2024. These YOT powercats are designed as versatile dayboats and cruising power catamarans, aiming to offer “performance, safety, wide open spaces, fun and agility” in a twin-hull motorboat format.

Catana Group also provides related services (about 2% of revenue), including a marina/boatyard operation (Port Pin Rolland in Toulon) offering boat maintenance, storage, and refit services. The client base is roughly half private owners and half charter fleet operators: about 50% of boats are sold directly to private individuals and the other 50% to charter/rental companies. The Bali line in particular was initially targeted toward large charter companies (whose customers charter these catamarans for vacations), though Catana is now diversifying toward serving smaller charter operators as well (Boating Industry - With growth of 16% over 9 months, Catana Group will diversify its sales strategy - Yachting Art Magazine). Geographically, Catana Group’s sales are well diversified: ~70% of revenue comes from Europe (especially France, Spain, Italy, Croatia, Greece, Turkey), ~10% from the United States, and ~20% from the rest of the world. This broad market exposure means the group is not overly reliant on any single country or region.

From an operational standpoint, Catana Group has built a vertically-integrated production model. It owns or controls five production sites: three in France (Canet-en-Roussillon headquarters, Rivesaltes, and a subcontracted site in Marans), one in Tunisia (HACO shipyard in El Haouaria, in operation for ~7 years), and a newly constructed factory in Aveiro, Portugal (opened in late 2024, dedicated to the YOT powercat range). The Group also operates two in-house furniture workshops (in Rivesaltes and Tunisia) enabling it to produce all interior furnishings internally. This integrated approach supports quality control and potentially shorter lead times. Overall, Catana’s business is built on a family-led, innovation-driven culture (founded by Olivier Poncin in 2003), focused on leveraging its multi-brand portfolio to serve both private yacht owners and the professional charter market worldwide.

2. Moat and Competitive Landscape

Catana Group benefits from several competitive advantages (a “moat”) in the catamaran niche.

Brand Portfolio and Reputation: The company is known for the Catana brand’s heritage in performance sailing cats and the Bali brand’s innovative design in cruising cats. Bali’s unique concepts – like a solid foredeck entertaining area, wide opening saloon doors, and emphasis on liveable space – have been a major commercial success, helping Catana rapidly penetrate the cruising catamaran market. This differentiated product design has created a strong customer following and brand recognition.

Vertical Integration and Production Know-how: Catana’s control over its manufacturing (multiple owned sites and internal carpentry) provides supply chain advantages and quality consistency. The company uses advanced composite techniques (e.g. carbon infusion in Catana models) to achieve strong yet lightweight hulls (The models - Catana). This technical expertise in high-performance catamaran construction is a barrier for new entrants. Furthermore, having a Tunisian facility and a new Portuguese plant gives Catana flexibility to manage costs (via lower labor cost regions) and capacity. During the recent industry boom, Catana’s integrated production helped it ramp output and double its revenue over 2021–2023, outpacing many competitors.

Innovation and Product Development: The Bali range itself was an innovation that competitors have struggled to replicate directly (e.g. the signature solid foredeck and “open-space” layout are unique in production cats). Catana continues to invest in new models – in 2024 it launched the Bali 5.8 (entering the >55ft segment for the first time) and the YOT 41 power cat. This ongoing innovation pipeline should sustain customer interest. Notably, Catana’s strategy of developing new models through its founding family’s separate R&D vehicle (Financière Poncin) means design costs are borne by the family and the Group pays royalties only on successful sales. This aligns incentives to create winning products and gives Catana a steady stream of new designs without burdening its balance sheet with heavy R&D spend.

Competitive Landscape: The global leisure boat market is fragmented, but in catamarans a few key players dominate. Catana’s main direct competitors in sailing cats are Fountaine Pajot (France) and Groupe Bénéteau (France, via its Lagoon and newer Excess catamaran lines). Fountaine Pajot is similar in scale and focus: it achieved ~€277 million revenue in 2023 and is also growing (doubling sales since 2020) (Fountaine Pajot: share price rises with outlook -January 17, 2024 at 04:59 pm IST | MarketScreener). Lagoon (part of Bénéteau) benefits from Bénéteau’s massive production capacity and dealer network – Bénéteau’s Boat division did ~€1 billion in sales in 2023 (though across many brands) (Financial statements of the major groups at the end of July 2024 regarding BRAND NEW BOAT sales. – Ita Yachts Canada). Lagoon historically has been the #1 in unit volumes for cruising catamarans. Despite these formidable rivals, Catana has carved out a solid position: its 2023/24 sales of €229.5 m are now in the same tier as Fountaine Pajot, reflecting Bali’s market share gains.

Globally, other notable catamaran players include Robertson & Caine (builder of Leopard cats, based in South Africa, supplying Moorings/Sunsail charter fleets), and high-end builders like Sunreef Yachts (Poland) in the luxury custom segment. Catana distinguishes itself with a broad product range (from 40ft to 65ft sail cats via Bali/Catana and 36–41ft power cats via YOT) and a focus on innovation over sheer volume. Industry trends have been favorable to catamarans: multihulls have grown in popularity for cruising due to their space and stability, with expected global catamaran market CAGR ~5–6% (Catana Group analysis + Special article 1Q23 Superyachts Earnings). This provides a secular tailwind for all players. However, demand can be cyclical. Catana’s pricing power was evident during the post-Covid boom – many catamaran brands raised prices 30–80% from 2020–2023 amid strong demand and cost inflation (Very good first-half results for 2023-2024 for Catana Group, which is anticipating the arrival of more than 65-foot Bali vessels - Yachting Art Magazine). Catana was able to pass on cost increases (regaining alignment of selling prices with costs by late 2023 thanks to its order backlog and Bali’s popularity. In a softer market, pricing power is more limited; indeed Catana’s Bali unit made a notable move in late 2024 to cut prices across the entire Bali range (the only yard to do so) as supply costs eased, in order to stimulate demand and stay competitive (SCOOP - Bali Catamarans lowers all its prices and increases its manufacturer's warranty - Yachting Art Magazine). This proactive adjustment shows management’s agility – sacrificing some margin to protect volume and market share.

Overall, Catana Group’s competitive position in the catamaran niche is strong: it has a recognized brand portfolio, a track record of innovation, and a vertically integrated model that competitors find difficult to match. While the yacht industry remains cyclical and competitive, Catana’s differentiated product offering (especially the Bali concept) and solid brand reputation give it an edge in attracting customers, including resilient demand from charter operators and private cruisers. Its main challenge is navigating cyclical downturns and ongoing competition from larger groups like Bénéteau (which have greater resources) – issues which it addresses through nimble pricing, continuous innovation, and maintaining a lean, family-driven corporate structure.

3. Financial Stability

Catana Group’s financial position is robust, providing a cushion to weather industry downturns. The company has a strong balance sheet with net cash and growing equity. As of August 2024 (FY2023/24 year-end), Catana had approx. €50 million in cash on hand. Even after significant expansion investments, its net cash (cash minus debt) stood at ~€16 million. This marks a reduction from ~€37 million net cash a year prior due to a deliberate ramp-up in capital expenditures (discussed in Section 8) and working capital build, but the Group remains debt-light. Total financial debt was about €47.9 million (mid-2024) after taking new loans for the Portugal factory (Very good first-half results for 2023-2024 for Catana Group, which is anticipating the arrival of more than 65-foot Bali vessels - Yachting Art Magazine), implying a modest gross debt-to-equity ratio (~0.58x, with equity €82 m). With cash exceeding debt, leverage is effectively nil on a net basis, which is exceptional in an industry known for leverage during growth phases.

Liquidity is further supported by positive operating cash flow generation. In FY2023/24 the company generated ~€13.3 m of operating cash flow despite a substantial working capital swing (inventory increased as some finished boats awaited spring delivery). Inventory build was a temporary effect of delivery timing, as all those boats were already sold. Catana’s current ratio is healthy; current assets (including €50 m cash and ~€66 m inventory) comfortably cover current liabilities. The firm has also renewed a 25-year concession for its Port Pin Rolland marina, securing that service income stream. The absence of substantial goodwill or intangible assets on the balance sheet (since R&D is externally funded by the Poncin family) means the equity is backed by tangible assets (factories, inventory, cash). The interest coverage is very high – interest expense on bank debt was only ~€3.8 m in FY2023/24, easily covered by ~€37 m operating profit. Even including lease interest (IFRS 16 on the port concession etc.), coverage remains solid.

Catana has demonstrated it can endure rough waters. During the 2008–2009 global financial crisis, the company (then much smaller) nearly went under, but was turned around by the Poncin family. Today’s Catana is far more resilient: it has ample cash reserves, minimal net debt, and a lean cost structure. Gross margins have improved with scale, providing a buffer if volumes decline. Moreover, management takes a conservative approach to financing – recent expansion was funded through internal cash flow and a relatively small amount of new borrowing, rather than excessive debt. This conservative financial management, combined with the flexibility to trim production (Catana can adjust output across its sites or rely on subcontractors if needed), positions the company to withstand cyclical downturns in yacht demand. In summary, Catana Group’s balance sheet strength and liquidity are a key investment positive – the company has the financial stability to continue its operations and strategic projects even in a tougher market, reducing long-term risk for investors.

4. Management Quality and Shareholder Alignment

Catana Group is a family-founded business, and its management is widely regarded as competent, transparent, and shareholder-aligned. The late Olivier Poncin, founder (in 2003) and long-time CEO, was known as an innovative yet pragmatic leader who rebuilt Catana from near insolvency into a global player. After Olivier Poncin’s passing in May 2023, his son Aurélien Poncin – who had been actively involved in the business – took the helm as CEO. This succession was smooth and underscores the family’s commitment to the company’s long-term success. The Poncin family remains the reference shareholder and continues to instill a long-term strategic vision. Olivier Poncin had a 50-year career in boatbuilding and fostered a culture of trust, teamwork, and “transparent, balanced and responsible management”. These values persist under Aurélien Poncin, who has already shown a willingness to consolidate and strengthen internal operations during the recent market lull.

Ownership Structure: The Poncin family (through Financière Poncin and related holdings) owns ~29% of Catana’s capital but controls ~46% of voting rights (due to double voting rights on long-held shares). This gives the family effective control, ensuring strategic stability. Importantly, minority shareholders’ interests have largely been respected – the company has refrained from dilutive equity raises in recent years and instead funded growth via earnings and modest debt. In fact, Catana has started returning cash to shareholders: it initiated dividend payments (e.g. €0.15 per share for FY22/23, increasing to €0.18 proposed for FY23/24), and has done share buybacks (holding ~5.9% treasury shares). The treasury shares are used to provide liquidity and for employee share grants. Notably, the company has granted stock to employees (approximately 523k shares across 2022–2024 plans) to incentivize staff, and none of the initial free share grants went to top executives – indicating a fair approach to employee rewards. There have been no alarming insider stock dumps; the Poncin family appears intent on holding or even slightly increasing their stake (e.g. through share buybacks improving their relative control).

Capital Allocation and Discipline: Management has shown prudent capital allocation. During the boom years, they reinvested heavily in capacity (the new Portuguese plant, French site upgrades) while still keeping a net cash position. They maintained cost discipline even as revenue doubled – for instance, headcount and expenses were scaled carefully. In FY2022/23, operating margin dipped due to external factors (supply chain issues), but management’s focus on efficiency helped restore margins in 2024 (operating margin rebounded to ~16% in H1 2023/24). The Poncin family’s royalty-based R&D model also aligns with cost discipline: the family’s holding company finances new model development (for Bali and YOT brands) and only earns royalties if those models succeed in the marke. This “pay-for-success” arrangement incentivizes management to launch commercially viable products and avoids burdening Catana’s P&L with large development costs or failed projects. It’s a related-party setup, but one that has so far benefited Catana by accelerating innovation without diluting shareholders or overleveraging – any potential conflicts of interest are mitigated by transparency (royalty fees are disclosed) and the clear upside it provides to the Group (access to new designs and IP without upfront cost).

Integrity and Governance: Catana’s governance includes an active board and audit controls typical of a listed company. The board periodically reviews conflicts of interest (for example, ensuring the AP Yacht subcontracting and Poncin royalty arrangements are fair). The founding family’s presence provides stability, but independent directors and auditors are in place to represent minority shareholders. So far, there have been no major governance controversies. The family’s long-term orientation (they explicitly base decisions on long-run value, not short-term market reactions) can be seen in moves like cutting Bali prices in 2024 to preserve the brand’s market position – a decision that may pressure short-term margins but protects the franchise for the future, which aligns with long-term shareholder interests. In summary, Catana’s management quality is high: it combines visionary product strategy with conservative financial stewardship. The Poncin family’s substantial ownership and the alignment mechanisms (family-funded R&D, employee stock plans) give confidence that management’s incentives are closely aligned with shareholder value creation over the long haul.

5. Operating Profit and Cash Flow Analysis

Catana Group’s operating performance has improved markedly in recent years, though the business does have cyclical swings. Revenue growth has been strong: FY2022/23 saw sales up +39% to €207.3 m , and FY2023/24 reached €229.5 m (+10% despite market slowdown). This surge, driven by Bali catamaran demand, led to operating income hitting €37.4 m in FY2023/24. The Group’s operating margin for 2023/24 was about 16.3%, a significant rebound from ~12.4% in FY2022/23 when inflation and supply-chain issues had temporarily eroded profitability. Historically, Catana’s normalized operating margin has been in the mid-teens (e.g. ~15.8% in 2022), reflecting solid pricing and cost control when operations run smoothly. During FY2022/23, shortages of engines and labor caused inefficiencies (out-of-sequence work, delivery delays) that hurt productivity. As those issues eased, Catana “regained perfect alignment between selling prices and material costs” by late 2023, allowing margins to normalize upward. Going forward, normalized operating income is likely in the range of 13–16% margin, assuming no major supply shocks – i.e. on FY2023/24 sales, a sustainable EBIT in the mid €30-millions. This is supported by management and analysts’ outlook that Catana can restore margins to pre-inflation levels (~16%) by 2025 through supply chain optimization and ramping the higher-margin YOT business.

On the expense side, Catana benefits from its integrated model (in-house manufacturing can yield cost advantages at scale) and from the fact that R&D costs for new models are borne by the Poncin family (Catana pays no R&D expense for Bali/YOT aside from the sales-based royalty). However, as a boat manufacturer, it does have high working capital needs. Inventories and work-in-progress build up ahead of delivery seasons. In FY2022/23, inventory rose by €30 m due to delayed deliveries, which temporarily tied up cash. This reversed in spring 2024 as those boats were delivered and invoiced. The cash conversion cycle can therefore be lumpy. Nonetheless, Catana has consistently generated positive operating cash flow. Over 2021–2023, operating cash flow averaged €13–14 m per year, even as the business expanded. Free cash flow (FCF) after capital expenditures did turn negative in FY2023/24 because of unusually large growth capex (€25.8 m), but on a normalized basis (excluding growth investments and adjusting for one-time working capital swings), Catana’s FCF remains positive. We estimate a normalized FCF (after maintenance capex and after the Poncin royalty which substitutes for R&D) on the order of €10–15 m annually in the current revenue range – this is after also expensing stock-based compensation (which has been minimal; the free share grants in 2022–24 amounted to <2% of shares). Stock comp is already reflected in the income statement (it was not given to executives, and it’s not large enough to distort operating profit), so adjusting for it doesn’t materially change FCF. In other words, Catana’s earnings quality is high – reported net profits largely translate into cash, aside from temporary working capital absorption during growth spurts.

Looking ahead, margin sustainability appears good, though not immune to market forces. Catana demonstrated during the post-Covid boom that it can achieve ~15%+ EBIT margins at high volumes, and even in a tougher 2023 environment it stayed solidly profitable. The company is proactively managing costs: as demand moderated, management initiated supplier negotiations to reduce input costs and enabled the Bali price cuts without severely denting margin. If the market were to weaken further, Catana might see some margin compression (due to lower factory utilization or the need for competitive pricing), but its lean structure and lack of fixed R&D overhead give it flexibility. Conversely, any future upswing or operational efficiency gain (for example, once the new YOT factory reaches volume production) could provide upside to margins. Normalized operating margin in a steady-state mid-cycle is expected to be around 15%, with downside to ~10–12% in a cyclical trough and upside to high teens in peak conditions. Importantly, even at the lower end of that range, Catana would remain cash-flow positive, which underpins its ability to self-fund and return cash to investors over time.

6. Debt and Interest Structure

Catana Group’s debt profile is conservative and long-term oriented. As of the first half of FY2023/24, the company’s financial debt was €47.9 million. This includes bank loans and lease liabilities, some of which are associated with long-term arrangements like the Port Pin Rolland concession (treated as finance leases). In FY2023/24, Catana took on €13.4 m of new loans specifically to finance construction of the new Portugal factory for the YOT range. These loans are likely term loans with multi-year maturities (the exact terms aren’t publicly detailed, but given the nature of the project, they could be medium-term facilities). The rest of the debt consists of earlier loans (possibly related to prior facility expansions or equipment financing) and lease obligations. Despite this increase, Catana’s net debt remained negative (i.e. net cash) due to its sizable cash reserves, meaning it effectively has no net gearing.

The interest payments on this debt are manageable. In FY2022/23, interest on borrowings was about €3.8 m. Even after the new €13.4 m loan (assuming an interest rate in the mid-single digits), annual interest expense might rise modestly. Additionally, the Port Pin Rolland concession renewal implies lease payments (interest component of €8.65 m was recorded, though that figure reflects accounting for the entire 25-year concession lease liability). In cash terms, annual lease payments are much smaller; the large €8.65 m figure is an IFRS accounting effect for the present value of future fees. The interest coverage ratio (EBIT/Interest) is extremely high – on pure bank debt interest (€3.8 m), coverage was ~10x in 2023/24. Even including lease interest, EBIT covers total interest several times over. The debt structure appears to be primarily fixed-rate or moderately priced bank debt; Catana likely benefited from low interest rates when arranging some loans. With rising rates in 2023, any floating-rate portions could see higher interest costs, but this is not a major concern given low leverage.

Catana’s long-term financial strategy is to maintain prudence. The company’s growth investments have been partly debt-funded, but management has signaled they intend to protect cash and avoid unsold inventory in the downturn, which will minimize any need to draw working capital lines. They also signaled intention to expand capacity at the French Canet shipyard (for larger Bali models) in collaboration with local authorities, which could involve further financing – but given current net cash and ongoing profits, Catana could likely fund a good portion internally or via targeted loans without straining the balance sheet. The debt maturity profile has not raised red flags; the new loans for the factory are presumably on a multiyear term, and the port concession lease runs 25 years (meaning its payments are long-term and steady). The interest rate risk is relatively low due to modest leverage – interest expenses were only 2% of revenue in 2023. In a high-interest scenario, Catana could even use some of its cash (€50 m) to pay down debt and reduce interest burden if desired.

In summary, Catana’s debt is structured conservatively with long-term assets (factory, concession) matched by long-term financing. The company’s policy has been not to over-borrow; even after doubling its size in two years, it kept net debt below zero. This gives flexibility to weather interest rate cycles. Catana’s long-term strategy is to use debt sparingly – primarily for high-impact growth projects – and otherwise rely on internally generated funds. With a solid equity base (€82 m group share equity) and continued profitability, Catana is unlikely to need significant external financing going forward. Indeed, the board is confident enough in cash flows to initiate dividends while still funding expansion, indicating they foresee no liquidity crunch. This conservative financial approach lowers the risk profile for a long-term investor.

7. Tax Profile

Catana Group is headquartered in France and thus subject to French corporate taxation, but its effective tax rate has been relatively low in recent periods due to various factors. The statutory corporate tax rate in France has been about 25% (for 2022 onward). However, Catana’s effective tax rate has often come in below this. For FY2022/2023, despite €25.6 m operating profit and €19.3 m net profit (Group share), the tax expense was not the full 25%. In fact, in H1 2023/24, Catana reported a tax charge of only €5.2 m on €18.6 m pre-tax profit (consolidated), implying ~28% including deferred tax adjustments. In FY2023/24, the consolidated net income was €29.7 m on €33.4 m pre-tax (after interest) – roughly a 11% effective tax rate, which seems very low. This likely reflects the utilization of prior tax loss carryforwards and different tax rates in jurisdictions of its subsidiaries. Catana had some deferred tax assets (around €1 m) on its balance sheet, which presumably related to past losses or timing differences; the utilization of these deferred tax assets would lower the effective tax as profits rose. Additionally, Catana’s Tunisian production subsidiary may enjoy a lower tax regime (many Tunisian free-zone manufacturing entities have reduced tax rates), and the Group also might receive research or investment tax credits in France.

The company has not flagged any significant tax contingencies or disputes – tax risk is not highlighted as a major risk in their filings. They appear to be in compliance and have conservative accounting (e.g., they accrue current taxes of around €7.98 m as of Aug 2024, indicating they are setting aside for taxes on the increased profits). The statutory vs effective tax difference should diminish as historical loss carryforwards are used up. By FY2024/25 and beyond, one can expect the effective tax rate to move closer to the French norm (~25% plus any minor local taxes). However, the Group’s structure might keep it a bit lower: profits from Tunisia (if reinvested or taxed locally at a lower rate) and any remaining French R&D credits can reduce it. Catana also had minority interests from a subsidiary (likely the port or other ventures) – these minority interests share of profit (e.g. €0.8 m in H1 2023/24) effectively is pre-tax profit not attributable to the Group, which can make the group’s net share appear lower-taxed.

The future tax outlook is that Catana will be a normal tax-paying entity at roughly the French rate on its French profits. For modeling purposes, assuming an effective tax rate of ~25% going forward is reasonable, up from the unusually low effective rate in FY2023/24 which was aided by non-recurring factors. One should note that France has no federal tax credits remaining beyond normal depreciation and R&D incentives that Catana might use. The Group does benefit from French industry support programs (in prior years, they mentioned a €1.5 m research tax credit) and Tunisia’s tax regime. But these are relatively minor. There are no material tax disputes or liabilities – Catana’s filings explicitly state no government or legal proceedings are expected to have a significant negative impact. Thus, taxes should simply follow profits. In summary, investors can expect Catana’s effective tax rate to normalize in the low-to-mid 20s (%) in coming years. The company has a clean tax profile with a small deferred tax asset and no known aggressive tax positions – appropriate for a long-term, transparent operation.

8. Capital Expenditures (CapEx)

Catana Group has been investing aggressively in growth, while maintaining relatively modest maintenance capex needs for its size. In FY2023/24, total capital expenditures (cash outflow for investing activities) spiked to €25.8 million, up from €9.8 m the prior year. This was largely growth CapEx: the single biggest project was constructing the new 25,000 m² catamaran factory in Aveiro, Portugal to produce the YOT power range. In H1 2023/24 alone, Catana spent €6.2 m on this new plant and another €1.3 m on modernizing its Rivesaltes joinery facility. Additionally, funds went into developing new models (like tooling for the Bali 5.8 and YOT 41) and other capacity enhancements. These investments represent expansion CapEx aimed at supporting the company’s long-term growth strategy (entry into powerboats and larger yachts).

By contrast, maintenance CapEx – the recurring spending needed to keep existing plants and equipment in good shape – is relatively low. We can infer maintenance CapEx by looking at depreciation: in FY2023/24 depreciation was ~€6.2 m. Maintenance needs are likely in the mid-single-digit millions annually (e.g. replacing molds, facility upkeep, IT systems, etc.). The bulk of Catana’s assets are manufacturing facilities and tools which have long useful lives. During the hyper-growth 2021–2023 period, Catana’s total CapEx was actually below depreciation (only €9.8 m in 2022/23 vs >€5.5 m depreciation), indicating they were running lean and deferring major expansion until demand proved durable. Now that they have expanded, we expect maintenance CapEx to normalize around €5–7 m per year (covering routine replacements and small upgrades). Growth CapEx for the future will depend on strategic projects: one major upcoming initiative is the proposed expansion at Canet-en-Roussillon for a new division building 65+ foot Bali models and to relaunch the Catana “Ocean Class” line. This could entail constructing new production halls or extending existing ones. While details are pending (discussions with local authorities are underway), it is conceivable that project will require a significant investment over the next 1–2 years – perhaps on the order of €10+ m if a new large hangar and equipment are needed for mega-catamarans.

Management has indicated that the long-term development plan involves multi-axis growth (sailing and motor divisions), so we can expect elevated CapEx through at least 2025. A reasonable estimate is that FY2024/25 will see CapEx still above maintenance level, albeit lower than the 2023/24 peak. The Portugal factory is now largely complete (it became operational in autumn 2024), so remaining spend there might be minimal. If the new Canet expansion kicks off in 2025, growth CapEx could be in the ~€10–15 m range for that year, tapering afterward. Future growth CapEx expectations: roughly €10 m in 2024/25 (mostly for Canet expansion and final Portugal payments), and perhaps another €5–10 m in 2025/26 if they phase construction or add more capacity. Beyond that, once these projects are done, Catana’s CapEx should drop dramatically, likely back toward maintenance levels. It’s worth noting that Catana’s innovative R&D model means it does not capitalize boat development costs – those are borne by the Poncin family, so the CapEx is purely on tangible manufacturing capacity. This keeps the balance sheet free of capitalized development intangibles and means CapEx is easier to forecast (tied to factories and machinery only).

The split of maintenance vs growth CapEx in 2023/24 can be roughly quantified: out of €25.8 m, an estimated ~€5 m was maintenance (covering normal replacements and some IT/other investments) and the remaining ~€20 m was growth (Portugal plant, new model tooling, etc.). In coming years, maintenance CapEx ~€5–6 m should be assumed, and growth CapEx will depend on strategic choices. If demand remains softer, management can throttle back expansion plans to conserve cash (they explicitly are focusing on “cash protection” and no unsold stock). This flexibility means Catana isn’t locked into spending beyond its means. In conclusion, Catana’s recent high CapEx reflects proactive expansion to seize new opportunities (power cats, larger yachts). These investments are expected to yield growth in revenue and profit over the long term. Meanwhile, the underlying maintenance capital requirement is modest relative to EBITDA, which bodes well for free cash flow generation once the current capex cycle tapers off.

9. Sector Cyclicality

The leisure boat industry, including catamarans, is inherently cyclical, with demand strongly influenced by economic cycles, wealth effects, and even social trends. Catana Group’s history and recent experience illustrate these cycles. In the 2000s, a global boom in yacht sales was followed by a severe downturn after the 2008 financial crisis – Catana (then Poncin Yachts) nearly succumbed as sales plunged and losses mounted. The fact that Catana survived the 2008–2010 downturn was due in part to restructuring and the Poncin family’s intervention. This episode underscores that during recessions or financial crises, demand for luxury yachts can drop precipitously.

The COVID-19 pandemic initially caused a brief shutdown and uncertainty in 2020, but it was followed by an extraordinary surge in boat demand in 2021–2022. With travel restrictions and newfound consumer interest in safe, private recreation, orders for cruising boats (especially catamarans suited for family vacations) skyrocketed. Catana’s market saw what management called “euphoric” conditions in 2021–2022, with an exceptional combination of favorable factors. Industry-wide, order books swelled – Catana’s backlog reached around €450 m by 2022, and competitors like Fountaine Pajot also reported record orders. This boom allowed companies to raise prices and operate at full capacity. However, by early 2023 the cycle turned sharply. As pandemic effects normalized, inflation and higher interest rates set in, and consumer confidence wavered, the yacht market cooled. Industry data show that by mid-2023, many boat dealers (especially in the U.S.) were reducing inventory orders amid softer retail demand (Financial statements of the major groups at the end of July 2024 regarding BRAND NEW BOAT sales. – Ita Yachts Canada). Groupe Bénéteau reported a 31% drop in H1 2024 boat sales (especially in smaller models) as dealers corrected inventories and end-customer orders slowed. In the catamaran segment, new order intake fell sharply starting in early 2023 after the boom. Catana noted that the market entered a “phase of regulation” with a much lower flow of orders and more hesitant customers. Factors like high prices (after 2–3 years of steep increases) and economic uncertainty caused a wait-and-see attitude among buyers. This recent mini-cycle shows how quickly sentiment can shift.

Despite these swings, certain aspects of catamaran demand are resilient. Charter companies, for example, base orders on tourism demand which tends to recover with the economy. After the 2020 dip, charter demand roared back, benefiting catamaran builders. Catana’s strategy to diversify to many smaller charter operators (70% of the charter market) should smooth out the impact of any single large customer pausing orders. The geographical diversification also helps: weakness in one region (e.g. North America in 2023 saw a big slowdown might be offset by relative strength elsewhere (Europe’s boat market held up a bit better). Additionally, multihulls have a structural growth trend – sailors are increasingly opting for catamarans over monohulls for cruising, which could make the catamaran segment more resilient than the overall boat market. Industry forecasts still predict growth in multihull sales over the next decade (Catamaran Market Size, Share & Trends Analysis 2024-2032).

That said, Catana is not immune to a serious recession. If global high-net-worth and upper-middle consumers pull back, yacht sales can fall abruptly. Typically, boatbuilders then cut production, lay off temporary staff, and conserve cash. Catana’s current financial strength (net cash and backlog) means it can likely ride out a moderate downturn without distress. Indeed, in calendar 2023 while new orders slowed, Catana could continue growing revenues by delivering its deep backlog. By late 2024, that backlog has thinned, so 2024/25 might see flat or slightly lower revenues if new order intake remains soft (Catana’s Q1 2024/25 sales were –19% year-on-year as production aligned with current orders). The management’s response – lowering prices and improving internal efficiency – is a classic playbook to navigate a downcycle. They also avoided overbuilding inventory (targeting zero unsold stock), which should prevent deep discounting later.

In terms of historical cycles, one can summarize: the mid-2010s were steady growth for Catana (Bali’s introduction helped it gain through the cycle), 2020 was a dip, 2021–2022 a spike, and 2023–2024 a cooling-off. Looking ahead, many analysts expect the leisure boat market to remain softer through 2025 as high interest rates and economic uncertainty persist, then potentially recover in 2026. Catana is preparing for this by bolstering productivity and launching new products to stimulate demand when the cycle turns up again. In conclusion, Catana operates in a cyclical sector but has proven adept at managing these swings. A long-term investor should be prepared for earnings volatility – bumper profits in boom years and tighter margins in lean years – but Catana’s cycle-aware management (ramping up in good times, pulling back in advance of slowdowns) and niche focus (catamarans remain a growth sub-sector) help mitigate the worst effects of cyclicality. The family ownership (next section) also means the company won’t chase unsustainable expansion at cycle peaks, instead prioritizing longevity.

10. Family Ownership and Governance Influence

Catana Group’s identity and strategy are deeply shaped by its founding family’s ownership. The Poncin family’s controlling stake (~46% voting power) gives it the ability to steer the company with a long-term horizon. This has generally been positive for corporate governance and market behavior, as the family is highly invested in the company’s success (both financially and personally). Unlike many public companies that may prioritize short-term quarterly results, Catana under family control has consistently prioritized sustainable growth and market positioning. For example, the decision to invest heavily in a new production site in Portugal and launch an entirely new product line (YOT powercats) was a long-term strategic move that the family backed, even though it meant significant expenditure and initial losses at the new subsidiary (a €1.6 m startup loss at Catana Portugal was absorbed in H1 2023/24). A more short-term focused ownership might have balked at such an initiative during a market peak; the Poncin family, however, is aiming to position Catana for the next decade of growth, leveraging its strong balance sheet to do so.

Governance and Control: With family control, certain governance practices differ from widely held firms. The board is chaired by the Poncin family (Aurélien Poncin leads the group now), and strategic decisions often reflect the family’s intimate industry knowledge. There is a “concert familial” shareholder group ensuring consensus in voting. This concentration of power means minority investors rely on the family’s stewardship – so far, the track record is good. The family recapitalized and saved the company in tough times and has not extracted undue benefits at the expense of others. The royalty arrangement for Bali/YOT (Financière Poncin licensing the brands) could be seen as the family taking a share of revenues, but it’s structured to fund R&D and is success-based, and importantly Catana Group pays no internal R&D costs because of it. This suggests the family is more interested in growing the pie (by investing in new designs) than in rent-seeking. The family also has not paid itself egregious salaries (the annual report doesn’t indicate any excessive executive compensation; in fact, no executives benefited from the initial stock grant plans.

Long-Term Strategy Influence: The Poncin family’s decades of boat industry experience guide Catana’s strategy. Olivier Poncin built the business around a “family model, based on the long term”, resisting pressures to sell out or dilute equity even when times were hard. This means Catana often behaves differently than peers in the market. For instance, while some competitors might chase volume at low margins or engage in aggressive dealer financing to boost sales, Catana has been more conservative – focusing on profitability and not oversupplying the market. The family’s control also allowed Catana to remain independent (unlike some rival brands that were acquired by larger groups). This independence is a double-edged sword: on one hand, Catana can pursue niche innovations (like Bali’s unorthodox design) without needing corporate approval from a conglomerate; on the other, it doesn’t have a big parent to bail it out in crisis. The Poncin family clearly embraces the former – keeping Catana agile and entrepreneurial. In recent market behavior, when orders slowed in 2023, Catana did not panic with drastic measures; instead, guided by Aurélien Poncin, they calmly adjusted pricing and negotiated cost reductions to “tackle the problem at the source”, confident in the long-term appeal of their products. This steadiness likely comes from the family’s long view (they’ve “seen it all before” in prior cycles).

For minority shareholders, family ownership provides stability but also means takeover or rapid strategic shifts are unlikely. The Poncin family is committed to running Catana and has plans to move the listing to the minor Euronext Growth from the main exchange to ensure an appropriate market for the stock. The float (~65% of shares) is sufficient for liquidity, but the family’s presence may deter activist investors or hostile bids – which can actually be reassuring for someone investing alongside the family for the long term. Essentially, an investor in Catana is aligning with the Poncin family, who have a significant portion of their wealth and legacy tied up in the business. The family’s “skin in the game”is a form of alignment; they suffer or prosper along with all shareholders.

In terms of market signaling, family insiders have generally been net buyers (earlier in the company’s life) or holders of stock; there haven’t been concerning sell-offs. Their consistent reinvestment of earnings into growth (while starting modest dividends) shows a balanced approach – they are not extracting cash irresponsibly, but they are willing to reward shareholders as profits grow. Family control also influences corporate culture: Catana’s workforce stability and commitment (many employees have been with the firm long-term) can be partly attributed to the familial, transparent management style, which likely reduces turnover and preserves know-how. This is a less tangible “moat” but important in craftsmanship industries like yacht building.

In conclusion, the founding family’s control imbues Catana Group with patient capital and strategic continuity. The Poncin family emphasizes innovation, prudent finance, and sustainable growth, which has generally benefited all shareholders. There is always a governance watchpoint in family firms for related-party dealings, but in Catana’s case the arrangements (R&D royalties, AP Yacht subcontracting) are disclosed and seemingly structured to further the Group’s interests (e.g., ensuring supply and new product development). The market tends to view Catana as a well-run family company – its shares reacted positively to strong results and the family’s plans, indicating investor trust. Thus, for a long-term investor, Catana’s family ownership is an asset: it provides vision and commitment that extend beyond quarterly earnings, aiming to build generational value in the company.

11. Financial Projections and Outlook

For a long-term investor, we outline base-case and conservative-case projections for Catana Group over the next few years, along with peer context:

Revenue Growth: In the base case, we assume the leisure marine market stabilizes by 2025 and Catana’s new models (Bali 5.8, YOT range) gain traction. After a flat or slight dip in FY2024/25 (reflecting the recent order slowdown), revenue could resume growth at ~5–10% per year. This yields FY2025/26 revenue in the €240–250 m range (mid-single-digit growth off the FY2023/24 base of €229.5 m and accelerating beyond if the market cycle turns up. In a conservative case, a prolonged downturn or tepid recovery might see revenues stagnate or grow only ~0–5% annually. That would put FY2025/26 sales roughly flat around €230–240 m. Notably, Catana’s backlog and new powercat segment provide some buffer; even in a downturn, it may outperform broader industry trends by capturing share from competitors or new customer segments.

Operating Margin: We expect Catana to maintain healthy margins. Base case: operating margin holds in the ~15% range in the mid-term. Management and analysts anticipate a return to ~16% EBIT margin by 2025 as supply efficiencies kick in. Thus, from FY2024/25 onwards, EBIT could be ~€35–38 m on ~€240 m sales. Conservative case: under softer demand, margin might dip to ~12% (closer to FY2022/23 level) due to under-utilization and any needed promotions. Even then, Catana would generate EBIT in the high €20 m range – still a solid profitability level. Over the long run, as the YOT division scales (powercats potentially have higher price points per length and could carry decent margins) and if Bali moves upmarket (with the >65ft models), there’s potential for margin expansion above 15%. But prudently, we keep base-case margins around mid-teens to account for input cost volatility and competitive pricing as needed.

Interest Expense Trend: Given Catana’s low debt, interest costs are not expected to be a major drag. Annual interest expense is projected around €4 m in the near term (assuming current debt and interest rates). In the base case, as EBITDA grows and potentially some debt is repaid, net interest may even decrease slightly. In a conservative scenario, if interest rates remain high and Catana keeps the loans outstanding, interest might tick up but remain <€5 m/year. With EBITDA on the order of €40 m, interest coverage will stay very high (>>10x). Thus, interest expense should remain a small percentage of operating income, and the company might even be net interest-positive if it earns interest on excess cash (interest rates on deposits are higher now). We do not foresee Catana needing to take on significantly more debt; capital expenditures can be funded from cash flow in the base case.

Effective Tax Rate Outlook: Catana’s effective tax rate is likely to rise to approximately 25% over the next couple of years, converging with France’s standard rate. In FY2023/24 the effective rate was unusually low (~11% of PBT due to deferred tax usage), but that was not structural. Base case assumes around 22–25% effective tax going forward (the lower end if international operations or any tax credits persist). Conservative case might be a bit higher if no offsets, say ~27%, but France’s stable 25% rate makes that a reasonable ceiling. We do not expect any major changes in tax law that would disadvantage Catana specifically. The company’s profitability and any repatriation of Tunisian earnings will be the main factors. So for projection, using ~24–25% tax on pre-tax profit gives a fair estimate of net income.

Maintenance vs Growth CapEx: Maintenance CapEx is estimated at ~€5 m per year, which is roughly in line with depreciation. This covers routine replacements and minor upgrades. Growth CapEx will be front-loaded in the next couple of years: Base case assumes Catana spends an additional €10–12 m in FY2024/25 (finishing Portugal plant payments and commencing the Canet expansion for large Bali/Catana yachts), and perhaps ~€5–8 m in FY2025/26 to complete that expansion. After FY2026, we project CapEx could fall back to maintenance levels (~€5–6 m) if no further major projects, boosting free cash flow. In a conservative scenario, Catana might defer or scale down expansion if demand is weak – so growth CapEx could be lower (or spread over more years), say only €5 m in FY2024/25 and €5 m in FY2025/26, focusing on critical needs. This flexibility means even in the conservative case Catana would not over-invest into a slump. By 2027 and beyond, we expect CapEx primarily for maintenance and occasional model tooling, which would be comfortably covered by operating cash flow.

Peer Comparison: In France and Europe, Catana’s closest peer Fountaine Pajot has comparable margins and growth prospects. FP’s revenue (forecast >€300 m in 2024) is slightly higher, and it planned ~€16 m of investment in 2024 (including a new Power 80 motor yacht launch) (Fountaine Pajot: share price rises with outlook -January 17, 2024 at 04:59 pm IST | MarketScreener). FP’s margins have been improving; it posted 10%+ net margin in H1 2023/24 (Fountaine Pajot: improved 1st half results -July 01, 2024 at 06:27 am | MarketScreener), similar to Catana. Groupe Bénéteau, a much larger entity (€1 b+ boats revenue), saw a sharp sales drop in early 2024 and operates on lower margins in volume segments (Financial statements of the major groups at the end of July 2024 regarding BRAND NEW BOAT sales. – Ita Yachts Canada), but its catamaran arm (Lagoon) remains a strong competitor. Lagoon benefits from Bénéteau’s scale but Bénéteau’s overall operating margin in the Boat division was only ~8–9% in recent good years (and lower in the dip) – Catana’s focus allows a higher margin. In terms of leverage, Catana’s net cash position stands out; FP has also net cash, whereas Bénéteau, being larger, uses more debt but still with a solid balance sheet. Global peers like Robertson & Caine (Leopard) are private, but anecdotally Leopard has a large order with Moorings and had similar post-Covid boom and 2023 slowdown (the used catamaran market saw more listings, indicating slower new sales).

From a long-term investor perspective, Catana Group compares favorably to its peers: it has similar or better profitability, lower financial risk (net cash vs net debt), and strong growth potential from new segments (power cats) without having over-extended. The family ownership provides stability akin to Fountaine Pajot (which is also founder/family-influenced to a degree), whereas Bénéteau is more corporate and diversified (monohulls, motorboats, etc.). If the sector downturn persists, all players will feel it – but Catana’s multi-year backlog entering 2024 and its agility (cutting prices, adjusting focus to smaller charters) may let it navigate the trough better. In the next upcycle, Catana could capture outsized growth as its expanded capacity comes online.

In summary, Catana Group is positioned as a financially sound, well-managed company in a niche that has both cyclicality and secular growth. Our base case assumes a soft FY2024/25 followed by resumed growth, with revenue expanding mid-single digits and margins stabilizing ~15%, yielding solid earnings CAGR in the high single digits. The conservative case sees minimal growth and slightly compressed margins, but even then Catana remains profitable and cash-generative. Peers face the same market conditions; Catana’s relative strengths (lean structure, net cash, focused strategy) give it a good chance to outperform the industry average through the cycle. Investors should be prepared for some volatility in annual results, but the long-term trajectory – driven by increasing popularity of catamarans, Catana’s innovations, and prudent management – is positive.

12. Valuation Analysis (DCF & IRR)

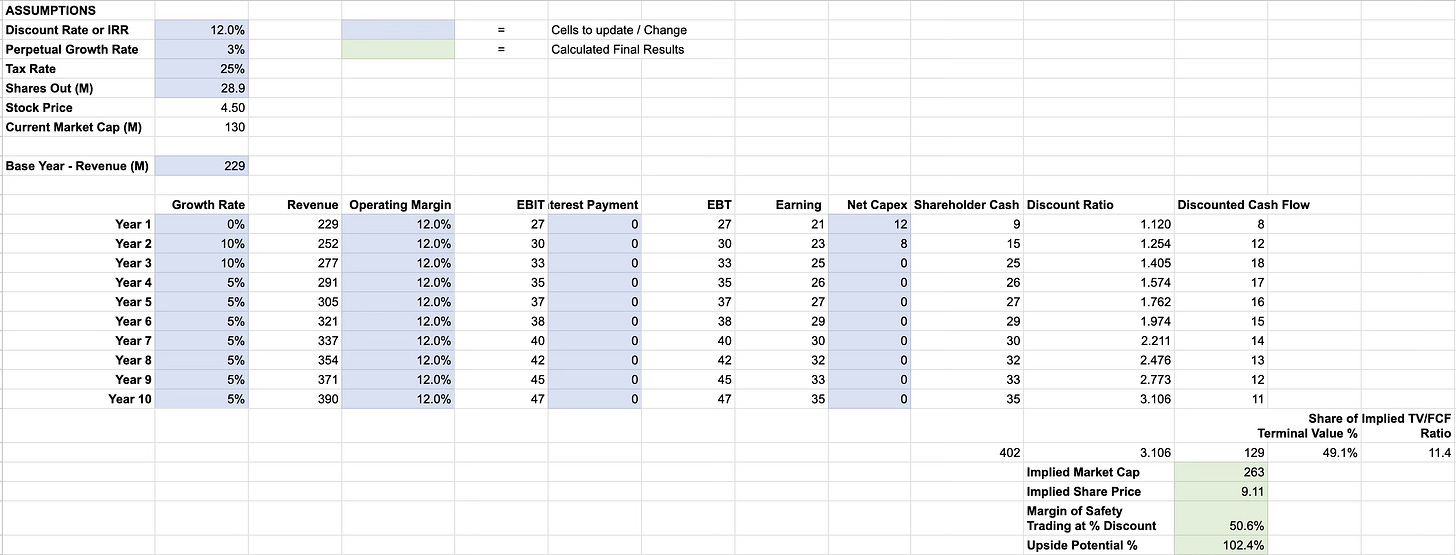

Assumptions

In assessing Catana Group's financial outlook, we have adopted a conservative approach, incorporating the following assumptions:

Revenue Projections:

Base Year Revenue: €229.5 million for the fiscal year ending August 31, 2024.

Year 1: 0% growth, anticipating sector rebalancing.

Years 2-3: 10% annual growth, driven by new investments in the YOT power catamarans.

Years 4-10: 5% annual growth, aligning with expected sector trends.

Perpetual Growth Rate: 3%, reflecting long-term GDP-inflation rates.

Operating Margin:

A conservative operating margin of 12% has been applied, corresponding to the lowest margin observed over the past four years.

Effective Tax Rate:

The French corporate tax rate of 25% has been utilized for projections.

Interest Payments:

Given Catana Group's substantial cash reserves, interest income is expected to offset any interest expenses, resulting in a net zero annual interest payment.

Net Capital Expenditures (CapEx):

Maintenance CapEx: Assumed to remain at minimal levels par with depreciation.

Growth CapEx: Projected at €12 million for the next fiscal year, €12 million for the following year, then €0 given that we haven2t added any extra growth afterwards.

These assumptions provide a framework for forecasting Catana Group's financial performance, incorporating cautious estimates to account for potential market fluctuations and investment requirements.

Methodology

You can check these two posts to understand the methodology I use here:

Step-by-Step Valuation: A Practical DCF and IRR Example

The Ultimate Valuation Guide: Discounted Cash Flow (DCF) to Internal Rate of Return (IRR)

Google Sheets Model

IRR at the Current Stock Price

At its current trading price of roughly €4.50, our model indicates an internal rate of return (IRR) of about 19.7%. In other words, this IRR is the annualized rate that aligns the present value of anticipated cash flows with the stock’s current price. If Catana achieves its projected growth, an investor buying in now could see an annual return in the vicinity of that percentage. It is also worth noting that the terminal value constitutes just 27.5% of the total cash flows, and the implied exit TV/PE multiple is a modest 6.2x - both solid sanity checks.

Discounted Cash Flow (DCF) Valuation & Upside Potential

At a 12% discount rate, the implied price drops to €9.11, with an upside potential of 102.4%.

At a 15% discount rate, the implied price drops to €6.59, with an upside potential of 46.5%.

💬 What are your thoughts on Catana Group’s potential? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe – your support truly motivates me to keep creating quality content.

I had a position in grand banks and did well. Looks like another good play

I really enjoyed this deep dive Moat Mind!