Axcelis Technologies: The Silent Powerhouse Driving the Semiconductor Revolution

How Axcelis is Carving a Niche in Ion Implantation and Securing Its Place at the Heart of the Digital and Electrified Future

Axcelis Technologies may not yet be a household name, but in the specialized world of semiconductor manufacturing, it holds the keys to a critical process—ion implantation. From doping silicon wafers in logic chips to enabling the rise of electric vehicles through power semiconductors, Axcelis’s tools are fundamental to the digital and electrified future. While larger players like Applied Materials dominate headlines, Axcelis has carved out a focused niche with its high-performance Purion platform, gaining market share, expanding margins, and fortifying a slender yet sturdy moat. Backed by a debt-light balance sheet, disciplined management, and strong free cash flow, Axcelis is quietly transforming from a niche player into a strategic cornerstone of the semiconductor supply chain.

This document explores the full spectrum of Axcelis’s business fundamentals, competitive dynamics, financial resilience, and long-term growth trajectory.

What you will read:

Business Overview

Moat and Competitive Landscape

Financial Stability

Management Quality

Operating Profit and Free Cash Flow

Debt Structure

Tax Structure

Capex Requirements

Growth Estimates

1. Business Overview

Axcelis Technologies is a semiconductor equipment manufacturer specializing in ion implantation systems used in chip fabrication. In simpler terms, Axcelis builds the high-tech machines that shoot dopant ions into silicon wafers to alter their electrical properties – a critical step in making integrated circuits. The company’s flagship Purion platform spans a full suite of implanter types: high-current (for shallow doping), medium-current, and high-energy (for deep implant) tools. Over 97% of Axcelis’s revenue comes from its ion implanters, with the remainder from services and upgrades on older equipment. Its customers are semiconductor chip manufacturers worldwide, ranging from advanced logic and memory chip fabs to producers of power semiconductors (e.g. silicon carbide devices for electric vehicles and industrial power electronics). Axcelis provides not just the hardware but also aftermarket support and process expertise, helping chipmakers fine-tune implant “recipes” for their specific devices. Headquartered in Beverly, Massachusetts, and originally spun off from Eaton Corp in 2000, Axcelis today operates globally to service chip fabs in the U.S., Europe, and throughout Asia. In short, Axcelis may be a relatively small player in the semiconductor equipment world, but it has built a big reputation in the niche of ion implantation – a niche crucial for everything from smartphone processors to the power converters in Teslas.

2. Moat and Competitive Landscape

Axcelis’s economic moat is narrow but deep – grounded in its technological edge and focus within the ion implant niche. The company has poured R&D into differentiating its Purion implanters, and it shows in performance. For example, Axcelis’s Purion M medium-current system offers higher throughput and 20% lower energy consumption than competing implanters. Likewise, the Purion Power series (tailored for silicon carbide devices) boasts “highly differentiated features and process control capabilities” that competitors struggle to match. In fact, Axcelis is currently the only ion implant vendor able to cover the full spectrum of implant steps needed for advanced power semiconductors, according to its CEO (Axcelis ships multiple systems to SiC chipmakers). These advantages translate into real customer value – higher productivity, lower cost of ownership, and the convenience of one-stop shopping for all implant needs. This technology lead has helped Axcelis steadily gain market share against its much larger rival, Applied Materials. Axcelis grew from a mere ~5% share of the implant market in 2011 to nearly 30% by 2017 (Applied Materials Continues To Get Walloped In Its Core Ion Implant ...). As of 2022, Axcelis held roughly 32% of the global ion implant equipment market, and in the fast-growing silicon carbide segment its share is an estimated 70–80% – far ahead of Applied.

This dominant position in a growth niche gives Axcelis a degree of pricing power and resilient demand. When a chipmaker is building out a new silicon carbide fabrication line (for electric vehicle chips, for instance), there are basically two choices for implant tools: Axcelis or Applied. Axcelis’s superior product performance in that realm has led to multiple wins at power semiconductor makers globally, even in Japan where domestic suppliers usually have an edge. The differentiation has not gone unnoticed – Axcelis’s CEO highlighted that the Purion Power series’ market leadership allows for increased pricing power and margin expansion in an otherwise cost-sensitive industry. Moreover, demand for Axcelis’s tools is underpinned by secular trends (the electrification of vehicles, growth in renewable energy systems, 5G infrastructure, etc.) that are driving a robust, multi-year investment cycle in power electronics. These end markets tend to be less sharply cyclical than the traditional PC or smartphone-driven chip segments, providing a bit of insulation when memory or logic spending downturns occur. Notably, during the recent industry slowdown, power device capacity investments held up better than cutting-edge logic, helping Axcelis only dip ~10% in revenue in 2024 versus far steeper falls at some peers.

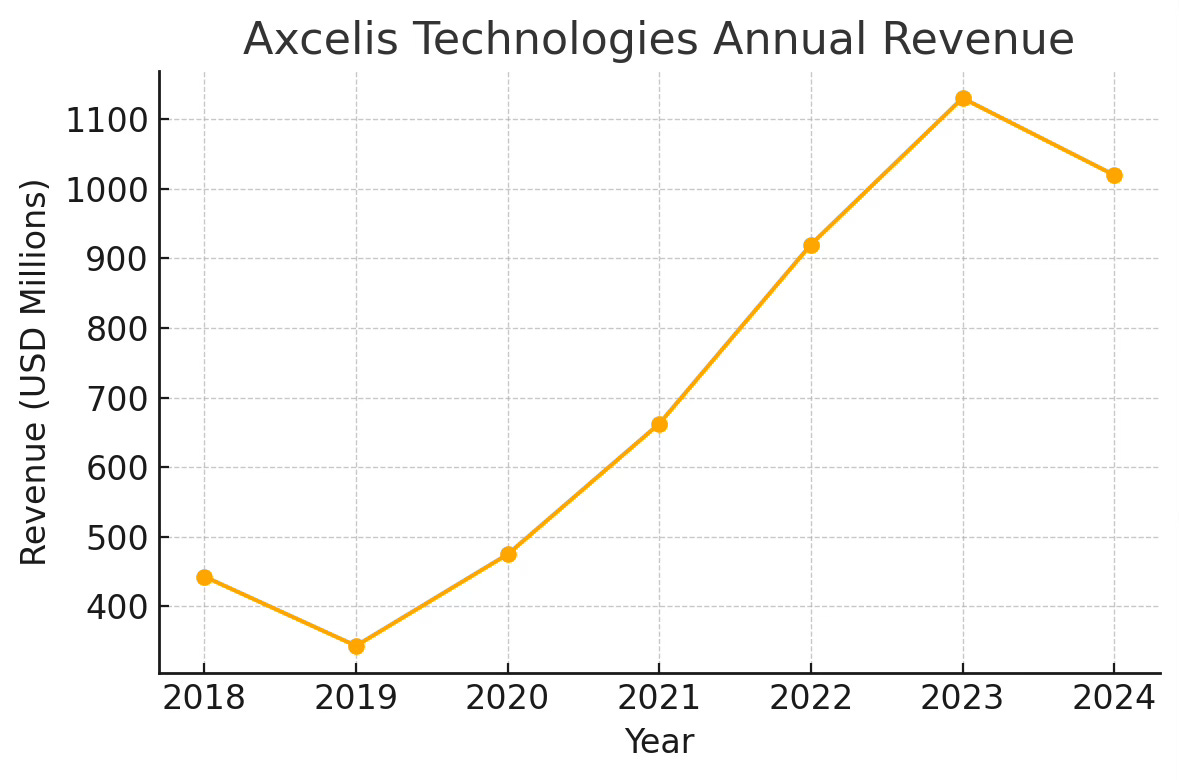

That said, Axcelis is not immune to the boom-bust cyclicality of semiconductor capital equipment. The company’s revenue history reads like a wild ride: a slump to $343 million in 2019 after a prior cyclical peak of $443 million in 2018, then a surge to over $1.13 billion by 2023 amid a global chip expansion.

Competition remains a constant threat as well. Applied Materials (which inherited its implant business from its Varian Semiconductor acquisition) is a formidable rival with vast resources. While Applied pulled back on implant R&D for a period – effectively ceding the high-end of the market to Axcelis – it has recently introduced new implant tools to “fend off Axcelis” as the market heats up. Any misstep by Axcelis in technology or customer support could allow Applied to reclaim lost ground. Beyond Applied, a few regional players exist (such as Nissin Ion in Japan or potentially emerging Chinese entrants), but none offer the full implant product range that Axcelis and Applied do. Still, one cannot rule out state-backed Chinese firms attempting to build a domestic implanter to replace imports, especially if export restrictions tighten. Axcelis’s heavy exposure to Asia (Asia-Pacific was ~75% of revenue in H1 2023 – particularly China, which alone may contribute ~40–60% of Axcelis’s systems sales – is a double-edged sword: it has fueled growth, but it also raises the stakes around tariffs and trade bans. U.S.–China tensions already threaten to curtail sales of “mature node” chip tools to China, a category that presumably includes some of Axcelis’s Purion implanters for older process nodes. In fact, new U.S. export rules announced in late 2024 are expected to shave $20–50 million off Axcelis’s 2025 revenue by limiting certain China shipments (the company now pegs the hit at the low end of that range). Such geopolitical risks, alongside the general capex cycle, remain key risk factors for Axcelis. Despite these challenges, Axcelis’s focused moat – deep expertise in ion implantation, a tight customer feedback loop, and a small but potent product portfolio – has thus far enabled it to punch above its weight in a land of giants.

3. Financial Stability

Despite operating in a volatile sector, Axcelis maintains a rock-solid financial position. The company carries essentially no net debt – as of the end of 2024 it had only ~$44 million in total debt on its balance sheet against a hefty $506 million cash pile. This net cash position means Axcelis earns interest rather than pays it; in other words, it has dry powder to weather downturns and fund strategic initiatives without relying on creditors. Axcelis’s balance sheet strength is evident in its equity ratio: total liabilities were just $336 million vs $1.35 billion in assets in 2024. The business is also consistently free-cash-flow positive through cycles. In 2023 – a record revenue year – Axcelis generated $156.9 million in operating cash flow and about $136 million in free cash flow after capital expenditures, while even the softer 2024 yielded ~$129 million in free cash. Importantly, the company has kept a tight rein on costs, allowing it to remain profitable at the operating level even in downturn years. For instance, during the 2019 slump Axcelis still eked out a modest $24 million operating profit and $17 million net income – not pretty, but a far cry from red ink. By 2023, operating margins had expanded to the mid-20s, riding higher volumes and improved pricing. Gross margins have been hovering in the 43–45% range recently, and notably actually rose in 2024 despite lower sales, thanks to a richer product mix and cost discipline. This suggests Axcelis can adjust its cost base or product pricing to defend profitability when times get tough. The company’s resilient balance sheet and cash flow give it the stability to invest through cycles and emerge stronger on the other side – a critical attribute in an industry where sudden downturns have sunk lesser-capitalized peers in the past.

4. Management Quality

Axcelis’s management team combines deep industry experience with apparent financial discipline, contributing to the company’s successful navigation of cyclical waters. Until 2023, Axcelis was led for over two decades by CEO Mary G. Puma, one of the few female CEOs in semiconductor tech. Puma’s 21-year tenure as chief executive saw Axcelis through multiple boom-bust cycles and strategic shifts (including exiting non-core product lines). In May 2023, Puma handed the reins to Dr. Russell J. Low, a Ph.D. engineer who had been serving as Axcelis’s Executive Vice President for product development. Low now serves as President and CEO, while Puma has moved to Executive Chairperson of the board – a succession that provides continuity (Puma is still involved at a high level) along with fresh operational leadership. By all accounts, this transition was orderly and was part of a planned succession, indicating sound governance.

In terms of integrity and incentives, there have been no red flags of unethical behavior or accounting issues at Axcelis in recent memory. The management ethos seems focused on shareholder value creation via operational performance rather than flashy M&A or empire-building. Axcelis has not engaged in major acquisitions; instead, management concentrated on organic growth and high-impact R&D within its niche. This capital allocation discipline shows up in the numbers – R&D spending was $97 million in 2023 (≈8.6% of sales), consistently supporting new product development like the Purion Power series, yet the company still expanded operating margins. Meanwhile, operating expenses have grown much more slowly than revenue, reflecting tight cost control(SG&A overhead, for example, only rose modestly year-over-year even as revenue jumped). Management also demonstrated restraint by selling and leasing back the Beverly HQ in 2015 to free up cash, a savvy move to lighten asset intensity.

Insider ownership of Axcelis is relatively small – insiders hold roughly 1.1% of the company – which is not unusual for a mid-cap tech firm 25 years post-IPO, but it means management’s fortunes aren’t heavily tied to the stock price. Top executives do have equity grants as part of compensation, though, and they have been realizing some gains: Puma herself sold nearly $10 million worth of shares in the last two years, and other insiders (CFO, directors) also sold portions of their holdings as the stock hit all-time highs in 2023. The selling was orderly and likely reflects personal diversification given the stock’s 4× run-up in two years, but the lack of recent insider buying (only token buys) could suggest management feels the stock is fairly valued. On the flip side, Axcelis has been returning cash to shareholders via buybacks, indicating confidence in the business. The company initiated its first buyback in 2019 and has since repurchased over $185 million of stock. In late 2022, the board authorized an additional $100 million share repurchase program. This capital allocation – investing sufficiently in R&D to protect the moat, while returning excess cash and avoiding debt – speaks to a management team that balances growth and shareholder returns prudently.

Overall, Axcelis’s leadership appears competent and shareholder-friendly. They navigated the 2019 downturn without panic, then skillfully ramped up production to seize the 2021–2022 opportunity. The fact that gross margins rose even as revenue fell in 2024 signals nimble cost management. As Axcelis grows, one area to watch is whether management can scale the organization (e.g. supply chain, customer support) to match a larger installed base. The recent hire of a new CFO (James Coogan succeeded retiring CFO Kevin Brewer in late 2023) suggests foresight in building the bench for the next phase. All indications are that Axcelis’s management has the technical know-how, strategic focus, and fiscal discipline to continue executing well.

5. Operating Profit and Free Cash Flow

Axcelis has evolved into a highly profitable operation, especially at scale, with healthy conversion of profits into free cash flow. During the latest up-cycle, operating profits hit new highs – in 2023 Axcelis achieved $265.8 million in operating profit (GAAP) on $1.13 billion revenue, a 23.5% operating margin. Even after fully expensing stock-based compensation (~$18 million in 2023) within that, the margins are impressive for a capital equipment business. In 2024, amid lower sales, operating profit was $210.8 million (20.6% margin). This suggests Axcelis’s sustainable operating margin is in the low-to-mid 20s percent in a normal environment – and could reach the mid-20s or higher in boom times when volume leverages fixed costs. Management believes these margins are durable; the CEO has indicated confidence in margin expansion thanks to differentiated products and pricing power. Axcelis’s gross margin profile (mid-40s%) supports this, as it leaves ample room for R&D and SG&A and still a hefty operating profit.

In terms of free cash flow (FCF), Axcelis’s earnings translate well into cash because the business has low working-capital needs and modest capex. Over the past few years, Axcelis has converted roughly 15–20% of revenue into FCF. In 2022, for instance, free cash flow was about $205 million (on $920 million sales), and in 2023 FCF was $128–136 million after a temporary working capital build. The dip in 2023 FCF (despite record profit) was mainly due to increased inventories and receivables to support the late-year shipment surge – not a structural issue. Indeed, Axcelis’s cash from operations was a strong $156.9 million in 2023 and $140.8 million in 2024, easily covering its small capex budget. With capital expenditures so low (more on that below), the company routinely generates free cash in the $100+ million range annually. We can estimate Axcelis’s sustainable annual operating profit at roughly $200–250 million in the near term (assuming ~$1 billion revenue and ~20–25% margin), which should yield on the order of $120–180 million in FCF after taxes and capex. Over a cycle, FCF may fluctuate (it could dip if a sudden revenue drop causes an inventory glut, or conversely surge if working capital is released), but Axcelis has shown it can remain cash-flow positive even in downturns. Notably, the company’s policy is to treat stock-based comp as a real expense – which it is – so the reported operating profits are after that cost, meaning the FCF is not artificially juiced by adding back large stock comp. Axcelis’s margin sustainability looks solid as long as its product superiority holds: customers are willing to pay a premium for tools that enable their roadmaps, and Axcelis has kept its overhead in check. As the revenue mix shifts more toward the high-margin power device segment (which often requires more process support and specialized tooling), Axcelis should be able to at least maintain, if not gradually improve, its margin profile. The biggest swing factor to watch is volume: a steep downturn could temporarily compress margins (due to under-absorbed factory costs), but the company’s recent performance indicates it can flex costs and still stay well above breakeven.

6. Debt Structure

Axcelis’s debt structure is minimalistic by design. The company has no significant long-term debt on its books – the token ~$43–45 million debt shown on the balance sheet likely consists of finance leases or other small obligations. Axcelis does not have any outstanding corporate bond or large bank loan; it hasn’t needed to borrow to fund operations or growth in recent years. Consequently, Axcelis pays almost no interest expense (any interest cost is negligible), and in fact with its large cash reserves, it earns interest income. In 2024, with over $500 million in cash yielding interest, Axcelis probably netted several million dollars in interest income, effectively bolstering its bottom line. Management’s approach has been to maintain a strong net cash position, which provides strategic flexibility. They have a revolving credit facility available for use if ever needed (most likely for short-term liquidity or potential opportunistic uses), but as of the latest filings it remained unused. This conservative capital structure indicates that Axcelis is self-funding – it generates enough cash internally to cover R&D, capex, and share buybacks without leveraging up. The long-term strategy seems to be avoiding debt unless absolutely necessary. This is prudent given the cyclicality of the business: carrying debt into a downturn can be disastrous if orders dry up, as interest costs would then eat into dwindling profits. By eschewing debt, Axcelis ensures it won’t be forced into fire-fighting mode by creditors at the wrong time. In short, the company’s “debt strategy” is to stay essentially debt-free and use cash on hand (and ongoing cash flow) to fund growth or shareholder returns. Axcelis thus “collects” interest (on its cash) rather than paying it, and its balance sheet strength is a competitive advantage that lets management play the long game.

7. Tax Structure

Axcelis is a U.S.-based corporation, and the headline statutory tax rate on its profits is 21%. However, the company’s effective tax rate has been well below that, thanks to various credits, incentives, and the international nature of its sales. In 2023, Axcelis’s effective tax rate was only about 11.6% – extremely low. In fact, in some recent years the effective tax rate was in the single digits. This is partly due to the U.S. tax code’s Foreign-Derived Intangible Income (FDII) deduction, which Axcelis qualifies for because a large portion of its revenue comes from exports of U.S.-made equipment to overseas customers. The FDII provision effectively lowers the tax rate on income from foreign sales. Axcelis also benefits from R&D tax credits (for its substantial research activities) and, historically, it had net operating loss (NOL) carryforwards from earlier years that reduced taxable income. For example, Axcelis had some lean years in the 2000s and 2010s that generated NOLs; as the company returned to solid profitability by the late 2010s, it likely utilized those NOLs (which shelter income from taxes until used up). This can explain why in 2022 Axcelis’s net income was higher than one might expect relative to operating profit – it was using up tax assets. By now, many of those NOLs have probably been exhausted, so the effective tax rate is starting to rise. Indeed, in 2024 the effective tax rate ticked up (net income of $201M on $211M operating profit implies around ~5% effective tax, slightly higher than prior years) and the company guides for about a 15% tax rate in 2025 as a planning assumption. Going forward, one can expect Axcelis’s effective tax rate to drift upward toward the mid-teens percentage, but likely still remain below the full 21% statutory rate due to ongoing FDII deductions and tax credits. It’s worth noting that Axcelis manufactures its tools in the U.S. (Beverly, MA) but sells globally, so the bulk of taxes are paid in the U.S., with some local taxes in countries where it has service operations. The company hasn’t signaled any complex international tax schemes or inversions – its tax profile is straightforward. One wildcard is U.S. tax law changes: if the FDII regime is altered or if R&D credits diminish, Axcelis’s effective rate could rise. Conversely, any new investment tax credits (for instance, related to domestic manufacturing incentives) could provide offsets. Axcelis does not currently report any significant tax controversies or unusual tax deferrals. In summary, the official corporate tax rate is 21%, but Axcelis has been paying closer to 10–15% effective tax recently, and expects to stay in that range short-term. The company also has a clean balance of deferred tax assets from past losses that it can utilize, meaning it shouldn’t face a cash tax spike in the immediate future. Investors can take comfort that Axcelis’s tax management has been efficient (boosting net margins), yet also based on stable, legitimate incentives rather than aggressive loopholes.

8. Capex Requirements

One of Axcelis’s attractive financial traits is its low capital expenditure (capex) requirements. Building semiconductor equipment is far less capital-intensive than building semiconductors themselves. Axcelis primarily assembles precision machines from purchased components; it doesn’t need fabs or extreme manufacturing infrastructure like its customers do. As a result, Axcelis’s capex has been running only around $20–25 million per year in recent years – a tiny ~2% of revenue. In 2023, for example, capital expenditures were about $20.7 million on $1.13 billion of sales. This capex was likely spent on routine equipment upgrades in its manufacturing and demo labs, facility improvements, and perhaps expansion of its applications lab capabilities to support new products. We can break down Axcelis’s capex into maintenance vs. growth components. The maintenance capex (needed to keep current operations running smoothly) is quite low – possibly on the order of $10–15 million annually – covering things like replacing older machinery, upkeep of IT infrastructure, etc. The growth capex – investments to add capacity or new capabilities – has also been modest because Axcelis’s business can scale without massive physical expansion. When demand spiked, Axcelis managed to more than double output from 2020 to 2023 with only incremental additions to capacity. This implies the company had slack or could outsource/subcontract parts of the manufacturing rather than building new factories. In 2021–2022, Axcelis did invest in a new global logistics center in Beverly and likely expanded its production floor to handle Purion orders, but these were not huge expenditures (the company even sold its HQ building and leases it, avoiding tying up capital in real estate).

Looking ahead, how much capex is needed for marginal growth? Axcelis should be able to support growth with only small increases in capex. To add, say, $100 million in extra annual revenue, the company might need to spend a few million on additional test equipment, tooling, and perhaps an expansion of its cleanroom assembly area – but not tens of millions. The nature of their product (ion implanters) is such that scaling production is more about skilled labor and supply chain coordination than about huge new assembly lines. Axcelis also often builds machines to order, which limits the need for large in-process inventory or idle capacity. We do note that 2022 saw a spike in “cash used for investing”of $257 million but that was not capex per se – it was mostly the company putting excess cash into short-term investments. Actual capex that year was around $12 million (if 2023 was $20.7 M, 2022 was likely in the teens). In 2024, capex was roughly $12.2 million for the first 9 months, tracking similarly low. Axcelis’s management has indicated that current facilities can support near-term growth, and they will invest gradually as needed. With the expected moderation in 2024–2025, there’s likely excess capacity in the system now, meaning even less growth capex is needed until orders ramp again.

How long will the current capex-light intensity persist? Quite possibly for the foreseeable future. Axcelis’s business model simply doesn’t require heavy fixed-asset spending – its competitive advantage lies in intellectual property and engineering talent, not in owning lots of plant and equipment. As long as the company isn’t attempting to in-source major components or diversify into radically different product lines, its capex-to-sales ratio should remain low. If Axcelis decided to build a new demo fab or a large R&D center, that could bump capex in a given year, but those would be strategic choices rather than recurring needs. For now, management seems inclined to keep things asset-light. In summary, maintenance capex is minimal and easily covered by depreciation, and growth capex is incremental. This lean capex requirement contributes to Axcelis’s strong free cash flow conversion. It also suggests that Axcelis can grow without devouring cash – a very favorable situation. Investors should monitor if a major capacity expansion becomes necessary (for instance, if orders surge beyond what Beverly can handle), but any such expansion would likely be a one-time project (and even then possibly just tens of millions, which Axcelis can afford internally). Thus, for the next several years, expect Axcelis’s capex to remain low-single-digit percentage of revenue, enabling the firm to continue returning cash to shareholders or building its cash reserves.

9. Growth Estimates

When projecting Axcelis’s future, one must account for both its long-term growth drivers and the inevitable cyclical swings along the way. Historically, Axcelis’s revenue growth has been dramatic but uneven. Over the last decade, the company went from around $343 million in 2019 to $1.13 billion in 2023 – a stunning increase driven by a mix of market share gains and a robust industry upcycle. However, that period also included a 22% revenue drop in 2019 and a 9.7% drop in 2024, illustrating that year-to-year volatility is high. Looking out to the next 10 years, we expect Axcelis to grow substantially overall, though with cyclical year-to-year fluctuations. The secular trend is positive: the rise of electric vehicles, renewable energy, and advanced computing is spurring greater demand for power semiconductors and mature-node chips, which in turn expands the total market for ion implantation equipment. Industry analysts estimate that the global ion implant equipment market (for all vendors) could exceed $6 billion in annual sales by 2030 – roughly double the size of the market in the mid-2020s. Axcelis, by virtue of its strong position, is poised to capture a significant chunk of that. William Blair, for example, forecasts Axcelis can maintain or even increase its share in the SiC power device implant segment as that segment grows five-fold by the end of the decade.

Revenue Growth: It’s reasonable to project Axcelis’s revenue growing at a high single-digit to low double-digit CAGR over the next decade. In the near term, the company itself has guided to a ~$1.3 billion revenue target in 2025 (up from $1.02 billion in 2024), implying a strong rebound once the current digestion phase passes. Beyond that, if the implant TAM indeed doubles by 2030, Axcelis’s sales could approach the $1.8–2.0 billion range by then (assuming it holds ~30–35% market share). That would be roughly 7–10% compounded annual growth from 2023 levels. Over ten years (2025–2035), the law of large numbers will eventually slow growth, but it’s conceivable Axcelis might find new avenues (e.g. gallium nitride power semiconductors, where implant might be needed, or penetrating further into memory/logic implants) that add to its opportunity. The company is actively trying to diversify its customer base, targeting memory and advanced logic fabs (for instance, it noted efforts to grow share in NAND flash implants by mid-decade). Success there could boost growth above the base-case. However, to be conservative, we expect some cycle in the next 10 years will cause a plateau or slight dip in one or two years – this is just how the chip equipment industry works. So the likely pattern is lumpy: a couple of booming years of >20% growth, then a correction, then another climb. Netting it out, revenue in ten years could be on the order of $2–3 billion, depending on industry conditions, with the mid-point around ~$2.5 billion if things go well (that assumes Axcelis continues outperforming and maybe nudges share higher in new markets).

Operating Margin Sustainability: As revenue grows, Axcelis should be able to sustain healthy margins. There might even be some upside to margins if volume increases faster than costs – e.g. utilization of their factory could improve and purchasing leverage on suppliers could lower unit costs. During the 2021–2023 up-cycle, Axcelis’s gross margin rose above 44%. If the company reaches $2 billion revenue, gross margins in the mid-to-upper 40s are plausible given economies of scale. Operating expense will also rise (they’ll need more field service engineers, more R&D for next-gen products, etc.), but Axcelis has shown an ability to add expenses at a slower rate than revenue growth. We therefore foresee operating margins staying in the 22–27% range at scale. One caveat: should a price war erupt with Applied Materials, margins could come under pressure. But given Axcelis’s technology lead, it likely won’t resort to competing on price alone – it can sell on value. Over a full cycle, average operating margins in the low 20s% seem sustainable, with peak years higher. The company’s margin resilience was on display in 2024: despite a sales drop, it held op margin above 20%, which bodes well for managing future slowdowns.

Capex and FCF Trends: We expect Axcelis’s capex-to-sales ratio to remain low (likely <3% on average) over the next decade. Even if revenue doubles, capex might only need to double in absolute terms (from ~$20M to ~$40M/year), which is trivial relative to cash flow. Thus, free cash flow will closely track operating profit. As profits grow, FCF should grow in tandem, minus some working capital variations. By 2030, if Axcelis is doing say $2 billion in revenue at ~25% operating margin, it could be pulling in ~$400–500 million in operating profit. After taxes (assume ~15% effective) and capex, free cash could be on the order of $300–400 million annually – a massive increase from ~$130M in 2024. That provides a lot of optionality: bigger buybacks, possibly dividends, or strategic investments. The key is that Axcelis’s growth does not demand big internal reinvestment, so shareholders stand to benefit from high FCF yields if growth materializes.

Peer Comparison & Valuation: Compared to larger semi equipment peers, Axcelis is growing from a smaller base but with a more focused product line. Giants like Applied Materials or Lam Research are far larger (tens of billions in revenue) and deeply entrenched in multiple process steps (deposition, etch, lithography, etc.), often sporting operating margins around 30%. Axcelis’s margins are a bit lower, reflecting its smaller scale and intense focus on one niche. However, Axcelis’s growth potential is arguably higher in percentage terms because of the secular wave in power semis and its ability to take share. ASML, for instance, dominates lithography with a wide moat but grows at the pace of leading-edge capacity expansion. Axcelis, in contrast, can ride both the leading-edge (through image sensor and logic implants) and the trailing-edge/power expansion. Investors should be aware that volatility will likely persist – both in fundamentals and share price – given the nature of the industry.

In conclusion, Axcelis is positioned as a structural winner in a critical semiconductor niche. It enjoys a real technological moat in ion implantation, a field with high barriers to entry and only one major competitor. The demand outlook for its products over the next decade is buoyant, fueled by transformative trends in automotive and energy. Financially, Axcelis combines growth with prudence: it’s delivering rising profits and cash flows without overleveraging or overextending. While one must remain cognizant of the cyclicality (today’s backlog can evaporate if chip makers suddenly cut capex), Axcelis has proven its resilience through cycles and emerged stronger each time. The next 10 years will likely see the company scale new heights in revenue and earnings, provided it continues to innovate and execute. From an investment perspective, Axcelis offers a compelling growth story with a strong balance sheet and competent management – albeit with the caveat of higher volatility and risk than more diversified tech firms. It’s a bit like the Guardian of a Narrow Gate: Axcelis has locked down a small but crucial market segment, and as long as that gate expands with industry growth, the company should thrive. Few companies its size have the mix of market leadership, secular tailwinds, and financial stability that Axcelis boasts. If the execution stays on point, Axcelis could very well graduate from a small-cap specialist into a mid-cap powerhouse of the semiconductor equipment world over the coming decade.

💬 What are your thoughts on Axcelis’s potential? Share your insights in the comments below! If you found this content engaging, please like, share, and subscribe — your support truly motivates me to continue creating quality content.

This is an amazing article, very well written! I’ve followed and invested into WFE and semi companies for a while but did not know about Axcelis. You just got yourself a subscriber and excited to read your future articles. I’ve personally written a big deep dive into ASML and plan to write more articles on WFE and semi (including auto semi) names.